Frequently Asked Questions

Top FAQs

If you require a replacement for your physical token, you

need to fill up a maintenance form.

Please contact your

relationship manager or visit the nearest UOB branch to your convenience to get

the required form.

To initiate a payment instruction in UOB Infinity, from the top menu bar, select Pay and Transfer > select the payment type and follow the on-screen instructions accordingly.

After logging in to UOB Infinity, you may click on “Trade Services (FSCM)” from top menu to navigate from Cash management to Trade Services (FSCM)

Yes, to access Trade Services (FSCM), you will need to sign up for UOB Infinity.

No. However, you will need to sign up for UOB Infinity – Trade Services (FSCM) via the maintenance form.

All FAQs

General

UOB Infinity is UOB’s digital banking platform for businesses. The platform offers a comprehensive suite of cash management and trade services to help you manage your cash and trade transactions more efficiently.

The key differences are in the user interface and features offered. UOB Infinity offers new features that enables you to navigate and complete your tasks faster and more efficiently. With UOB Infinity, you will be able to:

- Personalise your dashboard and access information that matters most to you quickly.

- Access any function in just one click.

- Authenticate cash transactions anytime, anywhere without a physical token.

- Track end-to-end status of cross-border payments and enjoy visibility of all fees and charges.

Yes, UOB Infinity is available 24/7. However, certain transactions may be subject to cut-off time. Please contact UOB representative for details.

Yes, as long as you have Internet access while you are overseas, you will be able to access UOB Infinity anytime, anywhere.

Yes, you can access UOB Infinity via the UOB Infinity mobile

app. You can download the mobile app from the  (for iPhones) or

(for iPhones) or  (for Android phones).

(for Android phones).

With the UOB Infinity mobile app, you can access your business account, make payments and authorise transactions anytime, anywhere.

Alternatively, you can access UOB Infinity using the browser from your mobile phone or tablet.

No new login credentials are required. You can use the same login credentials for BIBPlus to access UOB Infinity.

Both UOB Infinity and BIBPlus will run concurrently to give users time to get used to the new user interface on UOB Infinity. All transactions, templates, past payments, drafts and payee/beneficiary master will be available on both platforms.

The companies that have a corporate account with UOB are eligible to apply for UOB Infinity.

No, you do not have to apply for UOB Infinity if you are an existing BIBPlus user. You can simply log in to UOB Infinity with your current BIBPlus login details.

No, you do not have to apply for UOB infinity if you are an existing BIBPlus user. You can simply log in to UOB Infinity with your current BIBPlus login details.

Both UOB Infinity and BIBPlus will run concurrently to give users time to get used to the new user interface on UOB Infinity. All transactions, templates, past payments, drafts and payee/beneficiary master will be available on both platforms during concurrent period.

You will only need to apply for UOB Infinity if you are not an existing BIBPlus user. You may select "Apply Now" and follow the instructions to download the appropriate form.

- To reset Organisation ID/ User ID - please contact our service team on +852 2820 6663 from Monday to Friday, 9.00am to 6.00pm, excluding public holidays.

- Our service team may request information for identification. Please have the relevant ID documents.

Please contact your relationship manager or call us on +852 2820 6663 from Monday to Friday, 9.00am to 6.00pm, excluding public holidays.

It takes the Bank up to 5 working days from the receipt of your application and all required documents to process your application. Upon successful creation of your user ID, the Bank will send an email and SMS to the email address and contact number respectively as indicated on your UOB Infinity application. Please ensure that the email address and contact number provided in the application form is correct.

You will receive a UOB Infinity Welcome Pack delivered to

your postal contact address. The welcome pack will consist

of your UOB Infinity Organisation ID and User ID. Depending

on the products and services you selected in the submitted

form, you may also receive a physical token

separately.

Note: Physical token is required for Trade Services or

Global View functions.

At the moment, we can only send SMS notification (for account activation, password reset and digital token registration/activation) to the mobile number originated from the following countries/regions (based on alphabetical order):

- Australia

- Brunei

- Canada

- China (Digital token activation is not available)

- France

- Hong Kong SAR/li>

- India

- Indonesia

- Japan

- Malaysia

- Myanmar

- Philippines

- Singapore

- South Korea

- Taiwan

- Thailand

- United Kingdom

- United States

- Vietnam

We will be enhancing our service to cover more countries/regions.

Fees and charges related to product and services. For a full list of fees and charges, please see our pricing guide.

Your Company Administrator will be able to create/add users and assign different functional and data access privileges to different users. However, the Company Administrator cannot create/add other Company Administrators and/or Authorisers.

To create/add Administrator and Authoriser access, please submit a maintenance form.

To link/add more accounts, please submit a maintenance form.

