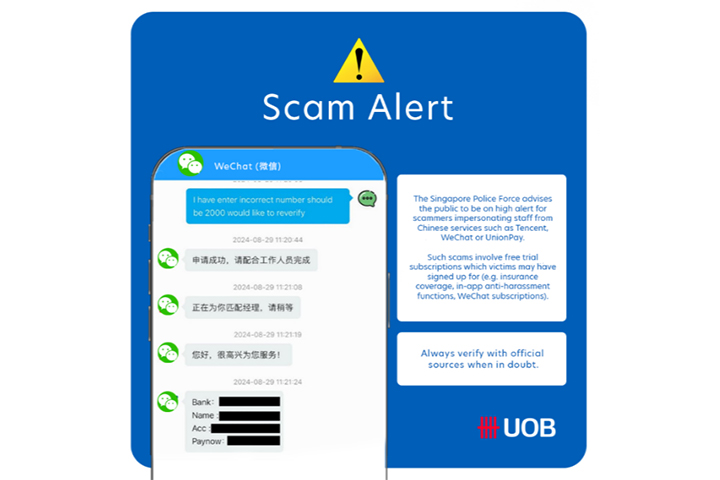

The Singapore Police Force advises the public to be on high alert for scammers impersonating as staff from Chinese services such as Tencent, WeChat or UnionPay. Such scams involve free trial subscriptions which victims may have signed up for (e.g insurance coverage, in-app anti-harassment functions, WeChat subscriptions)

Scammers would typically ask victims to verify their identities and bank accounts, by requiring them to provide their personal information and to make monetary transfers to various bank accounts. The victims were assured that their monies would be refunded upon successful verification. In some of the cases, the scammer would guide the victim through WhatsApp's screen sharing function to increase the bank transaction limit and perform the bank transfers.![]()

How you can protect yourself

Stay safe with extra measures that you can do simply from anywhere, at home, at work, anywhere, from your phone.

Tips to protect yourself against scams

The best line of defence to fight scams effectively is still public’s vigilance. Please follow these tips to protect yourself.

Protect your savings from digital scams with Money LockNEW!

Set a Money Lock amount in your existing UOB accounts to prevent unauthorised withdrawals. Rest assured, your money continues to earn the same interest (up to 6% p.a. for UOB One Account). Simply use the UOB TMRW app or visit any UOB ATM in Singapore to lock any amount, anytime. You can unlock your funds at any UOB ATM in Singapore.

SGD deposits are insured up to S$100k by SDIC.

Do not click on suspicious links

UOB will never send you SMS or email with a clickable link. UOB will never ask you to download another app or make a fund transfer to a third-party account. If unsure, verify it on official channels (such as our official UOB website)

Do not download apps from third-party websites

Use only apps from official app stores, as installing unknown apps may put your phone and data at risk.

To prevent this:

Go to "Settings" > "Security and Privacy"* > "Install unknown apps" and verify that no app is granted permission to install other applications from untrusted sources.

*Please note that the above path may differ by device manufacturer and operating system.

Keep your devices up to date

Updates often include security patches that protect against vulnerabilities

Reinforce your devices

Install a reputable anti-virus/malware protection software or use Google Play Protect to help keep your apps safe and your data private. Also remember to use biometrics, a strong password or relevant mechanisms to prevent unauthorised use

Avoid using public/unsecured WiFi

Avoid using public/unsecured WiFi when you perform banking transactions or are transacting with sensitive information. Scammers can use these Wifi networks to snoop and pry on your device

Never disclose your details

Keep your personal/internet banking details and one-time passwords (OTPs) confidential at all times and do not divulge it to anyone. UOB and our partners will never request for your details

Always stay updated

Always update your contact details such as your email address and mobile number to receive timely notifications and alerts about your account and to detect fraud early

Block unsolicited message and calls

Download and install ScamShield to block spoofed calls and SMSes based on a list from the Singapore Police Force and report scam messages/calls via the in-app reporting. Do not download any mobile applications, except through the official app stores by Apple, Google or Huawei.

This is a mobile app developed by the National Crime Prevention Council. Click here for more information.

Always log out

Always log out after an online banking session

Change your password regularly

Personal information such as your telephone number and birth date do not make strong passwords. Don’t use them

Don’t record passwords

Avoid keeping sensitive information on your devices’ note-taking apps

Do not grant remote access

Do not grant remote access of your computer to anyone or download any remote control software as instructed over the phone

Always verify

Confirm the legitimacy of every offer before sharing them with your family, friends, and colleagues

Report suspicious offers to the police

Help protect others from becoming victims

Do not root or jailbreak your devices

Jailbreaking and Rooting weakens your device's built-in security features, which means malware can breach your mobile security and infect the rooted software if it’s not protected by effective mobile antivirus

Protect your savings from digital scams with Money LockNEW!

Set a Money Lock amount in your existing UOB accounts to prevent unauthorised withdrawals. Rest assured, your money continues to earn the same interest (up to 6% p.a. for UOB One Account). Simply use the UOB TMRW app or visit any UOB ATM in Singapore to lock any amount, anytime. You can unlock your funds at any UOB ATM in Singapore.

SGD deposits are insured up to S$100k by SDIC.

