You are now reading:

ASEAN Consumer Sentiment Study 2024 (Malaysia): Cautious outlook despite economic strength

What does the ASEAN consumer think and feel about the economy? How has spending and financial behaviour changed? Get the latest highlights from the region’s barometer of consumer sentiments.

What does the ASEAN consumer think and feel about the economy? How has spending and financial behaviour changed? Get the latest highlights from the region’s barometer of consumer sentiments.

Explore key business trends and sentiments today.

View reportyou are in UOB ASEAN Insights

You are now reading:

ASEAN Consumer Sentiment Study 2024 (Malaysia): Cautious outlook despite economic strength

With one of the strongest growth stories in Southeast Asia, Malaysia’s economy grew by 5.9 per cent in Q2 2024, driven by strong domestic demand and rising exports.

Household spending increased, supported by robust labour market and government policies. The Malaysian Government expects economic growth to remain strong, fuelled by domestic demand and various external factors, while inflation is projected to stay within the forecasted range.

However, the ASEAN Consumer Sentiment Study 2024 - Malaysia highlights that despite the positive news, the mood in Malaysia has dipped. More Malaysians feel uncertain, worried, and anxious about the current economic situation.

Malaysia has one of the lowest inflation rates in the region. Despite higher diesel prices, government interventions have kept inflation in check, allowing Bank Negara Malaysia to keep the interest rate steady. Consumer prices were lower than expected in July 2024, leading analysts to revise their inflation forecasts downward, hovering around the 2 per cent mark.

Despite the relatively low inflation rates, less than half of Malaysian respondents are positive about the country's current and future economic performance. Sixty-one per cent of consumers reported at least one negative emotion, which is 17 per cent higher than the regional average and 10 per cent higher than last year’s survey.

This poor sentiment may be caused in part by slow-rising inflation throughout the year, from 1.5 per cent in December 2023 to 1.9 per cent in August 2024. Consumers may also fear that inflation can rise further with changes in petrol subsidy reforms and global commodity prices. Planned salary increases for civil servants could also create inflationary pressure.

Recession fears add to this feeling of gloom; 70 per cent of Malaysians think a recession is likely in the next six to 12 months, 4 per cent higher than the regional average.

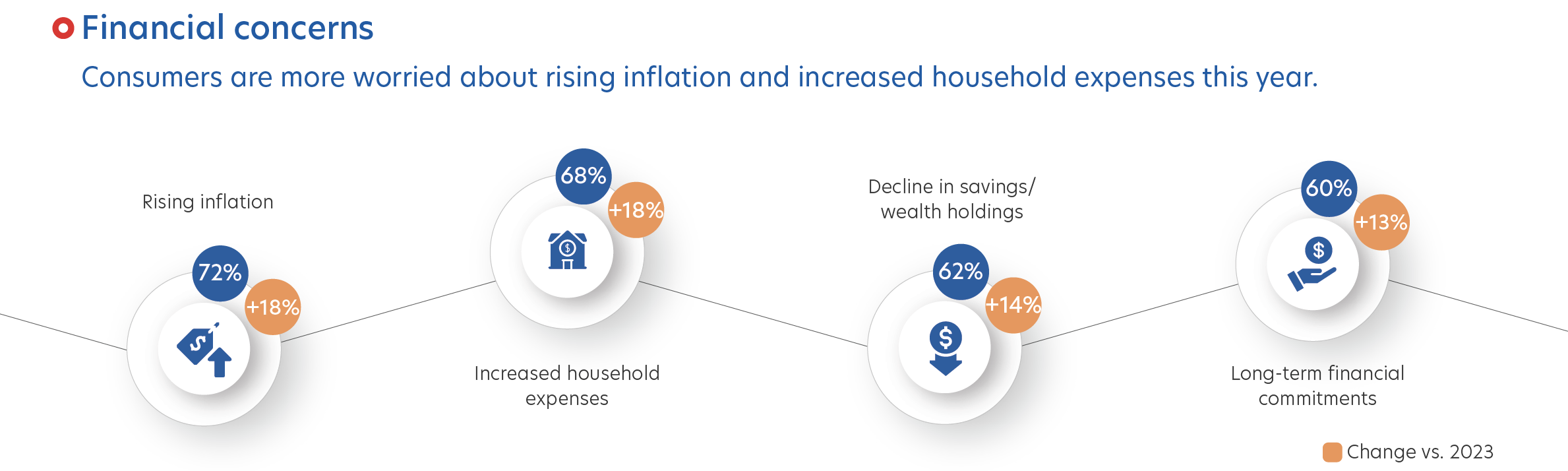

The vast majority of Malaysians are concerned about finances (85 per cent) and work (73 per cent). These are both higher than the regional average and the previous survey. Rising inflation and increased household expenses are the top financial concerns, with 72 per cent and 68 per cent of respondents worried about these issues, respectively.