To subscribe to more UOB Infinity services such as bulk payment/payroll/collection, MT103 copy and trade services, please submit a maintenance form.

You can activate your user ID from the UOB Infinity login page by selecting “Want to activate your new account?” and following the on-screen steps. For all users except Company Administrators and Authorisers, your Company Administrator will also be able to activate your account on your behalf.

Organisation ID – You cannot change your Organisation ID

User ID - You can change your User ID only during your first login to UOB Infinity. Subsequent changes are not allowed.

Password – You may change your password at any time from the “Manage Profile” menu at the top right corner of your dashboard.

UOB Infinity has a “Remember Me” function to store the Organisation and User ID from the last login. You will only need to enter your password the next time you log in. However, the “Remember Me” function can only save one Organisation and User ID.

UOB Infinity can display account activity data for the past 12 months.

For existing BIBPlus customers, you will be able to view/retrieve account activity data for the past 12 months in UOB Infinity.

For new UOB Infinity customers, you can only view/retrieve account activity data for the past 2 months when you access UOB Infinity for the first time.

You will be able to download/export the account statements of all your UOB accounts that are linked to UOB Infinity. Please note that the layout of the downloaded statement differs from the physical account statement.

To download/export account statements:

- From the top menu bar, go to Accounts > Account Activities from the top menu bar

- Select the account number and date range required.

- Click the “Export” button at the top right corner of the screen.

There are 4 file types available:

- CSV

- Spreadsheet

- Fixed Length

The external account balance will only be updated after a transaction is posted into the external account after linking it to UOB Infinity. As such, you may see a zero balance in the external account on the day the external account is linked to UOB Infinity.

Cash Management

To initiate a payment instruction in UOB Infinity, from the top menu bar, select Pay and Transfer > select the payment type and follow the on-screen instructions accordingly.

Yes, you can restrict users to creating/approving payment to specific payees only by allowing them to access pre-approved payees (PAP) only. The Company Administrator can set the user’s access by selecting “PAP Only” under the user’s account setup.

The Payee List shows the 10 most recent payees from the same user with the most recent listed first . There is no filtering by debit account or transaction type.

You can find out which authoriser is next to approve the transaction from Approval Status:

- From the top menu bar, select Accounts > Approval Status

- Search for your transaction and click the action menu

(

)

) - Select “Audit Trail” to view the authoriser name

To edit a transaction that has been submitted for approval, the approver has to return the transaction to the maker by selecting “Return to Maker”. After which, the maker of the payment will be able to edit the transaction.

You can approve a payment instruction from:

- Dashboard – In “My Tasks” widget, the five most recent transactions requiring your approval will be listed; OR

- My Tasks – From the top menu bar, select My Tasks to view the full list of requests requiring your approval

If you need a step-by-step guide, please log in to UOB

Infinity, click the user icon (![]() ) at the top menu

bar

and click "Need Help?".

) at the top menu

bar

and click "Need Help?".

To set up or update your approval mandate, or change the authorisers’ authorisation groups, please submit a maintenance form.

Every monetary transaction can only be approved according to the approval mandate in the authorisation profile. In addition, you can also set up the following limit controls:

|

Limit |

Type |

Default Limit |

Applies to |

||

|

Signatory Daily Limit |

Daily Limit per Signatory |

Any Amount, subject to availability of funds in the account |

Any Signatory in Group A, B, C, D or E |

||

|

Transaction Limit* |

Transaction Limit per Signatory in each Signatory Group |

Any Amount, subject to availability of funds in the account |

All products/services available in UOB Infinity. |

||

|

|||||

Yes, any authoriser indicated according to the company’s approval mandate can approve the payment.

If you are authorised to approve your own payment, you will have the option to approve the payment immediately by selecting “Submit Now”. Alternatively, you may approve the payment later by selecting “Add to My Tasks”. By selecting the latter, the payment will appear in My Tasks for you to approve it later.

To recall a payment after it has been sent to the Bank for processing, please contact UOB +852 2820 6663 from Monday to Friday, 9.00am to 6.00pm, excluding public holidays.

You can check the transaction status by selecting Accounts > Approval Status from the top menu bar.Approval Status provides a consolidated view of all transaction statuses in a single location. The transactions are classified by their status for easy reference:

- All (white) - all transactions regardless of status

- Pending (orange) - transactions that have not been submitted/sent to the Bank

- Sent to Bank (blue) - transactions that have been submitted to the Bank but have not been processed

- Rejected (red) – transactions that have been rejected or bulk transactions that have been partially rejected

- Successful (green) – transactions that have been successfully processed by the Bank

You can check the transaction status by selecting Accounts > Approval Status from the top menu bar.