Do not click on suspicious links

UOB will never send you SMS or email with a clickable link. UOB will never ask you to download another app or make a fund transfer to a third-party account. If unsure, verify it on official channels (such as our official UOB website)

Do not download apps from third-party websites

Use only apps from official app stores, as installing unknown apps may put your phone and data at risk.

To prevent this:

Go to "Settings" > "Security and Privacy"* > "Install unknown apps" and verify that no app is granted permission to install other applications from untrusted sources.

*Please note that the above path may differ by device manufacturer and operating system.

Keep your devices up to date

Updates often include security patches that protect against vulnerabilities

Reinforce your devices

Install a reputable anti-virus/malware protection software or use Google Play Protect to help keep your apps safe and your data private. Also remember to use biometrics, a strong password or relevant mechanisms to prevent unauthorised use

Avoid using public/unsecured WiFi

Avoid using public/unsecured WiFi when you perform banking transactions or are transacting with sensitive information. Scammers can use these Wifi networks to snoop and pry on your device

Never disclose your details

Keep your personal/internet banking details and one-time passwords (OTPs) confidential at all times and do not divulge it to anyone. UOB and our partners will never request for your details

Always stay updated

Always update your contact details such as your email address and mobile number to receive timely notifications and alerts about your account and to detect fraud early

Block unsolicited message and calls

Download and install ScamShield to block spoofed calls and SMSes based on a list from the Singapore Police Force and report scam messages/calls via the in-app reporting. Do not download any mobile applications, except through the official app stores by Apple, Google or Huawei.

This is a mobile app developed by the National Crime Prevention Council. Click here for more information.

Always log out

Always log out after an online banking session

Change your password regularly

Personal information such as your telephone number and birth date do not make strong passwords. Don’t use them

Don’t record passwords

Avoid keeping sensitive information on your devices’ note-taking apps

Do not grant remote access

Do not grant remote access of your computer to anyone or download any remote control software as instructed over the phone

Always verify

Confirm the legitimacy of every offer before sharing them with your family, friends, and colleagues

Report suspicious offers to the police

Help protect others from becoming victims

Do not root or jailbreak your devices

Jailbreaking and Rooting weakens your device's built-in security features, which means malware can breach your mobile security and infect the rooted software if it’s not protected by effective mobile antivirus

Bank securely. Stay vigilant & ACT on any scam signs

Join us and the National Crime Prevention Council (NCPC) to ACT against scams

A - Add

Add the various security features

– ScamShield App;

– Install and update trusted antivirus and anti-malware software; and

– Enable multi-factor authentication. to protect yourself against scams.

Update your contact details and enable alert notifications (SMS / email) to receive timely notifications for your transactions.

C - Check

Check information with trusted sources. Do not click on links within SMS or emails. Do not respond to automated calls asking for approval on transactions or disclose your banking login details or OTP to anyone.

Use the official UOB TMRW app or website to login to UOB Personal Internet Banking.

T - Tell

Tell the bank and report to authorities immediately if you encounter any scams. If you suspect your account has been compromised, call our 24-hour Fraud Hotline at 6255 0160 to disable your digital access and block all your cards instantly with our emergency “Kill Switch” feature. Click here for more information.

Latest Scams

- All

- Phone, Text and SMS

- Online platform

- Text and SMS

- Phone

Phone, Text and SMS

Chinese digital subscription services Impersonation Scam

Phone, Text and SMS

Impersonation Scam

Online platform

Fake Tickets E-commerce Scam

Text and SMS

Fake Fixed Deposit Promotion

Be on the lookout for scammers offering fake fixed deposit promotions and sharing fake UOB name cards to impersonate themselves as a UOB employee. We will not send you promotional messages or request for your personal information from a mobile number. If in doubt, always verify with official UOB sources such as our websites or branches.![]() .

.

Online platform

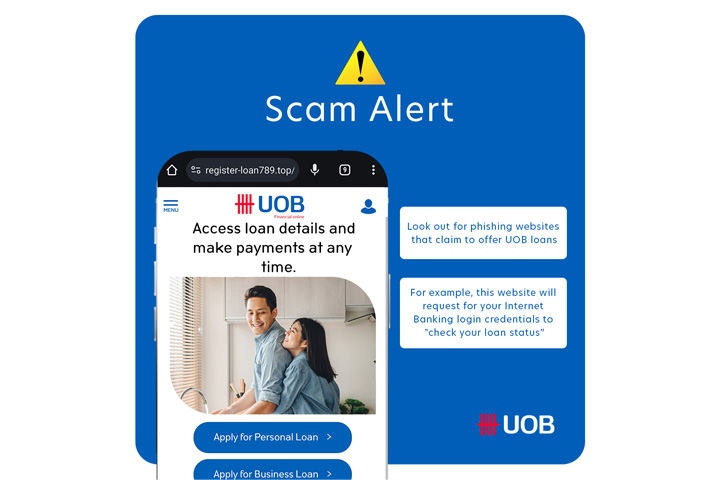

Fake Loans Platform Phishing Scam

Online platform

Fake Concert Tickets E-commerce Scam

Watch out for scammers on social media who claim to resell concert tickets, but will go missing or remain uncontactable as soon as you transfer funds to them. To avoid falling prey to such scams, purchase tickets only from authorised sellers, such as https://kkday.me/WaterbombUOB.![]()

Compare accounts

Remember these tips to #BeCyberSavvy:

- Do not click on suspicious links provided in unsolicited emails or messages.

