1 of 3

What do you need help with?

1 of 3

Starting or growing a business? Enjoy more than S$4,000 savings now with essential solutions. T&Cs apply.

Find out more

Your go-to sustainability guide. Get your customised report today by taking the quiz now.

Take the quizyou are in GROUP WHOLESALE BANKING

Optimise your workflow and transaction turnaround time with online submission.

Track transaction status and history with ease.

Access trade transactions online and transactions effected over the counter.

Get trade advice, track delivery status for export documents, and bill alerts.

Apply for a UOB business account today to help to manage your business:

Find out more about UOB business accounts

If you are interested in registering for Financial Supply Chain Management (FSCM):

Please contact your relationship manager or our Infinity enquiry team at 1800 226 6121 (for Singapore) or +65 6226 6121 (for Overseas) from Mondays to Fridays, 9.00am to 6.30pm, excluding public holidays.

For standard transaction approval settings only:

Apply here.

Click here to see a sample.

For customised transaction approval settings:

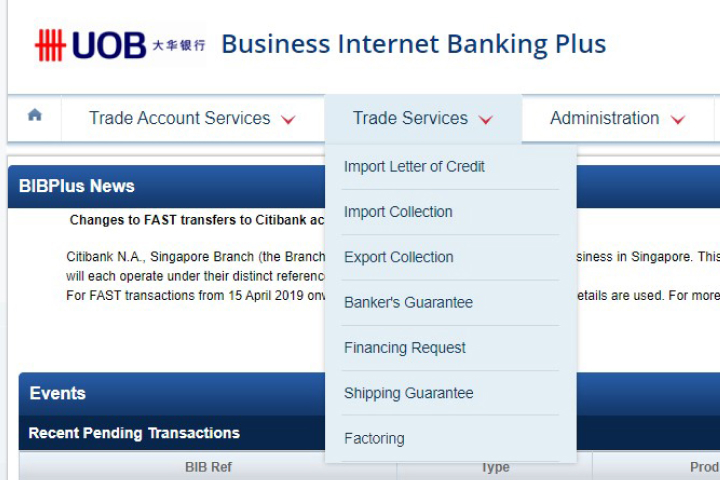

| Trade Services | How your business benefits |

| Trade Bill Summary | Real-time enquiry of outstanding trade bills |

| Import Letter of Credit (LC) | Application for issuance, amendment and cancellation of LC |

| Import Bill Notifications | Request for trust receipt financing for LC, documents against acceptance, and documents against payment |

| Shipping Guarantee | Application and endorsement Bill of Lading and air waybills |

| Banker’s Guarantee (BG) | Application for issuance, amendment and cancellation of BG |

| Financing Request | Request for clean invoice financing, packing credit, freight loan, export invoice financing and credit bills purchase |

| Trade Services |

| Trade Bill Summary |

| Import Letter of Credit (LC) |

| Import Bill Notifications |

| Shipping Guarantee |

| Banker’s Guarantee (BG) |

| Financing Request |

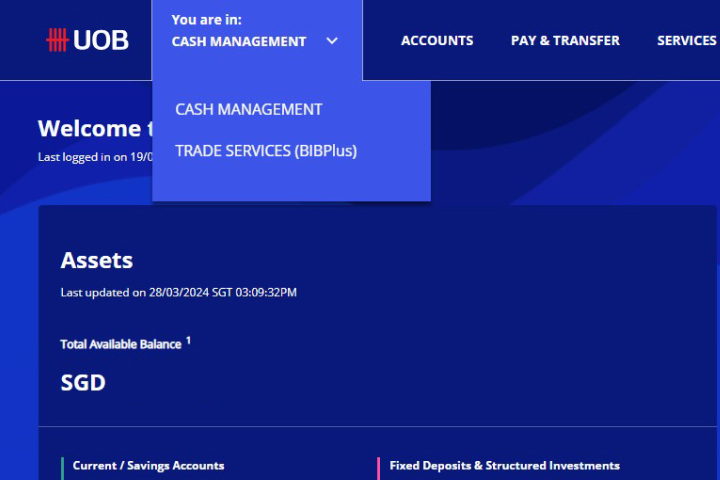

Select Trade Services.

Select trade product, complete & submit trade application or performing enquiry function.

Please select "Trade Services" in the registration or maintenance form under "Additional Infinity Services".

The interface upgrade of Trade functions is still a work in progress, and will be introduced at a later stage.

No. You can view trade transactions by selecting "Trade Services (BIBPlus)" > Trade Account Services > Transaction and Reports > Transaction Search.

No. You can approve trade transactions by selecting "Trade Services (BIBPlus)" > Trade Account Services > Transaction and Reports > To Do List.

No. You can set an alert/notification for a trade transaction by selecting "Trade Services (BIBPlus)" > Administration > Alert Management.

You will be redirected to UOB Infinity Cash Management. There is no need to log in again.

There are two ways to download Trade advices:

Trust Receipt Financing is a type of short-term import loan to provide the buyer with financing to settle goods imported where title of goods is held by the Bank.

It is applicable for Import bills under Letter of Credit (L/C) and Collection (D/A, D/P).

To access import bills:

Note: If you do not wish to apply for Trust Receipt Financing, you can use the same steps to instruct the Bank to settle the bills by debiting their account.

To repay outstanding Trust Receipt Financing (TF):

The transaction records in the "Trade Outstanding Amount" only reflect transactions effected after your trade access is setup.

The transaction records in "Trade Bill Summary" reflect all transaction records that you have with the Bank. This includes all trade transactions submitted over-the-counter before your trade access was set up.

Therefore, there may be differences in transaction records if you had outstanding Trade transactions that were effected before your trade access was set up.

Yes. Once the transaction is processed by the Bank, the transaction record as well as the relevant Trade advices will be made available in UOB Infinity.

We use cookies to improve and customize your browsing experience. You are deemed to have consented to our cookies policy if you continue browsing our site.