You are now reading:

ASEAN Consumer Sentiment Study 2024 (Indonesia): Rising costs spark shifts in consumer behaviour

What does the ASEAN consumer think and feel about the economy? How has spending and financial behaviour changed? Get the latest highlights from the region’s barometer of consumer sentiments.

What does the ASEAN consumer think and feel about the economy? How has spending and financial behaviour changed? Get the latest highlights from the region’s barometer of consumer sentiments.

Explore key business trends and sentiments today.

View reportyou are in UOB ASEAN Insights

You are now reading:

ASEAN Consumer Sentiment Study 2024 (Indonesia): Rising costs spark shifts in consumer behaviour

As Southeast Asia’s largest economy, Indonesia has shown resilience in 2024, with GDP growth projected to stabilise around 5.1 per cent for the year. This moderate growth is supported by strong private consumption, which has increased by 4.93 per cent year-on-year. Inflation has remained under control in recent months, hovering around the Government’s target of 2.5 per cent, supported by strong fiscal measures and government policies.

Despite this positive outlook, consumer sentiment in Indonesia remains subdued. Compared with the previous year, Indonesians feel less optimistic about their country’s economy. The ASEAN Consumer Sentiment Study 2024 – Indonesia reveals that rising spending on essentials is contributing to this negative sentiment. As a result, cautious consumers are navigating economic challenges by adjusting their financial behaviours accordingly.