- If in doubt, verify the authenticity of the information with our official website or sources.

- Never disclose your personal or internet banking details and one-time passwords (OTPs) to anyone.

Suspect that you have been scammed? Visit here for immediate steps to take to prevent further losses, or call our dedicated 24/7 Fraud Hotline 6255 0160 if unsure.

Subscribe to our UOB Facebook page for the latest updates and advice on scams.

Remember these tips to #BeCyberSavvy:

- Do not click on suspicious links provided in unsolicited emails or messages.

- If in doubt, verify the authenticity of the information with our official website or sources.

- Never disclose your personal or internet banking details and one-time passwords (OTPs) to anyone.

Suspect that you have been scammed? Visit here for immediate steps to take to prevent further losses, or call our dedicated 24/7 Fraud Hotline 6255 0160 if unsure. Subscribe to our UOB Facebook page for the latest updates and advice on scams.

Remember these tips to #BeCyberSavvy:

- Do not click on suspicious links provided in unsolicited emails or messages.

- If in doubt, verify the authenticity of the information with our official website or sources.

- Never disclose your personal or internet banking details and one-time passwords (OTPs) to anyone.

Suspect that you have been scammed? Contact our dedicated 24/7 Fraud Hotline at 6255 0160 or click here for immediate steps to take to prevent further losses. Subscribe to our UOB Facebook page for the latest updates and advice on scams.

Click here for details. Call our dedicated 24/7 Fraud Hotline 6255 0160 if unsure. Subscribe to our UOB Facebook page for the latest update and advice on scams.

Can you spot all the red flags in the screenshots?

🚩 Sender’s email is a personal email.

🚩 The website URL is not legitimate (ltpro.shop).

🚩 You are asked to provide your bank account details for balance withdrawal outside of the eCommerce app.

🚩 You are asked to provide card details or log in to internet banking to receive payments. This might potentially be a phishing website to steal your banking credentials which result in fraudulent transactions.

Remember these tips to #BeCyberSavvy:

- Do not click on suspicious links provided in unsolicited emails or messages.

- If in doubt, verify the authenticity of the information with our official website or sources.

- Never disclose your personal or internet banking details and one-time passwords (OTPs) to anyone.

Suspect that you have been scammed? Contact our dedicated 24/7 Fraud Hotline at 6255 0160 or click here for immediate steps to take to prevent further losses. Subscribe to our UOB Facebook page for the latest updates and advice on scams.

Do remain vigilant this festive season. Remember these tips to #BeCyberSavvy:

- Do not click on suspicious links provided in unsolicited emails or messages.

- If in doubt, verify the authenticity of the information with our official website or sources and do not respond to an unfamiliar sender.

- Never disclose your personal or internet banking details and one-time passwords (OTPs) to anyone.

Suspect that you have been scammed? Contact our dedicated 24/7 Fraud Hotline at 6255 0160 or click here for immediate steps to take to prevent further losses. Subscribe to our UOB Facebook page for the latest updates and advice on scams.

Remember these tips to help you #BeCyberSavvy:

- Do not click on suspicious links provided in unsolicited emails or messages.

- If in doubt, verify the authenticity of the information with our official website or sources and do not respond to an unfamiliar sender.

- Never disclose your personal or internet banking details and one-time passwords (OTPs) to anyone.

Suspect that you have been scammed? Contact our dedicated 24/7 Fraud Hotline at 6255 0160 or click here for immediate steps to take to prevent further losses. Subscribe to our UOB Facebook page for the latest updates and advice on scams.

Remember these tips to help you #BeCyberSavvy:

- Do not click on suspicious links provided in unsolicited emails or messages.

- If in doubt, verify the authenticity of the information with our official website or sources and do not respond to an unfamiliar sender.

- Never disclose your personal or internet banking details and one-time passwords (OTPs) to anyone.

Suspect that you have been scammed? Contact our dedicated 24/7 Fraud Hotline at 6255 0160 or click here for immediate steps to take to prevent further losses. Subscribe to our UOB Facebook page for the latest updates and advice on scams.

Remember these tips to help you #BeCyberSavvy:

- Do not click on suspicious links provided in unsolicited emails or messages.

- If in doubt, verify the authenticity of the information with our official website or sources and do not respond to an unfamiliar sender.

- Never disclose your personal or internet banking details and one-time passwords (OTPs) to anyone.

Suspect that you have been scammed? Contact our dedicated 24/7 Fraud Hotline at 6255 0160 or click here for immediate steps to take to prevent further losses. Subscribe to our UOB Facebook page for the latest updates and advice on scams.

Remember these tips to help you #BeCyberSavvy:

- Do not click on suspicious links provided in unsolicited emails or messages.

- If in doubt, verify the authenticity of the information with our official website or sources and do not respond to an unfamiliar sender.

- Never disclose your personal or internet banking details and one-time passwords (OTPs) to anyone.

Suspect that you have been scammed? Contact our dedicated 24/7 Fraud Hotline at 6255 0160 or click here for immediate steps to take to prevent further losses. Subscribe to our UOB Facebook page for the latest updates and advice on scams.

Remember these tips to help you #BeCyberSavvy:

- Do not click on suspicious links provided in unsolicited SMSes, Whatsapp and emails.