Approval Status provides a consolidated view of all transaction statuses in a single location. The transactions are classified by their status for easy reference:

- All (white) - all transactions regardless of status

- Pending (orange) - transactions that have not been submitted/sent to the Bank

- Sent to Bank (blue) - transactions that have been submitted to the Bank but have not been processed

- Rejected (red) – transactions that have been rejected or bulk transactions that have been partially rejected

- Successful (green) – transactions that have been successfully processed by the Bank

In addition, the Company Administrator can also set up email or SMS alerts to notify the transaction makers and/or authorisers when a transaction has been successfully processed or rejected.

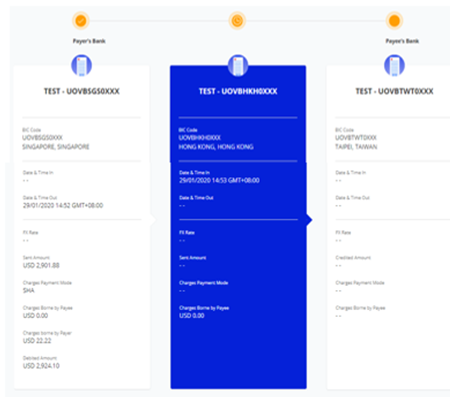

Yes, you can track your cross-border and cross-currency transactions from “Track Payments (SWIFT gpi)”. To access “Track Payments (SWIFT gpi), from the top menu bar, select Pay & Transfer > Track Payments (SWIFT gpi).

This feature allows users to do end-to-end tracking of their incoming/outgoing cross-border Telegraphic Transfer/MT202 transactions. There is no cost to using Track Payments (SWIFT gpi).

SWIFT Global Payment Innovation (SWIFT gpi) is a service offered by SWIFT, aimed at transforming the customer experience in tracking cross-border payments. SWIFT is a global provider of secure financial messaging services.

Yes, you can track telegraphic transfer as long as you know the originating account number of the payments.

The blue column indicates where the payment is at

currently.

A coloured circle can be found on top of each bank’s column indicating the status of the transaction at each bank:

- Green - Completed

- Orange - In Progress / On Hold

- Red - Rejected

- Grey – Not traceable (e.g. the payment has reached a non-SWIFT bank)

For a more detailed explanation of this feature, please log in to UOB Infinity, click the user icon (

Yes, you can export the transaction details as a PDF or CSV file. The CSV file format is only applicable for bulk transactions. For the PDF file format, you can choose to export the transaction details with or without the audit trail information.

To export transaction details:

- From the top menu bar, select Accounts > Approval Status

- Search for the transaction

- From the action menu (

), select

“View

Details”

), select

“View

Details” - Select “Export” at the top right of the transaction details

For single transactions:

- If you export as “PDF”, you will be able to download the file immediately.

- If you export as “PDF with Audit Trail”, you will receive an email notification when the file is ready to be downloaded. To download, from the top menu bar, select Accounts > Download Reports. Select “User Generated” tab > click the download icon for the transaction.

For bulk transactions:

- You will receive an email notification when the file is ready to be downloaded. To download, from the top menu bar, select Accounts > Download Reports. Select “User Generated” tab > click the download icon for the transaction.

“Please be noted this is for payment details export. If you want to download account statement details, please refer to the procedure under "Accounts" FAQ menu.”

Yes, there are a payment advices generated for payment. To locate the advice, from top menu bar:

-

Select Accounts > Account Activities

-

Select the account number and date range (when the outgoing/incoming payment occurred).

-

To download, click the icon available at the “Advice” column

You can also view and export the inward remittance details using the same steps.

If you are subscribing to other reconciliation/statement reports (e.g. MT940), you can request for the report to be made available in UOB Infinity through your customer representative or call our service hotline +852 2820 6663 from Monday to Friday, 9.00am to 6.00pm, excluding public holidays.

To download the report:

- From the top menu bar, select Accounts > Download Reports

- Click the icon under the “Downloads” column.

Transaction details are kept in UOB Infinity for 6 months. If you need to obtain the details of payments made more than 6 months ago, please contact our service team on +852 2820 6663 from Monday to Friday, 9.00am to 6.00pm, excluding public holidays.

Yes, you can utilise your existing FX contracts when you submit cross-currency payments. To utilise existing FX contracts when initiating cross-currency payments:

- Choose “Use FX Contract”

- The list of FX Contract(s) that you can utilise based on the currency pair will be displayed

- Alternatively, there is an option for you to enter the FX Contract ID manually

Please note:

- For cross-currency payment to another UOB account – you can only use one FX contract.

- For cross-currency payment using Telegraphic Transfer (TT) – you can use multiple FX contracts within one single TT transaction.