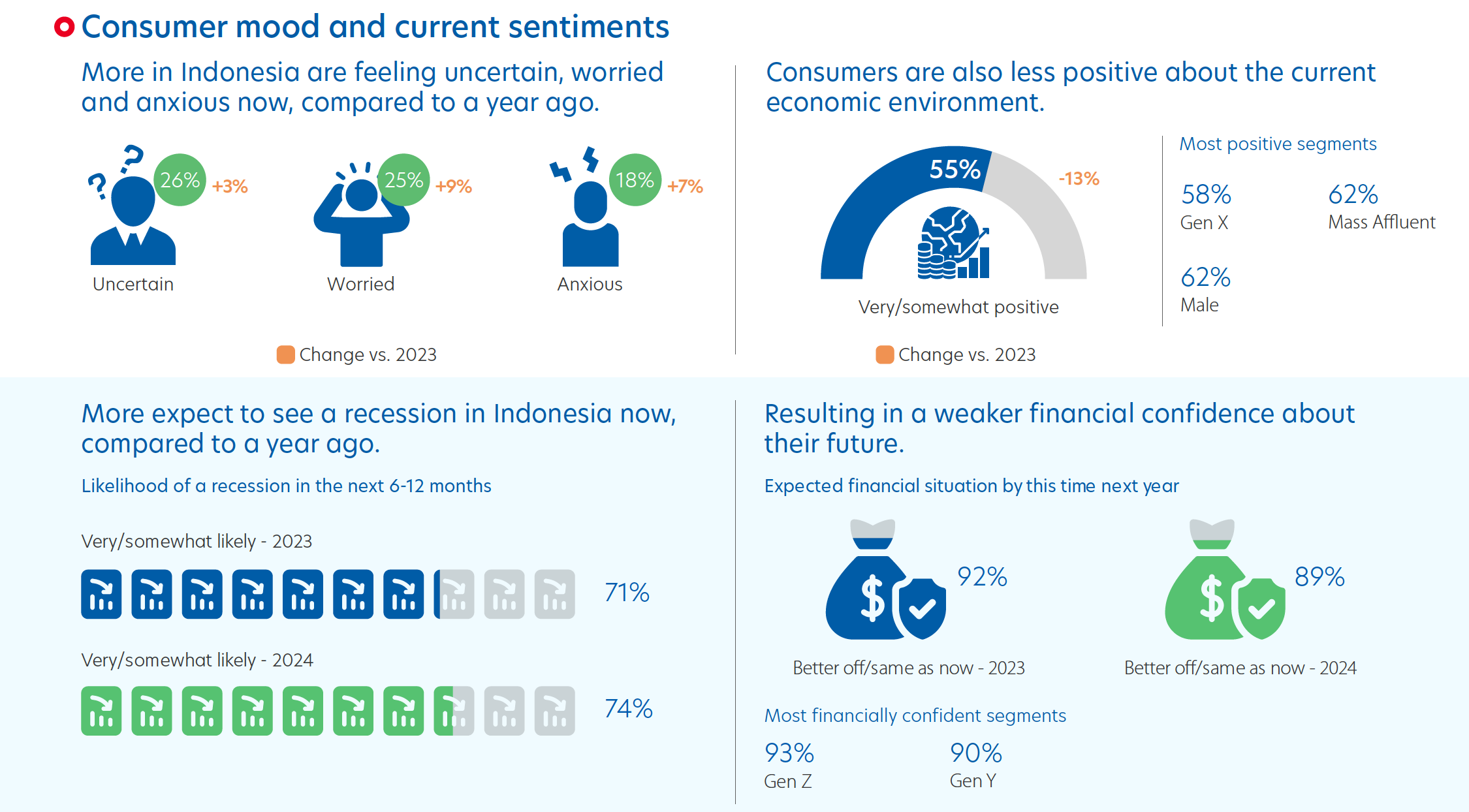

Indonesians are on par with the region in terms of their outlook on the current economic environment. More than half of Indonesian consumers (55 per cent) feel positive about the current economic environment.

While it may not seem alarming, this number represents a 13 per cent decrease from last year’s survey. Similarly, only 56 per cent of consumers feel positive about future economic performance—down 12 per cent from last year. Almost three in four Indonesians see the likelihood of a recession happening in the next six to 12 months, higher than the regional average (74 per cent vs. 71 per cent).

Figure 1: More in Indonesia are feeling uncertain, worried and anxious now compared with a year ago

Top concerns of Indonesian consumers remain focused on finances and work. Mass segments are more worried about their finances, with rising inflation and household expenses being the primary woes.

Job loss and the possibility of a pay cut are the top work-related concerns, especially for Gen Z. Both the mass segment and Gen Z demographics are also markedly more concerned about health and wellbeing – for themselves and for their loved ones.

Despite inflation steadily going down, many Indonesian consumers worry about the cost of living. These concerns revolve around their ability to save (49 per cent), invest (40 per cent), and afford essentials for themselves and their families (35 per cent).

Notably, Indonesians are more worried about saving and investing compared with the regional average, by +12 and +14 percentage points respectively. There are also significant concerns when it comes to paying for children's education (28 per cent), planning for retirement (28 per cent), and covering parents' financial and healthcare needs (20 per cent).

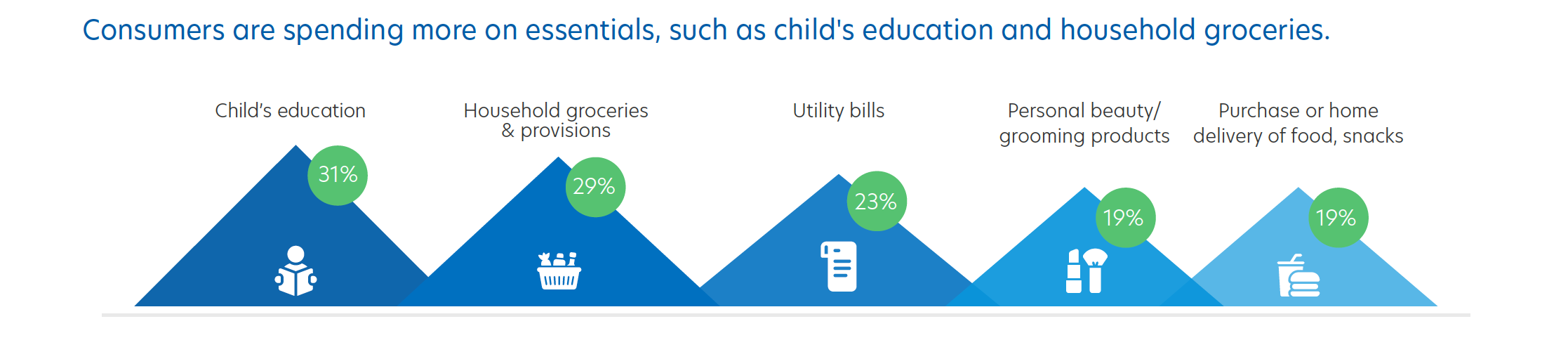

To cope with inflation, around three in five consumers have started secondary income sources or are delaying big-ticket purchases. Consumer spending in Indonesia has increased in areas such as children's education (31 per cent), household groceries (29 per cent), and utilities (23 per cent), mostly led by the Gen Y demographic. This rise in expenses aligns with trends.