- If in doubt, verify the authenticity of the information with our official website or sources and do not respond to an unfamiliar sender.

- Never disclose your personal or internet banking details and one-time passwords (OTPs) to anyone.

Suspect that you have been scammed? Contact our dedicated 24/7 Fraud Hotline at 6255 0160 or click here for immediate steps to take to prevent further losses. Subscribe to our UOB Facebook page for the latest updates and advice on scams.

Remember these tips to help you #BeCyberSavvy:

- Do not click on suspicious links provided in unsolicited SMSes and emails.

- If in doubt, verify the authenticity of the information with our official website or sources and do not respond to an unfamiliar sender.

- Never disclose your personal or internet banking details and one-time passwords (OTPs) to anyone.

Suspect that you have been scammed? Contact our dedicated 24/7 Fraud Hotline at 6255 0160 or click here for immediate steps to take to prevent further losses. Subscribe to our UOB Facebook page for the latest updates and advice on scams.

Remember these tips to help you #BeCyberSavvy:

- Do not click on suspicious links provided in unsolicited emails.

- If in doubt, verify the authenticity of the information with our official website or sources and do not respond to an unfamiliar sender.

- Never disclose your personal or internet banking details and one-time passwords (OTPs) to anyone.

Suspect that you have been scammed? Contact our dedicated 24/7 Fraud Hotline at 6255 0160 or click here for immediate steps to take to prevent further losses. Subscribe to our UOB Facebook page for the latest updates and advice on scams.

If you suspect that you have been scammed, immediately file a police report and call our dedicated 24/7 Fraud Hotline at 6255 0160. Press ‘1’ to report a case or ‘2’ to activate our emergency self-service Kill Switch feature, which will disable access to your UOB Personal Internet Banking and UOB TMRW app.

Subscribe to our UOB Facebook page for the latest updates and advice on scams.

Remember these tips to help you #BeCyberSavvy:

- Do not click on suspicious links provided in unsolicited SMSes and emails.

- If in doubt, verify the authenticity of the information with our official website or sources.

- Never disclose your personal or internet banking details and one-time passwords (OTPs) to anyone.

Suspect that you have been scammed? Visit go.uob.com/reportscam for immediate steps to take to prevent further losses. Call our dedicated 24/7 Fraud Hotline 6255 0160 if unsure.

Subscribe to our UOB Facebook page for the latest updates and advice on scams.

Remember these tips to help you #BeCyberSavvy:

- Do not click on suspicious links provided in unsolicited SMSes and emails.

- If in doubt, verify the authenticity of the information with our official website or sources.

- Never disclose your personal or internet banking details and one-time passwords (OTPs) to anyone.

If you suspect that you have been scammed, immediately file a police report and call our dedicated 24/7 Fraud Hotline at 6255 0160. Press ‘1’ to report a case or ‘2’ to activate our emergency self-service Kill Switch feature, which will disable access to your UOB Personal Internet Banking and UOB TMRW app.

Subscribe to our UOB Facebook page for the latest updates and advice on scams.

Remember these tips to help you #BeCyberSavvy:

- Do not click on suspicious links provided in unsolicited SMSes and emails.

- If in doubt, verify the authenticity of the information with our official website or sources.

- Never disclose your personal or internet banking details and one-time passwords (OTPs) to anyone.

If you suspect that you have been scammed, immediately file a police report and call our dedicated 24/7 Fraud Hotline at 6255 0160. Press ‘1’ to report a case or ‘2’ to activate our emergency self-service Kill Switch feature, which will disable access to your UOB Personal Internet Banking and UOB TMRW app.

Subscribe to our UOB Facebook page for the latest updates and advice on scams.

Remember these tips to help you #BeCyberSavvy:

- Do not click on suspicious links provided in unsolicited SMSes and emails.

- If in doubt, verify the authenticity of the information with our official website or sources.

- Never disclose your personal or internet banking details and one-time passwords (OTPs) to anyone.

Remember these tips to help you #BeCyberSavvy:

- Do not click on suspicious links provided in unsolicited SMSes and emails.

- If in doubt, verify the authenticity of the information with our official website or sources.

- Never disclose your personal or internet banking details and one-time passwords (OTPs) to anyone.

- Download mobile apps only from official app stores.

- Keep your smartphone’s OS and apps updated.

- Download and install ScamShield to block unsolicited message and calls.

For more information, please visit uob.com.sg/security.

If you suspect that you have been scammed, immediately file a police report and call our dedicated 24/7 Fraud Hotline at 6255 0160. Press ‘1’ to report a case or ‘2’ to activate our emergency self-service Kill Switch feature, which will disable access to your UOB Personal Internet Banking and UOB TMRW app.

Subscribe to our UOB Facebook page for the latest updates and advice on scams.

Remember these tips to help you #BeCyberSavvy:

- Do not click on suspicious links provided in unsolicited SMSes and emails.

- If in doubt, verify the authenticity of the information with our official website or sources.

- Never disclose your personal or internet banking details and one-time passwords (OTPs) to anyone.

Impersonation scams

If you suspect that you have been scammed, immediately file a police report and call our dedicated 24/7 Fraud Hotline at 6255 0160. Press '1' to report a case or '2' to activate our emergency self-service Kill Switch feature, which will disable access to your UOB Personal Internet Banking and UOB TMRW app.