Yes, you can utilise your existing FX contracts when you submit cross-currency payments. To utilise existing FX contracts when initiating cross-currency payments:

Choose “Use FX Contract”

The list of FX Contract(s) that you can utilise based on the currency pair will be displayed

The biometric feature allows you to access the mobile app quickly and securely by using your mobile device’s fingerprint/face recognition function. With this feature, you do not need to enter your password to log in to the UOB Infinity mobile app.

For a step-by-step guide to setup the fingerprint / face

recognition authentication, please log in to UOB Infinity,

click the user icon (![]() )

at the top menu bar and click “Need Help?”.

)

at the top menu bar and click “Need Help?”.

For security reasons, each user is allowed to enable the fingerprint / face recognition function on one mobile device only. If you are switching to a new mobile device, you need to re-enable your fingerprint / face recognition function on the new device. The fingerprint / face recognition function set up on the existing device will be removed automatically once it has been set up on the new mobile device.

For security reasons, your fingerprint / face recognition setup in the app will be removed when you uninstall the app or clear the app data. You will need to re-enable your fingerprint / face recognition function on your mobile device.

For security reasons, your fingerprint / face recognition function will be disabled after the 5th failed attempt. Please use your password to log in so as to re-enable your fingerprint / face recognition function.

Yes, you can approve all types of transactions using the UOB Infinity mobile app.

Infinity Secure is a digital security token that allows you to log in to UOB Infinity and approve cash transactions in UOB Infinity.

If you are an existing BIBPlus user, you will need valid login details (BIBPlus Group ID, User ID, Password and a working physical token) to kick start the registration process for Infinity Secure.

- Download UOB Infinity mobile app and log in to Infinity via the mobile app.

- Register for Infinity Secure (under "More Services" in the Infinity mobile app)

- Wait for 8 hours

- Activate Infinity Secure (under "More Services" in the Infinity mobile app)

For a step-by-step guide, please log in to UOB Infinity,

click the user icon (![]() )

at the top menu bar and click “Need Help?”.

)

at the top menu bar and click “Need Help?”.

If you do not see the option to register Infinity Secure, it is likely that you are using a global token that is currently not supported by Infinity Secure

*Note:

- Private token – a shared physical token used by more than one UOB Infinity/BIBPlus login credential within the same country.

- Global token – a single physical token used to access UOB Infinity/BIBPlus accounts in more than one country (e.g. Singapore and Malaysia) with the same login credentials.

This is a security feature of Infinity Secure’s registration and activation process to prevent fraudulent activation of Infinity Secure.

Should you receive the One-Time Verification Code via SMS or email for UOB Infinity Secure registration without initiating the registration, please contact UOB at +852 2820 6663.

Please try again after 30 minutes. If the problem persists, please contact the Bank at +852 2820 6663.

Yes, you can subscribe for Global View service and you can still use your digital token (Infinity Secure) locally (e.g. Hong Kong) as well.

When you subscribe for Global View service, a physical shared token will be issued to you, where it will allow you to access more than one UOB Infinity User Profiles (login credentials) across different locations (e.g. Hong Kong and Singapore).

Alternatively, you can also easily access Hong Kong and other locations’ UOB accounts on Infinity mobile after upgrading to Infinity Secure with Global View functionality.

You will still require your physical token to authorise trade transactions. However, you have the flexibility to use Infinity Secure to authorise your cash payments within and across different locations, after completing linking process.

You may request your Company Administrator (CA) to deregister Infinity Secure that is linked to your user ID. If you are the CA and you have lost your mobile phone, please contact UOB at +852 2820 6663.

You can either:

- Deregister Infinity Secure from the UOB Infinity app on your existing mobile device before changing to the new mobile device; OR

- Use your physical token and follow the steps in here to start using Infinity Secure on your new mobile device.

No, Infinity Secure will not be automatically deregistered. You will need to deregister Infinity Secure from your account by following these steps:

- Log in to the UOB Infinity mobile app

- Select “More Services”

- Click “Remove Infinity Secure from this account”

If you have forgotten to deregister Infinity Secure before uninstalling the UOB Infinity mobile app, please use your physical token to log in to the UOB Infinity mobile app and follow the above steps to deregister the Infinity Secure. You can also inform your Company Administrator or call the Bank to deregister your Infinity Secure.

If you have exceeded the maximum number of tries (i.e. 5 times) for your Infinity Secure PIN, for security reasons, you will be required to re-register for Infinity Secure.

Please use your physical token to log in and follow the steps here to register and activate your Infinity Secure.

I have forgotten my 6-digit Infinity Secure PIN. What should I do?

