You are now reading:

A Beginner’s Guide to Budgeting

you are in Better TMRW

You are now reading:

A Beginner’s Guide to Budgeting

Finding it hard to save money each month? Here are some ways to get you started.

We all have many financial goals we want to achieve in life - but with a stack of bills to pay, saving enough money each month can be a challenge. Having a solid budgeting plan helps you keep track of spending and gives you more control over your finances. Read on to learn more about the different types of budgeting methods out there.

Just like it sounds, this is a traditional method that involves putting cash into physical envelopes, one for each category of spending. (e.g. Rent, Groceries, Entertainment etc.)

Place the amount of money you plan to spend each month into each envelope, which is all you can spend for that category. If you prefer to use cash and be strict with how you manage money, this may be the method for you.

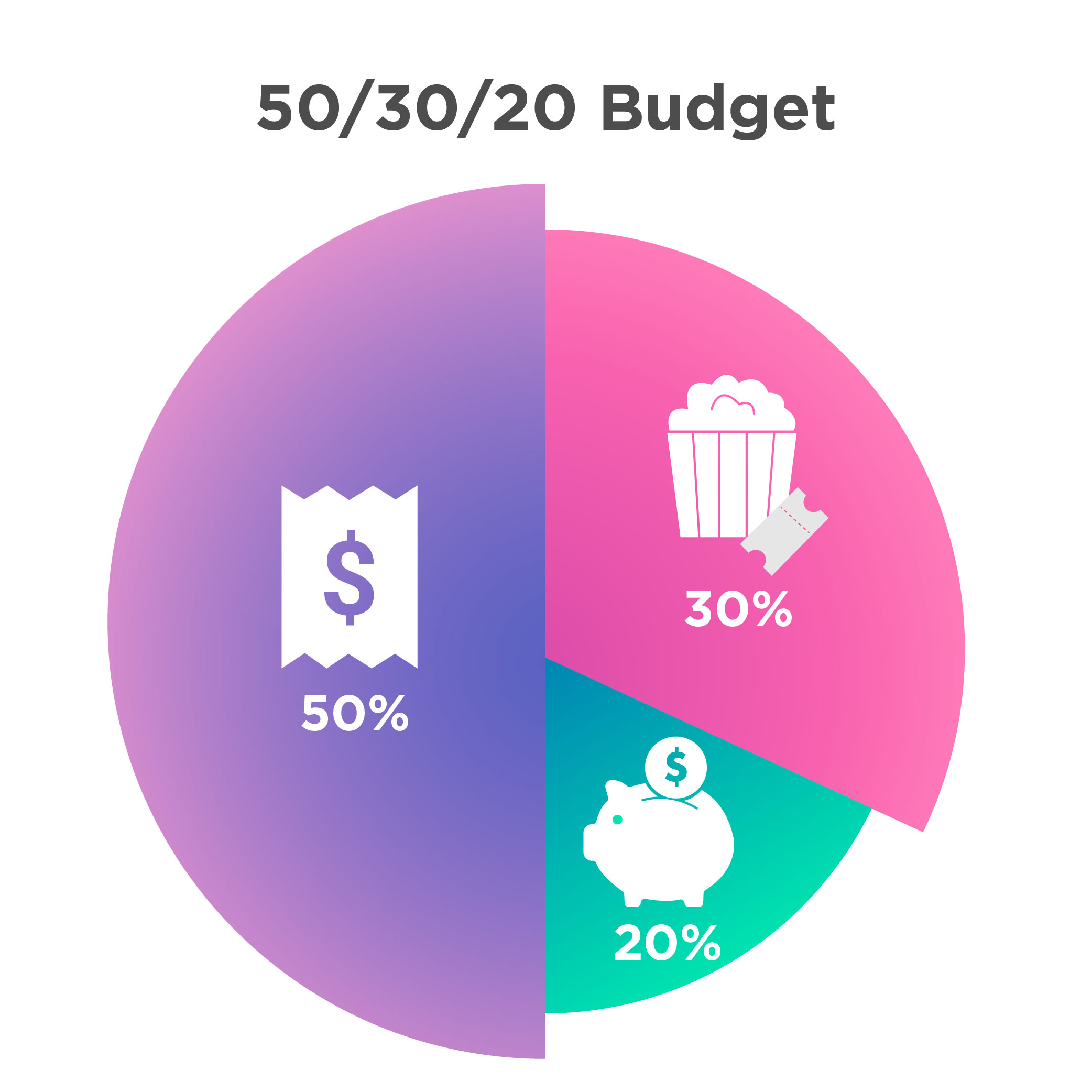

For those who don’t like to deal with too many categories, this method divides spending into just 3:

• 50% Essential Expenses (e.g. rent, utilities, food)

• 30% Non-essential Expenses (e.g. movie tickets, Spotify subscription, hairdressing)

• 20% Financial Goals (e.g. saving for a wedding / new home)

The 50/30/20 ratio is recommended for most people, but you can come up with your own allocation based on your situation and goals. It’s a simple and straightforward approach for those who may be overwhelmed by more detailed methods.

The idea behind this method is simple - allocate each dollar you earn every month to a different budget category (including savings) until you’re left with $0. For instance:

| Monthly Income: $3,000 | |

| Rent | -$700 |

| Utilities | -$100 |

| Handphone Bill | -$50 |

| Groceries | -$300 |

| Entertainment | -$300 |

| Medical | -$200 |

| Insurance | -$350 |

| Savings | -$1000 |

| Balance | -$0 |

Essentially, when you’re finished you should see that Income - Expenses = Zero. This gives every dollar you spend a purpose, be it for essentials or a savings goal. If you overspend in one category, you'll need to stop spending in that area until the next month or take money from another category.

The Zero-based method is the most time consuming as it requires you to dig into the details behind each line item, but it also gives you a clear picture of your finances and where you can adjust your spending.

The first 3 methods have all focused on controlling spending. This last method reverses that approach and prioritises saving instead - it’s also the simplest one to apply.

After receiving your paycheck each month, set aside the sum you want to save, and pay off all your bills. That’s it! You’re now free to spend whatever is left. For example:

| Monthly Income | Savings | Bills | Spendings |

| Category | Description | Description | Description |

This is the easiest method to apply as you don’t need to track anything at all. If you’re a frugal person who doesn’t tend to overspend, this method should work well for you.

Pick a method and stick to it

When it comes to budgeting, there is no one-size-fits-all method. You should choose an approach that makes the most sense to you logically and fits your lifestyle. The most important thing is to stay consistent and have a goal in mind. Don’t be afraid to try something else if the current method is not working for you, or make adjustments to tailor it to your needs!

We are providing you this financial literacy information (including any videos) (“Information) for your general information only. We do not intend for you to use the Information as accounting, legal, regulatory, tax, financial or any other type of advice. Before making any financial decisions, please speak with your own professional advisors on suitability. We make no representation or warranty as to the accuracy and completeness of the Information. We are not liable should you suffer any losses arising from your reliance on the Information.

10 Apr 2023 • 5 mins read

03 Feb 2023 • 5 mins read

03 Feb 2023 • 5 mins read