You are now reading:

Budgeting 101: Putting Your Money in the Right Place

you are in Better TMRW

You are now reading:

Budgeting 101: Putting Your Money in the Right Place

Are you wondering where your money has been going every month? Then, it's time you start keeping track of your expenses.

One of the best ways to do that is with a budget. Setting up a budget helps you take control of your finances. You can organise your spending and savings in an orderly manner. Plus, it is helpful in figuring out what expenses are unnecessary. Take for instance, unused mobile app subscriptions or even over-indulging on hobbies.

The budget also serves another purpose -- helping you meet your financial goals. These could range from paying off debts, preparing for retirement or saving up for a big expense. Once you have goals, your budget serves a clearer purpose too.

Not sure how to get started?

Thankfully, creating a budget can be simple. Here are some easy-to-follow tips on budgeting that’s perfect for beginners and experts alike.

Find out how much you’re actually earning every month with this simple formula:

Where is your money going? Do your best to account for every dollar spent! Start categorising your expenses: Rent and utilities:

Most importantly, remember to set aside some money for your savings!

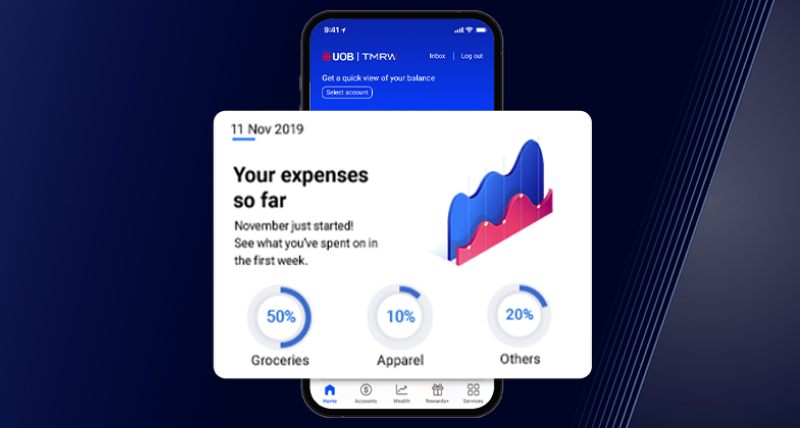

This can be a tedious task. But, if you’re using the UOB TMRW app, your expenses will be tracked in real-time and categorised for you.

What personal goals do you have, and what are you saving for?

Make concrete steps on how to achieve this goal – set a time frame and designate some savings for this.

Are your current spending habits sustainable to meet these goals?

If not, trim out what you don’t really need, such as shopping for the latest fashion or cutting back on occasional indulgences (think eating at home instead of dining out).

Are your current spending habits sustainable to meet these goals?

After this, it’s time to reallocate your finances. How much of your income can you set aside for your savings? Will you have enough for everyday expenses?

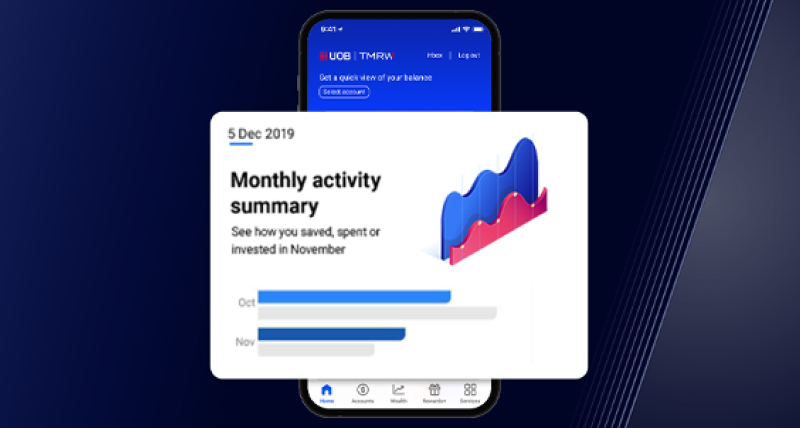

If you find it hard to save, you can use the UOB TMRW app to automatically save a fixed amount of money every month.

Bonus: here are some budgeting plans you can adopt, based on your spending and savings appetite.

Life happens, and sometimes you’ll have to pay for some unexpected expenses with emergency funds.

Ensure you have savings for these occasions, and rethink your budget if required. This will help you stay on track with your saving habits.

We are providing you this financial literacy information (including any videos) (“Information) for your general information only. We do not intend for you to use the Information as accounting, legal, regulatory, tax, financial or any other type of advice. Before making any financial decisions, please speak with your own professional advisors on suitability. We make no representation or warranty as to the accuracy and completeness of the Information. We are not liable should you suffer any losses arising from your reliance on the Information.

10 Apr 2023 • 5 mins read

03 Feb 2023 • 5 mins read

03 Feb 2023 • 5 mins read

02 Feb 2023 • 5 mins read