For security reasons, there is no reset function for your Infinity Secure PIN. If you have forgotten your 6-digit Infinity Secure PIN, you can select “Forget Secure PIN” on your UOB Infinity mobile screen. After which, you will be guided to re-register for Infinity Secure.

If you require a replacement for your physical token, you

need to fill up a maintenance form.

Please

contact your relationship manager or visit the nearest UOB branch to your

convenience to get the required form.

Yes, if you switch to a new mobile phone:

- Please install the UOB Infinity mobile app on the new mobile phone and perform the registration and activation of Infinity Secure on your new mobile phone.

- You will be prompted to transfer existing linkages to new mobile, or you may choose to re-link all of the User Profiles across the different Organisation IDs under the UOB Infinity mobile app on your new mobile phone again.

Note: If you are using iCloud services to migrate your iOS apps and configurations to your new iPhone, please uninstall the migrated UOB Infinity mobile app under your new iPhone and re-install the latest version from the iOS App Store.

A shared digital token (Infinity Secure) conveniently allows a user to access more than one UOB Infinity User Profiles (login credentials) across different Organisation IDs within the same location (e.g. Singapore or Malaysia) and across different locations on a single UOB Infinity mobile app.

By registering and activating Global Digital Token, you may access, view, and transact all UOB accounts within and across locations with a single login.

- Infinity Secure only – a digital token which allows user to login to Infinity with multiple user access within or across locations.

- Infinity Secure with Global View – a digital token which allows user to login to Infinity with multiple user access, view consolidated accounts and perform transaction within and across different locations with a single login via primary user.

This feature is available in Singapore, Malaysia, Hong Kong, Vietnam, Brunei, Manila and Yangon and will be progressively made available to more locations.

You will need valid login details (UOB Infinity Organisation ID, User ID, and Password) to kick start the registration process for Infinity Secure.

- Download UOB Infinity mobile app and log in to Infinity via the mobile app

- Register for Infinity Secure

- Wait for 12 hours

- Activate Infinity Secure

For a step-by-step guide to set up the shared digital token, you will need to log in to UOB Infinity, click the user icon (![]() ) at the top menu bar and click “Need Help?”.

) at the top menu bar and click “Need Help?”.

You can refer to the "Register your digital security token" User Guide to link multiple UOB Infinity User Profiles (login credentials) across different Organisation IDs within the same location and across different locations to their shared digital token (Infinity Secure) on the UOB Infinity mobile app.

Under Infinity Secure “Manage Infinity Secure’s Linked Profiles” sub-menu, the user can input to-be linked Organisation ID and user ID and choose “Infinity Secure only” or “Infinity Secure with Global View” option to link users within and across different locations.

After successful linkage and upgrade of Infinity Secure, initiating user and linked user has to perform Infinity Secure activation. 12-hour cooling period is imposed before user activation process as part of enhanced security measures.

Activation of initiating user

Initiating user can activate his own profile after 12-hour cooling period has passed.

Activation of linked user

- Activate on behalf of Linked user. To do so, initiating user can select “Manage Infinity Secure’s Linked Profiles” sub-menu, select “Profile” and choose “Activate” option to activate the profile linkage.

- Alternatively, the Linked user will activate his own Infinity Secure profile by logging into the App directly after 12-hour cooling period has passed.

Please note that all existing users will be prompted to re-activate their user profile after linkage is completed.

User has to perform linking with to-be linked new user ID. Upon successful Global Digital Token upgrade, newly linked user has to activate user profile and will be prompted to accept Terms and Conditions if this is a first-time login.

Activation of linked user

Activate on behalf of Linked user: To do so, initiating user can select “Manage Infinity Secure’s Linked Profiles” sub-menu, select profile and choose “Activate” option to activate the profile linkage.

Alternatively, the Linked user will activate his own profile after 12-hour cooling period has passed.

Initiating user always has to request for the linkages of the users within or across different locations as the first step.

Initiating user can perform successful linking of user IDs when following conditions are met:

- Requestor/Initiating User and Linking User to have same Legal ID and

- Selected Infinity Secure Only Linkage Type (i.e. without Global View feature)

Company administrator of linked user has to approve the linkage when following conditions are met:

- Requestor and Linked User Legal ID are not matched, or

- Selected Linkage type is Infinity Secure with Global View

- If user (i.e. authoriser) had selected only “Infinity Secure Linkage only” and linked within same location, Push notification will be sent to the soft token registered device where authoriser can login and authorise transaction.

- If user (i.e. authoriser) had selected only “Infinity Secure Linkage only” and linked across different locations, authoriser will be redirected to login to Mobile Browser to authorise the transaction. It is still 2 user profiles in different locations using 1 mobile device/Infinity Secure), hence the authoriser is always redirected to Mobile Browser.