What can you do to protect yourself?

Remember these tips to help you #BeCyberSavvy:

- Do not click on suspicious links provided in unsolicited SMSes and emails.

- If in doubt, verify the authenticity of the information with our official website or sources.

- Never disclose your personal or internet banking details and one-time passwords (OTPs) to anyone.

Investment Scams on Chat Applications

Are you receiving messages on social media or chat applications from someone impersonating a finance professional offering investment opportunities? Investment scams involve promises of big payouts, quick money or guaranteed returns.

#BeCyberSavvy and keep in mind these security tips:

- Be wary when receiving unsolicited offers of investment opportunities via social media platforms or chat applications.

- If in doubt, verify the authenticity of the information with the official website or sources.

- Never disclose your personal or internet banking details and one-time password (OTP) to anyone.

Spotted an investment scam or suspect that you might have been scammed? Please call our dedicated 24/7 Fraud Hotline at 6255 0160 and press '1' to report a case or '2' to activate our emergency self-service “kill switch” feature, which will disable access to your Personal Internet Banking and UOB TMRW app.

Smishing Scam

Be on high alert for an ongoing targeted SMS phishing scam, where scammers are using UOB’s name to trick customers that their account had been suspended and asked for their account details through clickable links. Stop the scammers in their tracks – do not click on the link or call the number.

#BeCyberSavvy and keep in mind these security tips:

- Do not click on suspicious URL links or call any phone numbers provided in unsolicited SMSes and emails. Banks will not send you SMSes and emails containing clickable links.

- If in doubt, verify the authenticity of the information with the official website or sources.

- Never disclose your personal or internet banking details and one-time password (OTP) to anyone.

- Never grant remote access of your computer to anyone.

If you spot a phishing SMS or suspect that you might have been scammed, please call our dedicated 24/7 Fraud Hotline at 6255 0160 and press ‘1’ to report a case or ‘2’ to activate our emergency self-service Kill Switch feature.

Smishing Scams (Fixed Deposit Promotions)

"Smishing" is a common scam attack that involves text messages impersonating a bank or an organisation. These scammers will try different means to capture your attention and acquire your personal information. Some will even go to the extent of spoofing the sender's name, phone number or both to trick you. For example, a recent scam involves SMS messages sent from the sender name "TMRW" and "UOBTRMW", which resembles the UOB TMRW app name, informing recipients about unusual activity in their accounts. That link will lead you to a scam website.

Remember, UOB does not send SMSes with clickable links.

What can you do to protect yourself?

A sample of the phishing SMS sent by scammers.

Do NOT call the number in the unsolicited SMS

- UOB will never send you an SMS message that requires you to call a phone number to get details for a promotion. Stay vigilant and do not call the number stated on the SMS.

- Do not click on dubious links and always examine the links when presented in an email or SMS.

- Hover over links to check the destination of the URL. Check for any typos or misspelt words in the URL. When verifying links using mobile phones, press and hold the link to display the actual URL.

- Always visit the legitimate website bookmarked in your browser or found via a Google search.

- Ensure that you do not overlook the spelling mistakes when inspecting the website URL.

- UOB will never send an SMS to inform customers about account closures or being locked out of their account, or to reactivate accounts.

- Do not share any personal or internet banking details such as your full name, mailing address, password or OTP.

- Do not transfer funds to any account directed by anyone who claims to be a UOB staff.

If you spot a phishing SMS or suspect that you might have been scammed, please call our dedicated 24/7 Fraud Hotline at 6255 0160 and press '1' to report a case or '2' to activate our emergency self-service Kill Switch feature.

If you suspect that you have been scammed, immediately file a police report and call our dedicated 24/7 Fraud Hotline at 6255 0160. Press ‘1’ to report a case or ‘2’ to activate our emergency self-service Kill Switch feature, which will disable access to your UOB Personal Internet Banking and UOB TMRW app.

Subscribe to our UOB Facebook page for the latest updates and advice on scams.

Remember these tips to help you #BeCyberSavvy:

- Do not click on suspicious links provided in unsolicited SMSes and emails.

- If in doubt, verify the authenticity of the information with our official website or sources.

- Never disclose your personal or internet banking details and one-time passwords (OTPs) to anyone.

Investment Scams

There is a new type of scam where scammers are using UOB’s name to trick people to join a WhatsApp group and thereafter, persuade them to invest in fraudulent products.

Do NOT join the WhatsApp group

- Be cautious when befriending strangers on social media platforms.

- Understand that investments with high returns come with high risks.

- Always check with a licensed financial advisor before making any investment.

- Check if an entity is blacklisted on the Monetary Authority of Singapore (MAS) Investor Alert List. Deal with companies that are licensed and regulated by MAS.

- Ask as many questions as you need to fully understand the investment opportunity.

- Do a thorough check on the company and its representatives using resources such as the financial institution's directory, register or representatives, and investor alert list, which can be found on the MAS website.

- Never provide your name, identification number, passport details, contact details, bank account or credit card details to anyone you do not know well.

- Be careful when dealing with unregulated entities as you will have little recourse if things go wrong. If an entity is based outside of Singapore, check if it is regulated with the respective overseas authority.

- Before committing to an investment, always Ask, Check and Confirm.

- More information on investment scams can be found at MoneySense: How to spot investment scams.

