1 of 3

What do you need help with?

1 of 3

you are in GROUP WHOLESALE BANKING

Universal e-invoice standards resulting in more efficient processing and payment time.

Get increased value from our Trade Finance or Cash Management solutions.

Companies that wish to adopt e-invoicing must subscribe to an Access Point (AP) provider or use an existing solution provider that is PEPPOL-enabled. UOB has existing partnership arrangements with AP and solution providers that can cater to your business needs, and you can gain access to a PEPPOL AP provider through UOB. By connecting via our PEPPOL AP / solution provider, you can connect to other businesses across the entire PEPPOL network (i.e. connect once, connect all) both locally and globally. Businesses that are PEPPOL-enabled will also be able to use the PEPPOL invoice for our Cash Management and Trade Financing services.

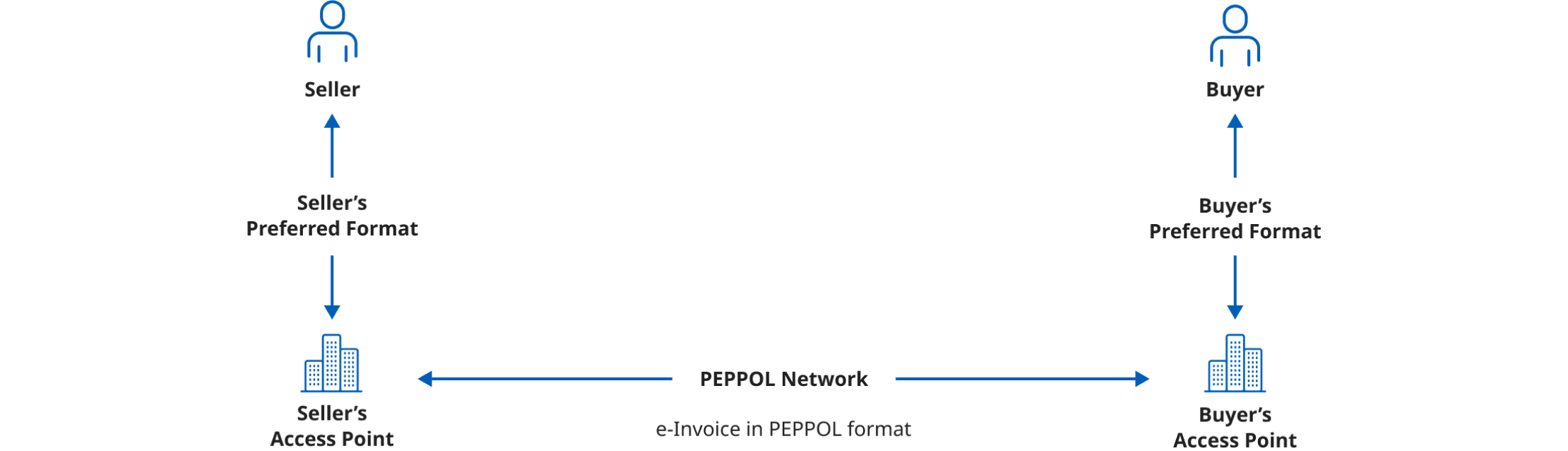

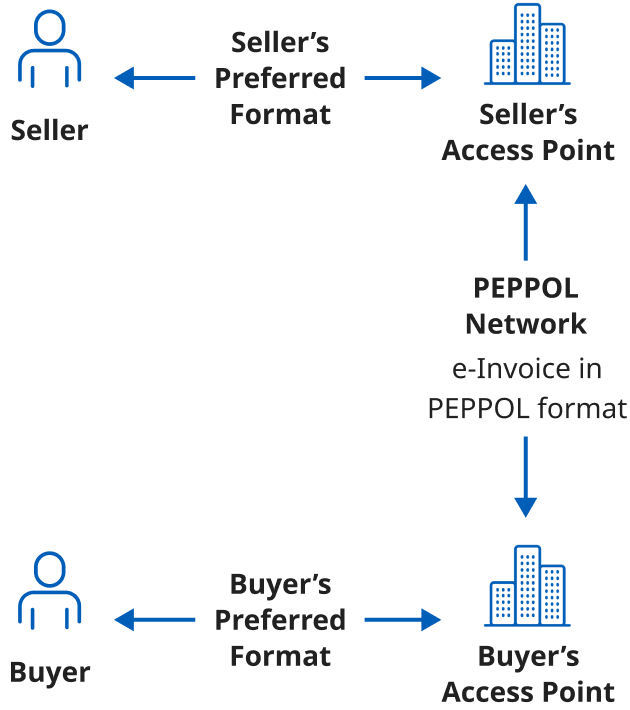

PEPPOL (Pan-European Public Procurement Online) is an international E-Document delivery network allowing enterprises to transact with other linked companies.

In January 2019, IMDA launched a Nationwide E-Invoicing Network based on the PEPPOL standard. Clients who sign up for the PEPPOL will be able to transact with overseas companies that are already onboarded onto the PEPPOL network. PEPPOL is in use in overseas locations, such as Europe, Australia, Canada, New Zealand, Singapore and the USA. There are currently 17 PEPPOL authorities participating in the network.

In a common business scenario today, an invoice is either a hard copy document or a PDF file sent to the recipient organisation either by the postal service or by email. This is a single-sided operation requiring your recipient to re-enter the details of the invoice into their own accounting system (as accounts payable). A more complete and secure solution would involve the transmission of data directly from the supplier’s system to the buyer’s system without human intervention. With PEPPOL invoices, there will be a reduction in paperwork and errors / discrepancies as PEPPOL standardises the invoicing format between buyers and sellers.

Studies have shown that E-Invoicing improves the time required for payments (45% of paper invoices are paid on time compared to 92% of e-invoices), reflecting a more efficient invoice-to-collection cycle.

Duplicated efforts in data entry are reduced as companies do not need to key in the information received on hardcopy invoices.

E-Invoicing minimises most transcription errors and cost. Rectification of a single invoice can cost as much as $72.

Lastly, it is also more eco-friendly with reduced paper usage.

A business that wishes to adopt PEPPOL E-Invoicing must first subscribe to an Access Point (AP) or Solution Provider. They can then send their E-Invoices to their AP or via their Solution Provider who delivers the E-Invoices on their behalf to APs that serve the receiving parties. Each business only needs to connect to a single AP, through which they can then be connected to all parties in the network.

UOB has existing partnership arrangements with different AP partners to suit your business' digital readiness. UOB will refer you to an appropriate AP partner that can meet your business needs. You will also get to enjoy preferential rates if you choose to adopt UOB's PEPPOL AP provider.

You may contact your RM for guidance on the sign-up process.

You may also use the eForm to register your interest and our partnered AP providers will reach out to you on the on-boarding process.

We use cookies to improve and customize your browsing experience. You are deemed to have consented to our cookies policy if you continue browsing our site.