- If user (i.e. authoriser) had selected only “Infinity Secure with Global View Linkage” and across different locations, authoriser user can act on push notification and authorise the transaction seamlessly.

User can select “Remove Infinity Secure From This Account” sub-menu from Infinity mobile, and choose the profile to be de-linked.

If selected user is the linked user within group, only the linked user will be delinked.

If selected user is the primary user, then all the linked users will be delinked.

If the selected user is the last user on Infinity App (e.g. Hong Kong’s user ID on Hong Kong Infinity App), the linked users of other locations (i.e. Singapore user ID on Hong Kong Infinity App) will also be delinked.

You can continue to retain Global View physical token to access UOB accounts across all locations via Infinity browser.

Alternatively, you can also easily access Hong Kong and other locations’ UOB accounts on Infinity mobile after upgrading to Global Digital Token with Global View functionality.

You will still require your physical token to authorise trade transactions. However, you have the flexibility to use Infinity Secure to authorise your cash payments within and across different locations, after completing linking process.

For optimal user experience, you are recommended to use Chrome browser for UOB Infinity web. The following system/browser combinations are for your reference to access UOB Infinity

For the UOB Infinity mobile app, the following OS are recommended:

- iOS - version 11 to version 13. Please note that the UOB Infinity mobile app does not support iPhone 6 and below.

- Android OS - version 7 to version 11

Click here to view the list of devices tested with UOB Infinity.

UOB Infinity has a system that provides a high standard of security for banking over the Internet. This security system safeguards the confidentiality of your personal account information and banking transactions by employing:

- Multiple levels of firewalls

- 2048-bit Secure Sockets Layer (SSL) encryption – currently recognised internationally to be of the highest standard in encryption technology commercially available

- A two-factor authentication that uses User ID and password (or biometric login for UOB Infinity mobile app) along with a secure token

To further protect your company's account and transaction

information while banking via UOB Infinity, we recommend

doing the following:

- Change your password regularly as an added security measure

- Clear the browser's cache after each session in UOB Infinity so that details of your transactions are removed

- Always log out properly after you have completed your online banking activities

For more details, you may wish to view our best privacy and security practices.

Financial Supply Chain Management

UOB Infinity – Trade Services (FSCM) is our newly added module, with new features to help you manage your supply chain program more efficiently, effectively and securely, to bring you and your buyers/ sellers onto a whole new banking experience.

BIBPlus for Trade Services: For submission of documentary trade, open account (import/export finance) transactions.

UOB Infinity for Trade Services (FSCM): For submission of FSCM related transactions and documentations for processing.

Clients can still continue to access or submit their Documentary trade and Open Account transactions via BIBPlus Trade Services after UOB Infinity – Trade Services (FSCM) is launched.

The modules available in BIBPlus Trade Services are as follows:

- Trade Bill Summary

- Trade Advices

- Import Letter of Credit (LC) Issuance, Amendment and Cancellation

- Import Bill Notifications including Trust Receipt Financing

- Shipping Guarantee/Endorsement

- Banker’s Guarantee (BG) Issuance, Amendment and Cancellation

- Financing Request (E.g. Clean Invoice Financing, Packing Credit, Freight Loan, Export Invoice Financing and credit bills purchase)

- Trade Loan Repayment

The modules available in UOB Infinity for Trade Services (FSCM) are as follows:

- Supplier Finance (Pre and Post Shipment Finance)

- Supplier Finance (Irrevocable Payment Undertaking)

- Distributor Finance (Post Shipment)

- Account Receivables Purchase (With/Without Recourse)

UOB Infinity – Trade Services (FSCM) offers new features that will help you to navigate and complete your tasks more swiftly and efficiently. With UOB Infinity – Trade Services (FSCM), you will be able to :

- Digitise and automate processing of invoices and request for financing, which helps to reduce time of information input and exchange

- Enjoy cost savings by eliminating duplication and reducing errors by automating the request of financing and settlement of outstanding loans

- Connect to a digital eco-system of suppliers/ distributors (domestic/ overseas) by linking up with them on one single platform

- Manage your documents seamlessly by tracking your past/present PO and invoices for up to 13 months

After logging in to UOB Infinity, you may click on “Trade Services (FSCM)” from top menu to navigate from Cash management to Trade Services (FSCM).

To navigate back to BIBPlus Trade Services: Select “Cash Management” to navigate back to UOB Infinity then select “BIBPlus Trade Services”

To navigate back to UOB Infinity – Cash Management: Select “Cash Management”

You will not be able to view transactions that you submitted via BIBPlus Trade Services. You will need to navigate back to BIBPlus Trade Services to access your Documentary Trade or Open Account Transactions.