- Visit scamalert.sg or call Anti-Scam Centre at 1800 722 6688 for more information on scams.

Phishing Scams

Recently, customers of Singapore banks have been targeted by a series of phishing scams. Through email and SMS messages that appear to be sent officially by the bank, these scams trick users into accessing fake websites to provide sensitive personal information.

What can you do to protect yourself?

- Do not click on dubious links and always examine the links when presented in an email or SMS.

- Hover over links to check the destination of the URL. Check for any typos or misspelt words in the URL. When verifying links using mobile phones, press and hold the link to display the actual URL.

- Always visit the legitimate website bookmarked in your browser or found via a Google search.

- Ensure that you do not overlook the spelling mistakes when inspecting the website URL.

- UOB will never send an SMS to inform customers about account closures or being locked out of their account, or to reactivate accounts.

- Do not share banking login credentials or OTP on suspicious SMS.

- If you are in doubt about the authenticity of any SMSes received, please contact UOB at 6255 0160 or Anti-Scam Centre at 1800 722 6688.

E-wallet Phishing Scam

These scams usually involve the customer receiving either a voice or video call from an unknown number where the caller may impersonate a government official or police officer by dressing up like one. On the call, they may request for the victim’s personal information and subsequently use this information to create e-wallet accounts under the victim’s name and top-up the account through the victim’s bank account. The victim will only realise that they have been scammed after they notice unauthorised transactions on the account.

What can you do to protect yourself?

- No foreign law enforcement or authority can investigate offences here in Singapore.

- No public authority can require you to open bank account or request for you to include digital banking to your account.

- Never reveal your bank account numbers, one-time passwords (OTPs) or 3-digit credit card security code. No government officials or those who are involved in the contact tracing exercise will ask for such banking information or require remote access to your computer.

- Never grant remote access of your computer to anyone.

- Never download any application or software directed by the caller.

- Never login into any website directed by the caller.

- If you receive such calls asking for banking information such as OTPs, you should hang up and call UOB or the police immediately.

- Visit scamalert.sg or call Anti-Scam Centre at 1800 722 6688 for more information on scams.

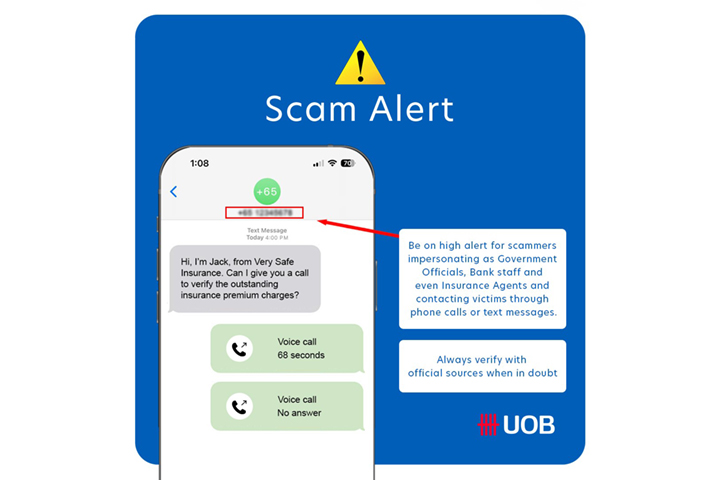

Impersonation Scams by Local and China Officials

Phone impersonation scams involve claims that the scammers are local and/or foreign government officials or police officers or individuals who are professionals such as recruiters. Victims are accused of being involved in crime and are persuaded to divulge confidential information on fraudulent websites. The scammers will transfer funds out from the victims’ accounts once they have received them.

Remember these tips to help you #BeCyberSavvy:

- No foreign law enforcement or authority can investigate offences here in Singapore.

- No public authority can require you to open bank account or request for you to include digital banking to your account.

- Never reveal your bank account numbers, one-time passwords (OTPs) or 3-digit credit card security code. No government officials or those who are involved in the contact tracing exercise will ask for such banking information or require remote access to your computer.

- Never grant remote access of your computer to anyone.

- Never download any application or software directed by the caller.

- Never login into any website directed by the caller.

- If you receive such calls asking for banking information such as OTPs, you should hang up and call UOB or the police immediately.

- Visit scamalert.sg or call Anti-Scam Centre at 1800 722 6688 for more information on scams.

Suspect that you have been scammed? Contact our dedicated 24/7 Fraud Hotline at 6255 0160 or click here for immediate steps to take to prevent further losses. Subscribe to our UOB Facebook page for the latest updates and advice on scams.

'Fake Friends' Scams

This is a variant of the typical Impersonation Scams. With these 'Fake Friends' scams, victims receive unsolicited calls from scammers who do not identify themselves but instead ask victims to guess their identity. The scammers then assume the identity of whoever the victims have guessed and make small talk. A follow-up call will then be made to the victims within the next couple of days, and scammers will thereafter make up excuses to ask for urgent loans from the victims, citing emergencies or urgent needs. Once victims make the transfer, the scammers will stop contacting them.

What can you do to protect yourself?

- Avoid answering calls from unknown numbers. When this is not possible, ascertain the identity of the person calling. You may do so by asking specific questions that only you and the purported person know (for example, how you met, who your mutual friends are and when the last time you met was);

- Verify the call by contacting the actual person whom the scammer claimed to be. You should use known contact details of that person after the unsolicited call to verify if he/she indeed made the call.