Earlier in the year, the Indonesian Government reported that prices in the Food, Beverage and Tobacco expense group increased by 6.36 per cent year-on-year. Much of this increase in food prices was driven by reduced rice harvests due to bad weather.

The increased costs are affecting consumer outlook; fewer Indonesians now expect to be better off financially in the coming year compared with last year’s survey results.

Figure 2: Increased spending on essentials

More than half of Indonesians also started spending less on non-essential items, similar to the rest of the region. However, not all demographics are cutting back on discretionary spending. Gen Z is spending more on personal grooming, dining out, and fitness, reflecting their increased concern for personal health and wellbeing.

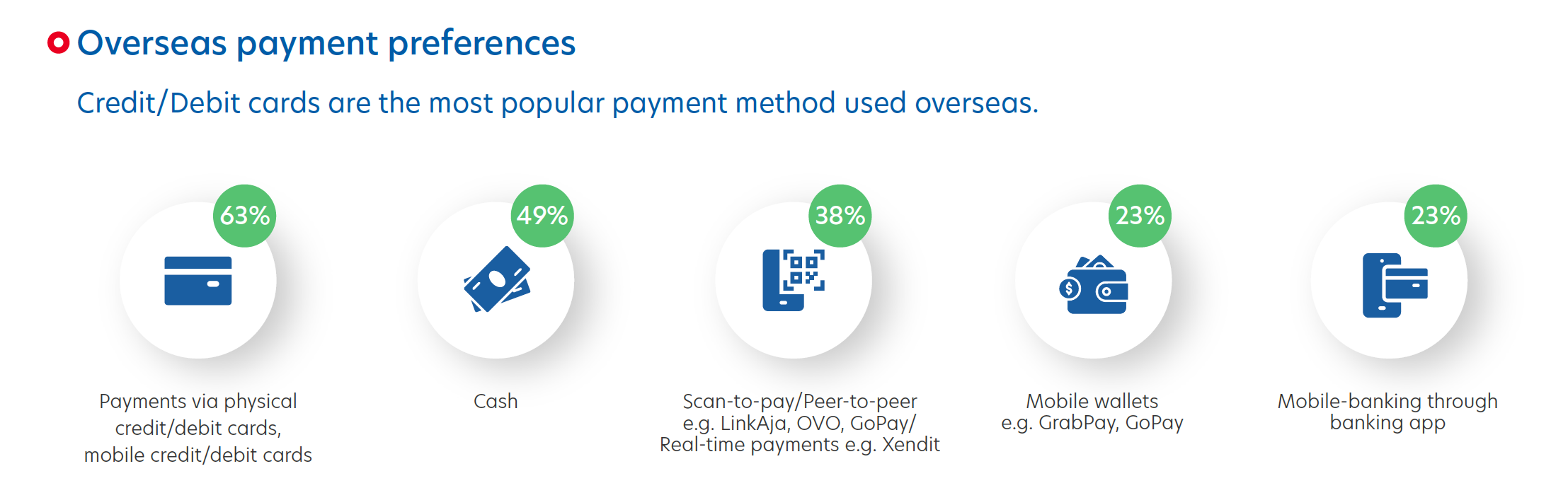

Moreover, 60 per cent of Indonesian consumers have spent money overseas in the past year, primarily during leisure trips (38 per cent) and business trips (22 per cent). Popular destinations for overseas spending include Singapore and Malaysia. When overseas, more than three in five prefer using physical credit/debit cards and mobile credit/debit cards for payment.

Figure 3: Preferred payment methods during overseas trips

The frequency of use (at least once a week) across most banking products has remained relatively stable compared with the previous survey. There are some minor increases for mobile wallet credit/debit cards (from 45 per cent to 48 per cent), e-wallets (from 81 per cent to 87 per cent), and peer-to-peer payment services (from 79 per cent to 82 per cent).