Yes, to access Trade Services (FSCM), you will need to sign up for UOB Infinity.

No. However, you will still need to sign up for UOB Infinity – Trade Services (FSCM) via the maintenance form.

Yes. If you are an existing BIBPlus user, you will still be able to access to Trade Services from BIBPlus.

You will need to provide a separate approving mandate for Trade Services (FSCM) from UOB Infinity via a Maintenance form.

Please contact your relationship manager or our service team team at +852 2820 6663 from Mondays to Fridays, 9.00am to 6.00pm, excluding public holidays

To link/add more accounts, please submit a maintenance form.

To create/add users, please submit a maintenance form.

At the moment, we can only send SMS notification to a mobile number originating from the following countries/regions (based on alphabetical order):

- Australia

- Brunei

- Canada

- China

- France

- Hong Kong SAR

- India

- Indonesia

- Japan

- Malaysia

- Myanmar

- Philippines

- Singapore

- South Korea

- Taiwan

- Thailand

- United Kingdom

- United States

- Vietnam

We will be enhancing our service to cover more countries/regions.

You can download our user guide by logging in to UOB

Infinity, click the user icon (![]() ) at the top menu

bar

and click “Need Help?”.

) at the top menu

bar

and click “Need Help?”.

Should you require any assistance, please contact your relationship manager.

Yes, UOB Infinity – Trade Services (FSCM) is available 24/7. However, some transactions may be subject to cut-off time. Please contact UOB representative for details.

Yes, as long as you have Internet access while you are overseas, you will be able to access UOB Infinity anytime, anywhere.

Currently, UOB Infinity – Trade Services (FSCM) cannot be accessed via your mobile phone or tablet.

For optimal user experience, you are recommended to access UOB Infinity – Trade Services (FSCM) using the following system/ browser combinations:

Trade Services

Please contact your relationship manager or our service team team at +852 2820 6663 from Mondays to Fridays, 9.00am to 6.30pm, excluding public holidays.

- Log in to UOB Infinity

- From the top menu bar, click on the drop-down menu “You are in: Cash Management”

- Select “Trade Services (BIBPlus)”

You will be redirected to BIBPlus for trade services. There is no need to log in again.

The interface upgrade of Trade functions is still a work in progress, and will be introduced at a later stage.

No. You can view trade transactions by selecting “Trade Services (BIBPlus)” > Trade Account Services > Transaction and Reports > Transaction Search.

No. You can approve trade transactions by selecting “Trade Services (BIBPlus)” > Trade Account Services > Transaction and Reports > To Do List.

No. You can set an alert/notification for a trade transaction by selecting “Trade Services (BIBPlus)” > Administration > Alert Management.

- From the top menu bar, click on the drop-down menu “Trade Services”

- Select “Cash Services”

You will be redirected to UOB Infinity Cash Management. There is no need to log in again.

There are two ways to download Trade advices:

- From Trade Bill Summary screen

- From the top menu bar, select Account Services > Trade Bill Summary

- Search for the individual outstanding trade bill detail

- Click on the Bank Reference No. hyperlink

- A pop-up window with the transaction consolidated summary view and all events including advices related to this trade bill will be displayed

- From Trade transaction screen (e.g. Import Letter of Credit)

- From the top menu bar, select Trade Service > Import Letter of Credit > Processed LC

- Search for the individual LC record

- Click “History of LC”

The LC consolidated summary view and all events including advices related to this letter of credit will be displayed.

Trust Receipt Financing is a type of short-term import loan to provide the buyer with financing to settle goods imported where title of goods is held by the Bank.

It is applicable for Import bills under Letter of Credit

(L/C) and Collection (D/A, D/P).

To access import bills:

- Import Bills under L/C

- From the top menu bar, select Trade Services > Import Letter of Credit > Message to Bank

- Select either From Bill Arrival – Discrepant OR From Bill Arrival – Clean

- For Import Bills Under D/A or D/P

- From the top menu bar, select Trade Service > Import Collection > Message to Bank > Action Required

Note: If you do not wish to apply for Trust Receipt Financing, you can use the same steps to instruct the Bank to settle the bills by debiting their account.

To repay outstanding Trust Receipt Financing (TF):

- From the top menu bar, select Trade Service > Financing Request > Update TF > From Past TF

- Select the Outstanding TF to repay

- Select one of the following payment options:

- Partial Payment:

You can indicate the amount to repay with the following repayment options:

- Principal

Indicated amount will be debited for settlement of the principal amount. In addition, the full interest amount will be deducted from the same account.

- Principal + Interest

Indicated amount will be debited for settlement of interest amount. Remaining balance of the indicated amount will then be used to settle the Principal amount.

-

Final/Full Payment:

This is used to repay the full outstanding amount.