- If funds were transferred, quickly report this to the Police and the Bank.

- Do not divulge personal and banking information to anyone.

Business Email Compromise Scam

Received and email prompting you to transfer funds to an unverified bank account? It may be from a scammer impersonating a business partner or a colleague. Watch this video to learn about the tell-tale signs of a Business Email Compromise scam.

What can you do to protect yourself?

#BeCyberSavvy and keep in mind these security tips:

- Do not click on suspicious URL links or call any phone numbers provided in unsolicited emails. Banks will not send you emails containing clickable links.

- If in doubt, verify the authenticity of the information with the official website or sources.

- Do not click on links or open attachments that accompany email messages from unknown parties.

If you suspect that you have been scammed, please call our dedicated 24/7 Fraud Hotline at 6255 0160 and press '1' to report a case or '2' to activate our emergency self-service "kill switch" feature, which will disable access to your Personal Internet Banking and UOB TMRW app. For more information, please visit uob.com.sg/security.

Online Purchase Scams

Beware of scammers posing as buyers on e-commerce platform. Read on to find out how these scammers operate and trick their victims into entering their banking details on spoofed websites, use these information to make charges on the victims’ cards or take over their bank accounts and transfer funds.

#BeCyberSavvy and keep in mind these security tips:

If you suspect that you have been scammed, immediately call our dedicated 24/7 Fraud Hotline at 6255 0160. Press ‘1’ to report a case or ‘2’ to activate our emergency self-service Kill Switch feature, which will disable access to your UOB Personal Internet Banking and UOB TMRW app. You should also lodge a police report.

Online Shopping Deals Scams

These scams involve seemingly attractive online shopping deals, listed by scammers pretending to be legitimate vendors on e-commerce platforms. The scammers often offer discounts if a buyer pays through a direct bank transfer, rather than the official platform. The buyer does not receive the purchased item after the payment is made.

What can you do to protect yourself?

- Be wary of popular products priced suspiciously below the market rate.

- Review the seller’s past transactions and user ratings, and check that the listing has clear terms and conditions.

- Only pay through the platform’s secure payment option.

- Check that all costs are stated clearly.

- When in doubt, do not make payments and seek advice from the Police, or check out scamalert.sg.

Job-related Scams

Job openings are often posted to lure hopeful applicants into providing their bank information and even login details to scammers. One such scam involves asking for applicants’ details to help the "company" test how well its software synchronises between its "clients" and local banks, with a promise of a small fee for each test transaction. Other similar scams involve fraudsters offering jobs that require victims to buy advertised items on e-commerce platforms, with the promise that they will receive a refund on the purchase price plus additional commissions. They are however required to make payments to designated bank accounts instead of the e-commerce portals, and they subsequently do not receive the refund or commission.

What can you do to protect yourself?

- Do not accept dubious job offers that offer lucrative returns for minimal effort.

- Always verify the authenticity of the job with the company’s website and other official sources.

- Do not give your username, password, One-Time Passwords (OTPs), payment cards or card PINs to anyone.

- Do not click on suspicious URLs or download applications from unknown sources.

- Do not pay in advance for a job offer.

Parcel Delivery Phishing Scam

Waiting for an update on the status of your online purchases? Keep a look out for scammers who may target unsuspecting victims with spoofed messages or emails claiming to be arranging for a delivery. These messages may lead to websites that try to lure victims into divulging their credit or debit card information to make fraudulent transactions.

What can you do to protect yourself?

- Do not click on links shared on unsolicited emails or SMS messages.

- Verify the link from the message by cross-checking with the vendor.

- Verify the merchant details indicated in the OTP message and do not share your OTP if you are not making the transaction.

- Never disclose your personal or Internet banking details to anyone.

Suspect that you have been scammed? Visit go.uob.com/reportscam for immediate steps to take to prevent further losses.

Subscribe to our UOB Facebook page for the latest updates and advice on scams.

Remember these tips to help you #BeCyberSavvy:

- Do not click on suspicious links provided in unsolicited SMSes and emails.

- If in doubt, verify the authenticity of the information with our official website or sources.

- Never disclose your personal or internet banking details and one-time passwords (OTPs) to anyone.

Remember these tips to help you #BeCyberSavvy:

- Do not click on suspicious links provided in unsolicited SMSes, WhatsApp and emails.

- If in doubt, verify the authenticity of the information with our official website or sources and do not respond to an unfamiliar sender.

- Never disclose your personal or internet banking details and one-time passwords (OTPs) to anyone.

Suspect that you have been scammed? Contact our dedicated 24/7 Fraud Hotline at 6255 0160 or click here for immediate steps to take to prevent further losses. Subscribe to our UOB Facebook page for the latest updates and advice on scams.

Remember these tips to #BeCyberSavvy:

- Be on guard if someone you meet online quickly expresses affection yet declines video calls or meeting face-to-face.

- Verify the legitimacy of any business or investment opportunities offered to you.

- Never disclose your personal or internet banking details and one-time passwords (OTPs) to anyone.

Suspect that you have been scammed? Contact our dedicated 24/7 Fraud Hotline at 6255 0160 or click here for immediate steps to take to prevent further losses. Subscribe to our UOB Facebook page for the latest updates and advice on scams.