Figure 1: Respondents’ top financial concerns

Compared with last year, Malaysians report allocating a bigger portion of their budgets to expenses and less to insurance and investment. Consumer spending has increased on groceries, children's education, and utilities. The latter may partly be due to the rise in water utility prices, which grew 31.8 per cent this year.

To cope with inflation, three out of five Malaysians have reduced spending on non-essentials, 54 per cent of consumers sought offers or discounts, and over a third (37 per cent) lowered utility usage.

On their personal outlook, many Malaysians are hopeful. Despite current concerns, over three in four Malaysian consumers expect to be financially better off or the same next year, although this is a decrease from 2023 and lower than the regional average.

Gen Z consumers, who are the biggest savers among the respondents, have also increased their spending across multiple categories, including spending on experiences.

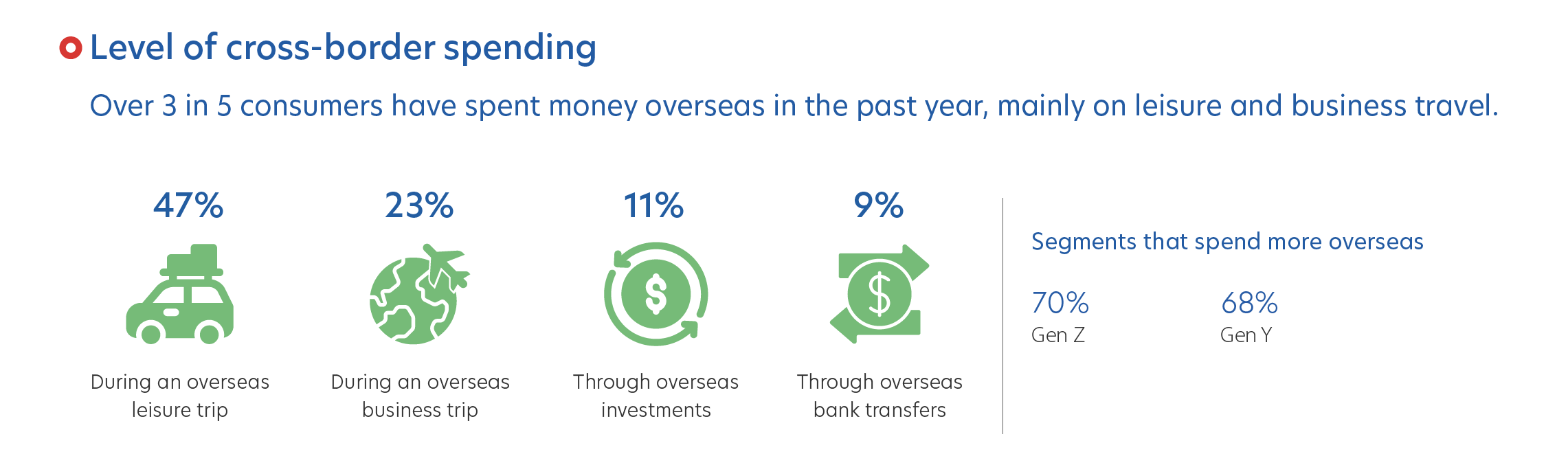

In terms of cross-border transactions, three in five Malaysians have spent money within ASEAN on overseas travels, investments or bank transfers. For those who have travelled overseas, the preferred payment method was through physical or mobile credit/debit cards (62 per cent). Cash was the second highest preferred payment method (47 per cent).