The use of other products or services like internet banking, Buy Now Pay Later (BNPL) services, digital currencies, overseas money transfers, and cash have either remained largely unchanged or seen minor fluctuations from the previous year.

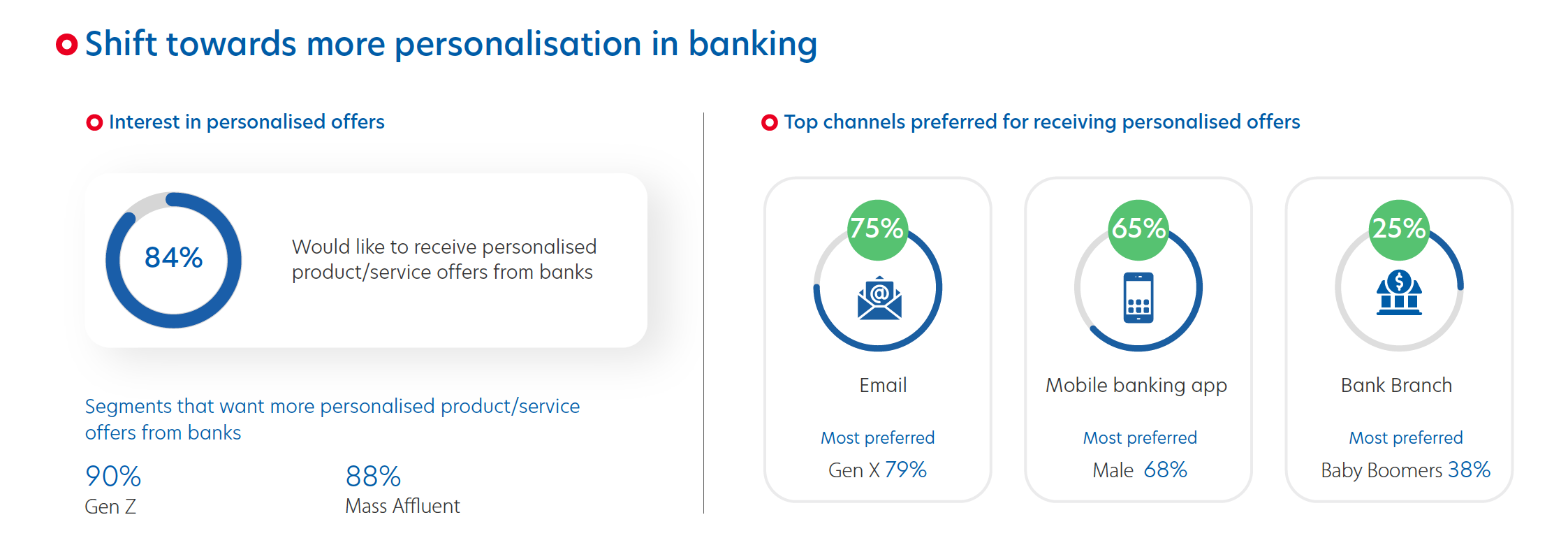

The strong majority (84 per cent) of Indonesian consumers still prefer to receive personalised product or service offers from banks, with more Gen Z customers expressing this preference (90 per cent). Seventy-five per cent of Indonesians prefer to receive such offers through email, followed by mobile banking apps at 65 per cent. Interestingly, the preference for bank branches as a channel for personalised offers has seen the most significant increase (+5 percentage points), indicating that Indonesians still value in-person interaction.

Figure 4: Shift towards more personalisation in banking

Indonesians are allocating more funds towards savings and investments, particularly among Gen Z and Gen Y. Conversely, allocations towards insurance and mortgage or loans have largely remained the same or decreased. Among those with loans, 46 per cent make additional payments to reduce their loan tenure.

But there’s a catch: financial literacy is low.

Only 21 per cent of Indonesians have enough savings to cover more than six months of expenses, even though 91 per cent say they have an emergency fund. However, retirement planning seems to be a priority for many. Eighty-nine per cent of Indonesian consumers have taken steps to save for retirement, while seven in 10 have a “fair” to a “very good” idea of how much they will need to retire comfortably.