Remember these tips to help you #BeCyberSavvy:

- Do not click on suspicious links provided in unsolicited emails or messages.

- If in doubt, verify the authenticity of the information with our official website or sources.

- Never disclose your personal or internet banking details and one-time passwords (OTPs) to anyone.

Suspect that you have been scammed? Contact our dedicated 24/7 Fraud Hotline at 6255 0160 or click here for immediate steps to take to prevent further losses. Subscribe to our UOB Facebook page for the latest updates and advice on scams.

These are not official UOB websites:

❌ uoblife.com

❌ uob-login-sg.homes

❌ uob.finance

Remember these tips to #BeCyberSavvy:

- Do not click on suspicious links provided in unsolicited emails or messages.

- If in doubt, verify the authenticity of the information with our official website or sources.

- Never disclose your personal or internet banking details and one-time passwords (OTPs) to anyone.

Suspect that you have been scammed? Contact our dedicated 24/7 Fraud Hotline at 6255 0160 or click here for immediate steps to take to prevent further losses. Subscribe to our UOB Facebook page for the latest updates and advice on scams.

Remember these tips to #BeCyberSavvy:

- Do not click on suspicious links provided in unsolicited emails or messages.

- If in doubt, verify the authenticity of the information with our official website or sources.

- Never disclose your personal or internet banking details and one-time passwords (OTPs) to anyone.

Suspect that you have been scammed? Contact our dedicated 24/7 Fraud Hotline at 6255 0160 or click here for immediate steps to take to prevent further losses. Subscribe to our UOB Facebook page for the latest updates and advice on scams.

Remember these tips to #BeCyberSavvy:

- Do not click on suspicious links provided in unsolicited emails or messages. You can download the ScamShield App on your mobile app to detect scam SMSes and calls.

- If in doubt, verify the authenticity of the information with our official website or sources.

- Never disclose your personal or internet banking details and one-time passwords (OTPs) to anyone.

Suspect that you have been scammed? Contact our dedicated 24/7 Fraud Hotline at 6255 0160 or click here for immediate steps to take to prevent further losses. Subscribe to our UOB Facebook page for the latest updates and advice on scams.

Kill Switch

(Disable digital access and block your cards)

This will disable your digital access to Personal Internet Banking, UOB TMRW app and block all your cards instantly.

3 ways to do so:

- Call our 24-hour Fraud Hotline at 6255 0160 › Press 4 to activate Kill Switch Learn how

- Call General Hotline at 1800 222 2121, press 1 (for English) or 2 (for Chinese) > press 1 > press 2

- Make a report at our nearest UOB branch

Upon activating our self-service "kill switch" feature, you will receive two SMS notifications confirming the activation of the Kill Switch, which disables your digital access and blocks all your cards.

Any active digital login session will be terminated.

To re-activate your digital access, please call our General Hotline at 1800 222 2121 or visit your nearest UOB branch for assistance.If you wish to re-enable all your cards, please unblock them via the UOB TMRW app, or call our General Hotline at 1800 222 2121, or visit your nearest UOB branch for assistance.

Things you should know

Our security best practices and policies

- Do not click on suspicious links provided in unsolicited SMSes and emails. You can download the ScamShield App on your mobile app to detect scam SMSes and calls.

- If in doubt, verify the authenticity of the information with our official website or sources.

- Never disclose your personal or internet banking details and one-time passwords (OTPs) to anyone.

Suspect that you have been scammed? Contact our dedicated 24/7 Fraud Hotline at 6255 0160 or visit go.uob.com/reportscam for immediate steps to take to prevent further losses.

- Use payment options that only release payment to sellers upon delivery.

- Avoid making advance payments or direct bank transfers - this does not offer any protection to buyers.

- Arrange for physical meet-up with sellers to verify the authenticity of the physical tickets. Bear in mind that the party you are dealing with online is a stranger.

- Report the fraudulent advertisements to the social media and e-commerce platforms.

- Never disclose your personal or internet banking details and one-time passwords (OTPs) to anyone.

Suspect that you have been scammed? Visit here for immediate steps to take to prevent further losses, or call our dedicated 24/7 Fraud Hotline 6255 0160 if unsure.

Subscribe to our UOB Facebook page for the latest updates and advice on scams

- Add the ScamShield app and set security features (e.g. set up transaction limits for internet banking transactions, enable Two-Factor Authentication (2FA), Multifactor Authentication for banks and e-wallets).

- Do not send money to anyone you do not know or have not met in person before. Do not disclose your personal information, bank/card details and One-Time Passwords (OTPs) to anyone.

- Check for scam signs with official sources (e.g. call the Anti-Scam Helpline on 1799 or visit www.scamalert.sg), or with someone you trust.

- Look out for tell-tale signs of a phishing website. Do not click on dubious URL links provided by anyone you do not know or have not met in person before.

- Tell the authorities, family, and friends about scams. Report any fraudulent transactions to your bank immediately.

- Activate Money Lock to protect your account balances by restricting unauthorised withdrawals from being made on your account.

Suspect that you have been scammed? Visit here for immediate steps to take to prevent further losses, or call our dedicated 24/7 Fraud Hotline 6255 0160 if unsure.

We use cookies to improve and customise your browsing experience. You are deemed to have consented to our cookies policy if you continue browsing our site.