Figure 2: Types of overseas spending

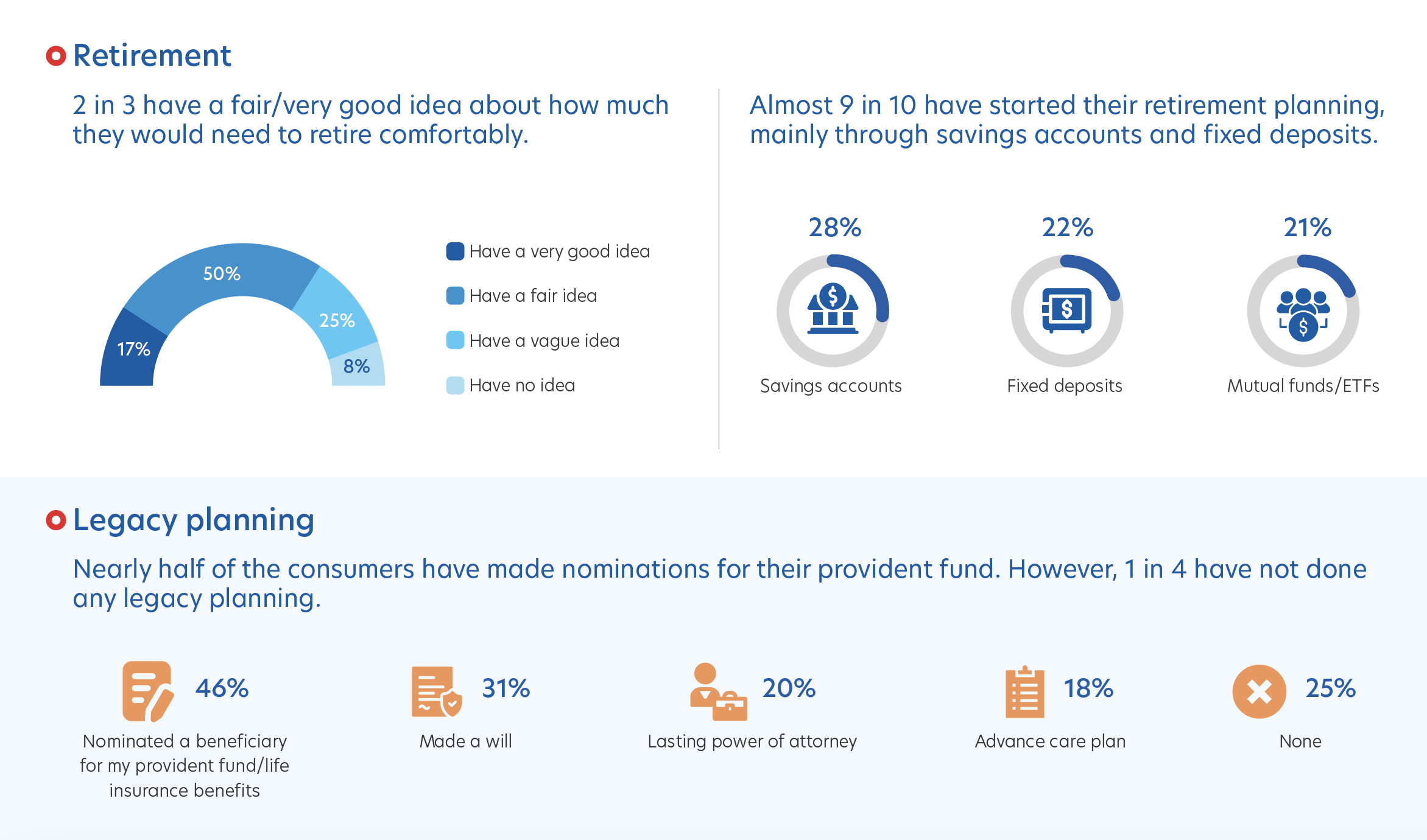

Only three in five Malaysians save more than 10 per cent of their monthly income, significantly lower than the regional average. Looking further out on the horizon, only 17 per cent of respondents have a very good idea of what they need to retire comfortably, more than 10 percentage points lower than the regional average. Compared with other countries in the region, when it comes to legacy planning, more Malaysians have nominated a beneficiary for their provident fund/life insurance benefits and made a will.

Figure 3: Retirement and legacy planning

About six in 10 consumers have health insurance, significantly lower than the regional average (seven in 10). Significantly fewer Malaysians are also insured on life insurance and term life plans compared with their regional counterparts. However, around nine in 10 have an emergency fund, and one in two have sufficient savings to cover at least three months of expenses.

Malaysian consumers are quickly embracing online banking and other online channels for various banking activities. Mobile banking apps are popular, with 48 per cent of consumers increasing their usage of these apps, especially among Affluent consumers (60 per cent) and Gen Z (54 per cent).

More Gen Z respondents have increased their usage of different banking channels compared with other age groups. Consumers tend to use online banking channels for activities like opening accounts, checking rewards or balances, and facilitating fund transfers.

