You are now reading:

The differences between unsecured and secured debt

Inspire the globetrotter in you with the first one-stop travel portal in Southeast Asia designed by a bank that inspires, helps you plan, and lets you book in one place.

Find out more

Get up to 6% p.a. interest in just two steps. Apply now and receive a pair of JBL Live Beam 3 and cash rewards! T&Cs apply. Insured up to S$100k by SDIC.

Find out more

Get instant cash at 0% interest and low processing fees. Enjoy S$100 cash rebate* on your approved loan amount!

Find out more

Invest in funds powered by Private Bank CIO – United CIO Income Fund and United CIO Growth Fund.

Learn more

Get PRUCancer 360 from just S$3.70 per week. Sign up now and enjoy 35% off your first-year premium. T&Cs apply.

Find out more

Meet UOB TMRW, the all-in-one banking app built around you and your needs.

Bank. Invest. Reward. Make TMRW yours.

you are in Personal Banking

You are now reading:

The differences between unsecured and secured debt

Think that taking on debt is a bad move? It’s time to change that mindset. When it comes to your finances, applying for loans are useful in easing your cash flow and providing you with the necessary resources for crucial needs.

Consider, for instance, buying a car, pursuing further education or unexpected emergencies – your current funds might not be sufficient to take on these potentially large expenses in one payment alone.

But, taking a loan is helpful if you need immediate access to funds in a safe and reliable way.

Before you enter the world of loans, you will also need to understand what is more suitable for your needs and circumstances.

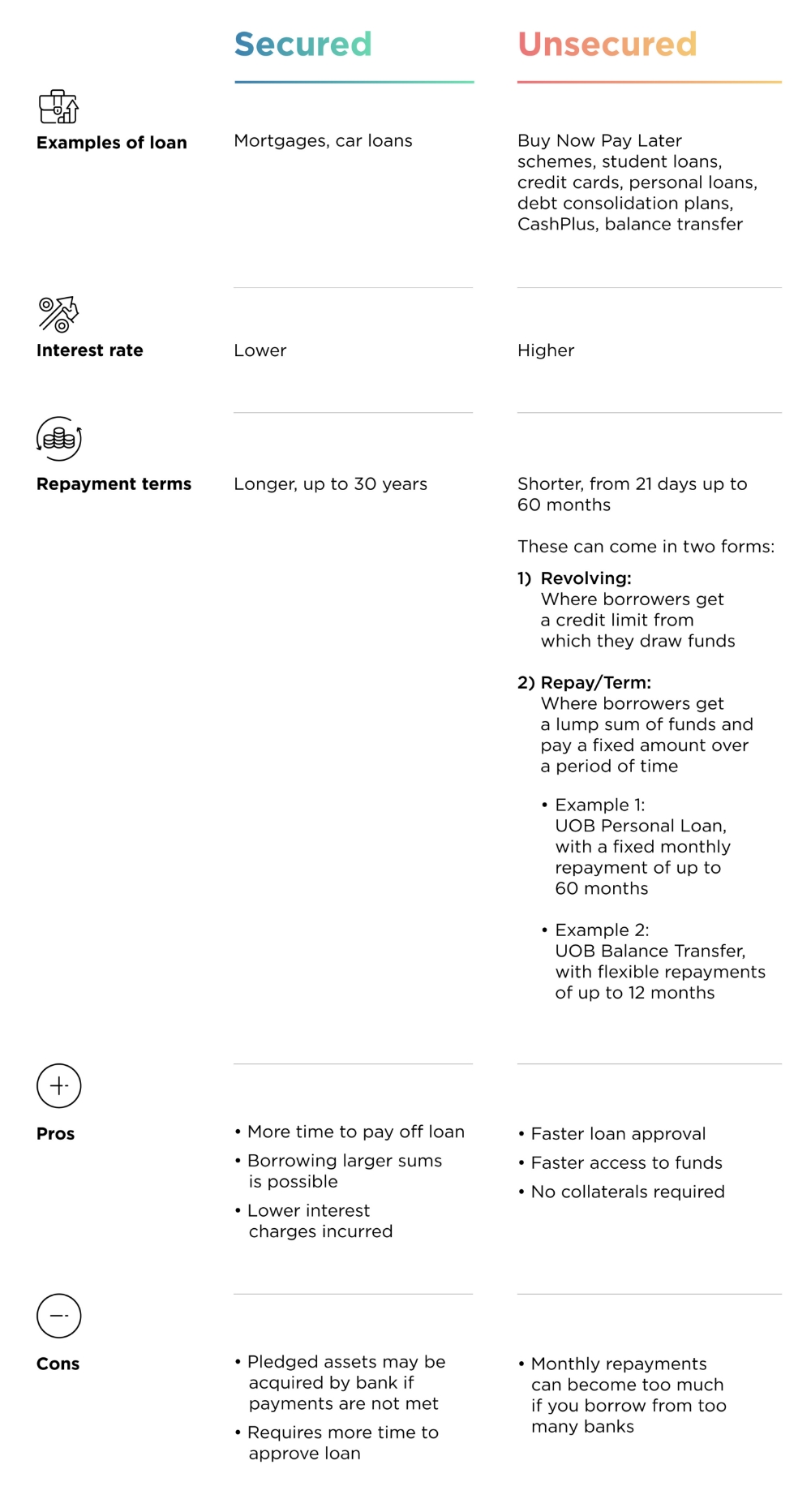

There are two categories of loans available: secured and unsecured.

To take on a secured loan, the borrower must be able to commit assets for collateral. These assets are tangible items, such as cars, property and other kinds of inventory that can be used to pay off the debt, in the event of a default.

In contrast, an unsecured loan depends on the borrower’s capability to pay. Instead of using assets, one must provide credit scores and be assessed before they can borrow. Because these loans rely solely on the borrower’s ability to clear the debt, such loans are deemed less secure or ‘unsecured’ compared to those backed by collateral.

These differences are also important in how secured and unsecured loans are managed by banks and other licensed money lenders, especially with regards to interest rates and repayment terms.

With your financial circumstances and the purpose of your loan in mind, consider whether a secured or unsecured loan may be more suitable for your needs. Here’s a quick look at the other necessary details to consider.

Still wondering which loan works better for you? That all depends on what methods you have to pay off your debt as well as your financial goals for the future. Regardless, UOB offers great options tailored to your needs.

A UOB Personal Loan can be an excellent choice for those requiring immediate funds in large amounts. While it offers instant access to cash, this option allows for flexible repayment terms of up to 60 months with fixed monthly payments.

Alternatively, if you’re looking to streamline your credit card debt, UOB Balance Transfer allows you to save on interest and free up the cash for other uses.

You shouldn’t be intimidated about taking on some debt. Depending on what you’re using the loan for, your debt could be ‘good’ for you too! Learn more about the differences between good and bad debt and what they mean for your finances here.

We are providing you these financial literacy information (including any videos) (“Information”) for your general information only. We do not intend for you to use the Information as accounting, legal, regulatory, tax, financial or any other type of advice. Before making any financial decisions, please speak with your own professional advisors on the suitability of the product. We make no representation or warranty as to the accuracy and completeness of the Information. We are not liable if you suffer any losses arising from your reliance on the Information.

27 Nov 2024 • 17 MINS READ

27 Nov 2024 • 10 MINS READ

27 Nov 2024 • 10 MINS READ