The transaction records in the “Trade Outstanding Amount” only reflect transactions effected after your trade access is setup.

The transaction records in “Trade Bill Summary” reflect all transaction records that you have with the Bank. This includes all trade transactions submitted over-the-counter before your trade access was set up.

Therefore, there may be differences in transaction records if you had outstanding Trade transactions that were effected before your trade access was set up.

Yes. Once the transaction is processed by the Bank, the transaction record as well as the relevant Trade advices will be made available in UOB Infinity.

Malware Security and Protection

This feature is essential for bolstering security by mitigating dangers and protecting against malware scams. It

prevents scammers from taking control of your device and compromising your banking and personal information.

Additionally, it alerts you when a scammer attempts to control your device remotely. For your security, your

access to

UOB Infinity will be restricted until these activities are stopped.

Please note that there are differences between iOS and Android devices due to device-specific behaviors. Our

stance is

to prevent these activities as much as possible, and we strongly urge customers not to share any content from

your

banking app.

If you did not perform screen sharing or recording, but received an anti-malware message upon login, please

switch your

device to flight mode immediately to disconnect it from the Internet. This will prevent scammers from further

accessing

your device remotely. Use reputable anti-virus software to scan and remove any detected malware on your device.

You are

strongly encouraged to report the incident to the police and contact our Client Service Team at +852 2820 6663

for

assistance during office hours.

We have detected that you have mobile apps with risky permissions. Applications that were downloaded from third-party

sites may compromise banking and personal information. For your security, your access to UOB Infinity will be restricted

until you uninstall or turn off accessibility permissions for the mentioned apps shown on the error message.

To mitigate the risk of malware attack from these apps, the recommended option is to uninstall the mentioned apps that

are not downloaded from official app stores.

However, if you are certain and trust that the mentioned app is safe (example: it is a workplace app), you may turn off

the accessibility permission.

We value your privacy and assure you that our new features do not monitor your phone activity, collect, or store any personal data.

We apologize for any inconvenience caused. The purpose of this security feature is to protect customers from malware scams. Our detection found that the mentioned mobile app was installed from a third-party site, rather than an official store, which may compromise your banking and personal information. To continue using UOB Infinity alongside your workplace app, you will need to turn off the accessibility permissions for your workplace app.

Step 1: Open your device’s Settings app.

Step 2: Scroll down and select "Accessibility".

Step 3: Scroll until you find "Advanced Settings".

Step 4: Tap on "Accessibility button" and then "Select actions".

Step 5: Toggle the switch for "Accessibility" to turn off the feature.

Please note that the exact steps may vary depending on your device manufacturer and operating system. If you encounter

any difficulties, please consult your device manufacturer.

The affected app could be malicious. Please follow these steps to protect yourself from malware scams:

a) Switch your Device to Flight Mode:

If you suspect your device has been infected by malware, immediately switch to flight mode to disconnect from the

internet. This will prevent scammers from accessing your device remotely.

b) Run an Anti-Virus Scan on your device:

Use anti-virus software to scan and remove any malware detected on your device to ensure all malware is identified and

removed.

c) Report the Incident:

You are strongly encouraged to report the incident to the relevant authorities and file a police report at the nearest

police station. Also, please contact our Client Service Team at +852 2820 6663 for urgent assistance.

Once the above steps are completed:

You may resume using your device by booting it in safe mode to temporarily disable third-party apps, then uninstall any

suspicious apps. Finally, install mobile security software from a trusted source to scan for any remaining malware.

As a further precaution, consider performing a factory reset and changing important passwords. Do not restore data from

backups after performing a factory reset.

Overlay is a feature where an App can appear on top of other apps. These could be invisible to the user and malicious parties can phish information that you are entered on your device. Hence for your security, it is recommended that you to turn off the device's overlay permission at the phone setting.

Step 1 : Open your device’s Settings app.

Step 2 : Scroll down and select "Apps".

Step 3 : Tap on "Advanced options" and select "Special access".

Step 4 : Tap on "Display over other apps", "Draw over other apps", or "Appear on top".

Step 5 : Tap the toggle switch for the app to turn off the overlay.

Please note that the exact steps may vary depending on your device manufacturer and operating system. If you encounter

any difficulties, please consult your device manufacturer.

USB / wireless debugging (developer option) is a specialized mode on Android devices that grants access to advanced settings and features not typically available to general users. These settings pose potential security risks to the app. Therefore, to ensure your security, access to UOB Infinity has been restricted.

App tampering involves modifying the original code of an application, potentially bypassing or manipulating its security features. To ensure your security, access to UOB Infinity has been restricted. It is recommended that you reinstall UOB Infinity from a legitimate app store.