1 of 3

What do you need help with?

1 of 3

you are in GROUP WHOLESALE BANKING

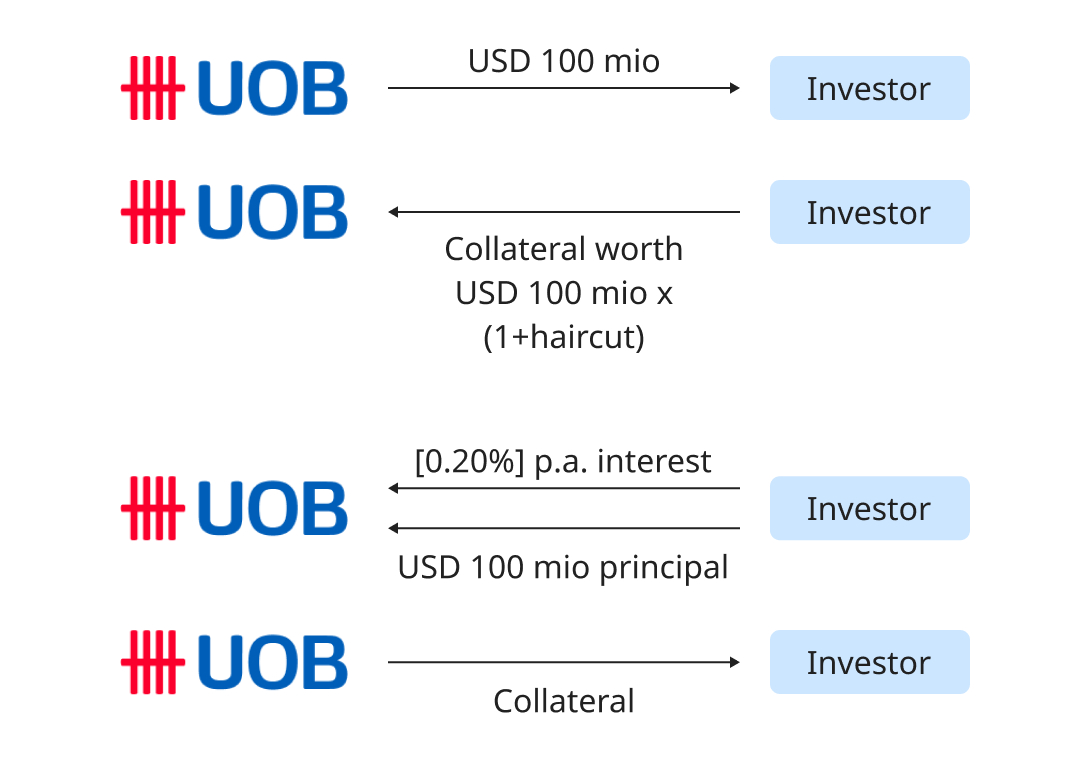

Borrow for the short-term by pledging securities to the lender as collateral. Securities will be returned to the borrower when the loan is repaid with interest at a future date.

Product types include repo, reverse repo, and cross-currency repo.

Documents required:

Risks involved:

Entity borrowing cash and pledging security as collateral

Entity lending cash and taking in collateral

| Repo Transaction | Description | Impact |

| Cash Borrower |

|

Balance sheet enlarged as both asset and liabilities increases. |

| Cash Lender |

|

Balance sheet size remains unchanged. Asset item changed from Cash to Account Receivables. |

| Repo Transaction |

| Cash Borrower |

| Cash Lender |

Generally, among the Asian market participants, the widely used collaterals are sovereign credit (e.g. U.S. Treasuries and Agencies, European Sovereigns, Asian Sovereigns) and certain corporate bonds.

We use cookies to improve and customize your browsing experience. You are deemed to have consented to our cookies policy if you continue browsing our site.