1 of 3

What do you need help with?

1 of 3

you are in GROUP WHOLESALE BANKING

| Services | Fees |

| Handling Commission | 1/8%, min. S$75 |

| Services |

| Handling Commission |

Click here for other charges applicable to all trade products.

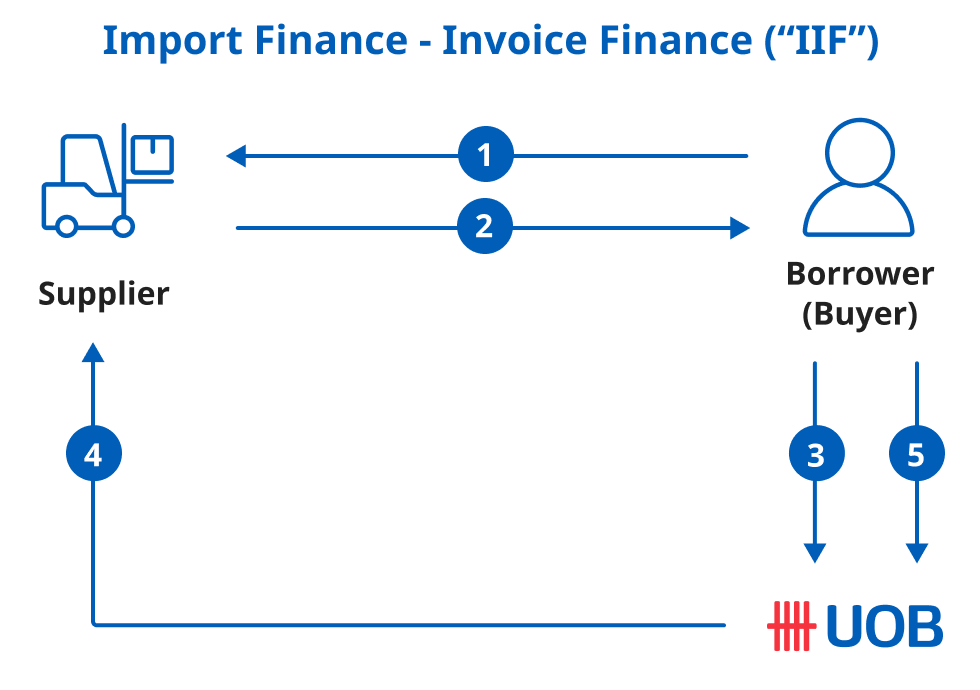

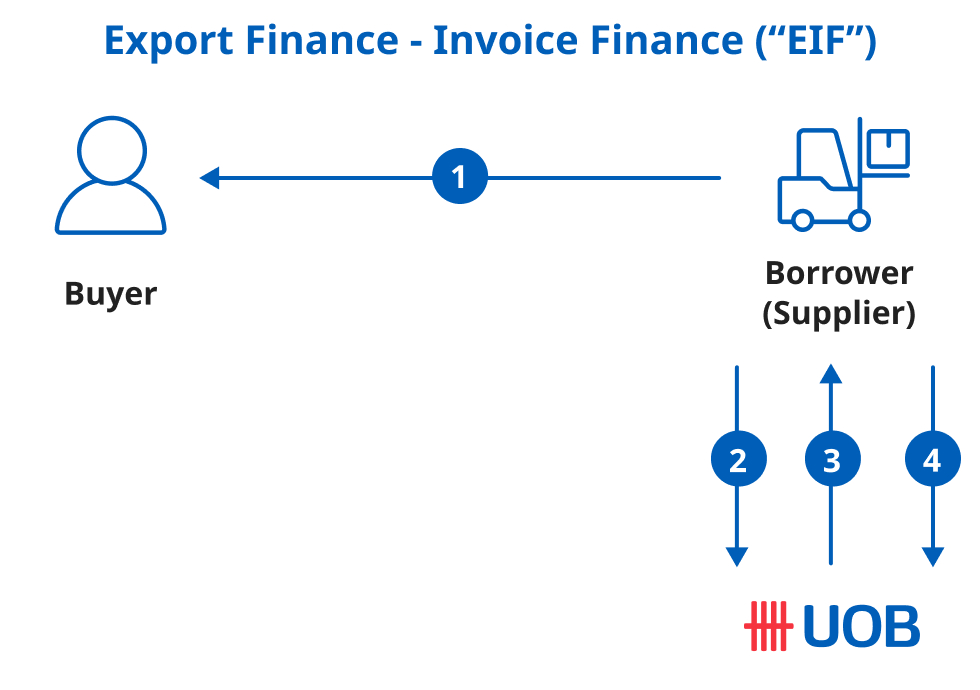

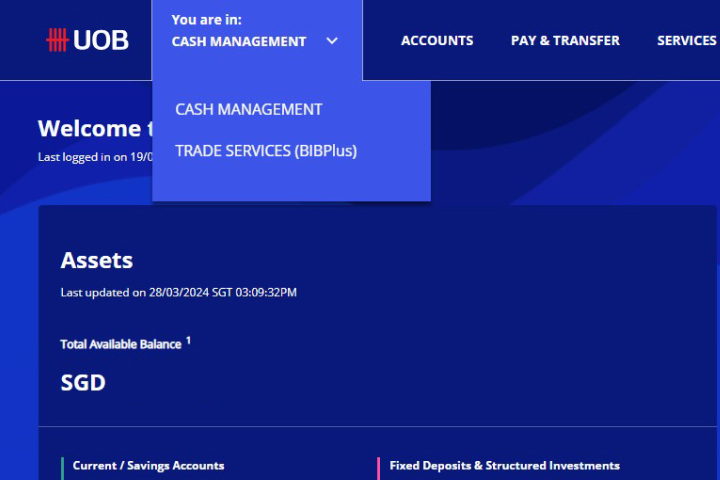

Select Trade Services (BIBPlus).

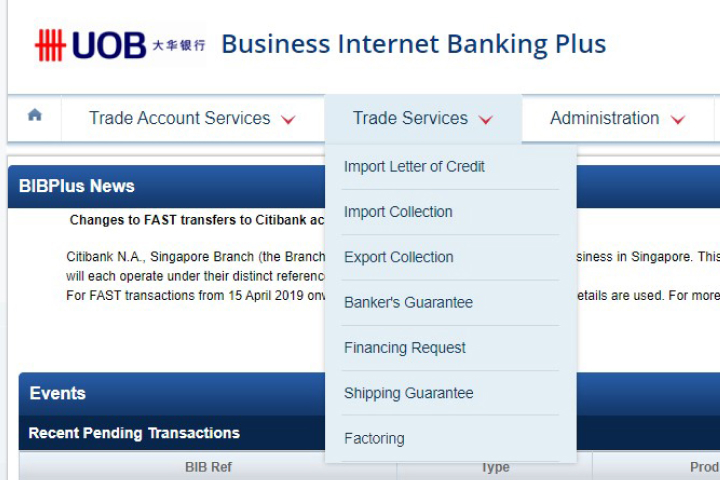

Select Financing Request, complete the application and click submit.

You may submit your application at any of our Trade Counters. Click here to find the Trade Counter nearest to you.

We use cookies to improve and customize your browsing experience. You are deemed to have consented to our cookies policy if you continue browsing our site.