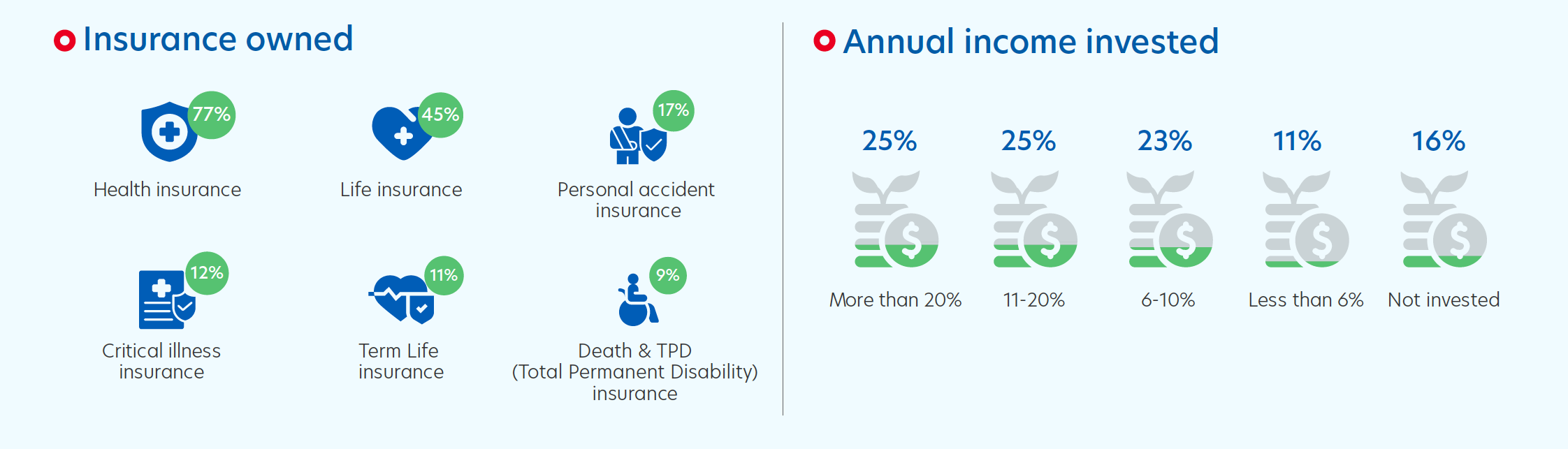

Indonesians are underinsured in areas like life, motor, personal accident, and critical illness insurance. However, health insurance penetration is higher in Indonesia compared with the regional average (77 per cent vs. 70 per cent).

While substantial savings and comprehensive insurance are uncommon, investing seems to be more ingrained in the culture. Half of Indonesians invest more than 10 per cent of their annual income, similar to the regional average. This is significantly higher among Mass Affluent and Affluent individuals.

Figure 5: Insurance owned and annual income invested

At UOB, we help businesses navigate the dynamic landscape of the ASEAN region to unlock its full potential. Contact us to find out about our tailored solutions, industry knowledge and market expertise.

The ASEAN Consumer Sentiment Study (ACSS) is UOB’s regional flagship study analysing consumer trends and sentiments in five countries: Singapore, Malaysia, Thailand, Indonesia and Vietnam. Now in its fifth year, the survey was conducted from May to June 2024 and captures the responses of 5,000 consumers across different demographic groups in the region. In Indonesia, 1,000 consumers were surveyed.

Some of the areas covered include:

This article shall not be copied or relied upon by any person for whatever purpose. This article is given on a general basis without obligation and is strictly for information only. The information contained in this article is based on certain assumptions, information and conditions available as at the date of the article and may be subject to change at any time without notice. You should consult your own professional advisers about the issues discussed in this article. Nothing in this article constitutes accounting, legal, regulatory, tax or other advice. This article is not intended as an offer, recommendation, solicitation, or advice to purchase or sell any investment product, securities or instruments. Although reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this article, UOB and its employees make no representation or warranty, whether express or implied, as to its accuracy, completeness and objectivity and accept no responsibility or liability for any error, inaccuracy, omission or any consequence or any loss or damage howsoever suffered by any person arising from any reliance on the views expressed and the information in this article.

Get the ACSS 2024 Indonesia infographics and report. Download now

02 Dec 2024 • 4 mins read

07 Nov 2024 • 5 mins read

28 Oct 2024 • 4 mins read