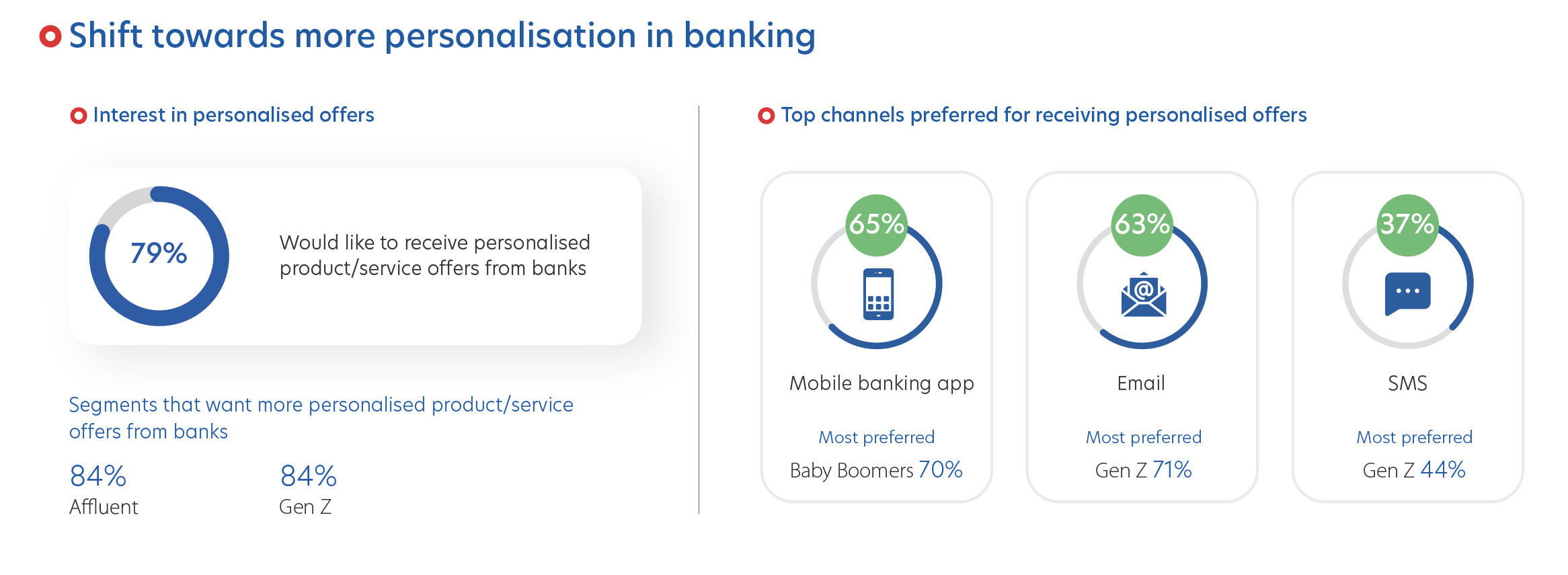

Nearly eight in 10 Malaysian banking customers (79 per cent) desire personalised product or service offers. This trend is stronger among younger generations (Gen Z: 84 per cent, Gen Y: 82 per cent). On the other hand, mobile banking apps and email are the most preferred channels for receiving personalised offers (65 per cent and 63 per cent, respectively).

Figure 4: A shift towards personalised banking experiences

At UOB, we help businesses navigate the dynamic landscape of the ASEAN region to unlock its full potential. Contact us to find out about our tailored solutions, industry knowledge and market expertise.

The ASEAN Consumer Sentiment Study (ACSS) is UOB’s regional flagship study analysing consumer trends and sentiments in five countries: Singapore, Malaysia, Thailand, Indonesia and Vietnam. Now in its fifth year, the survey was conducted from May to June 2024 and captures the responses of 5,000 consumers across different demographic groups in the region. In Malaysia, 1,000 consumers were surveyed.

Some of the areas covered include:

This article shall not be copied or relied upon by any person for whatever purpose. This article is given on a general basis without obligation and is strictly for information only. The information contained in this article is based on certain assumptions, information and conditions available as at the date of the article and may be subject to change at any time without notice. You should consult your own professional advisers about the issues discussed in this article. Nothing in this article constitutes accounting, legal, regulatory, tax or other advice. This article is not intended as an offer, recommendation, solicitation, or advice to purchase or sell any investment product, securities or instruments. Although reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this article, UOB and its employees make no representation or warranty, whether express or implied, as to its accuracy, completeness and objectivity and accept no responsibility or liability for any error, inaccuracy, omission or any consequence or any loss or damage howsoever suffered by any person arising from any reliance on the views expressed and the information in this article.

Get the ACSS 2024 Malaysia infographics and report. Download now

06 Dec 2024 • 4 mins read

07 Nov 2024 • 5 mins read

28 Oct 2024 • 4 mins read