Business momentum continues in 2Q24 backed by strong balance sheet position

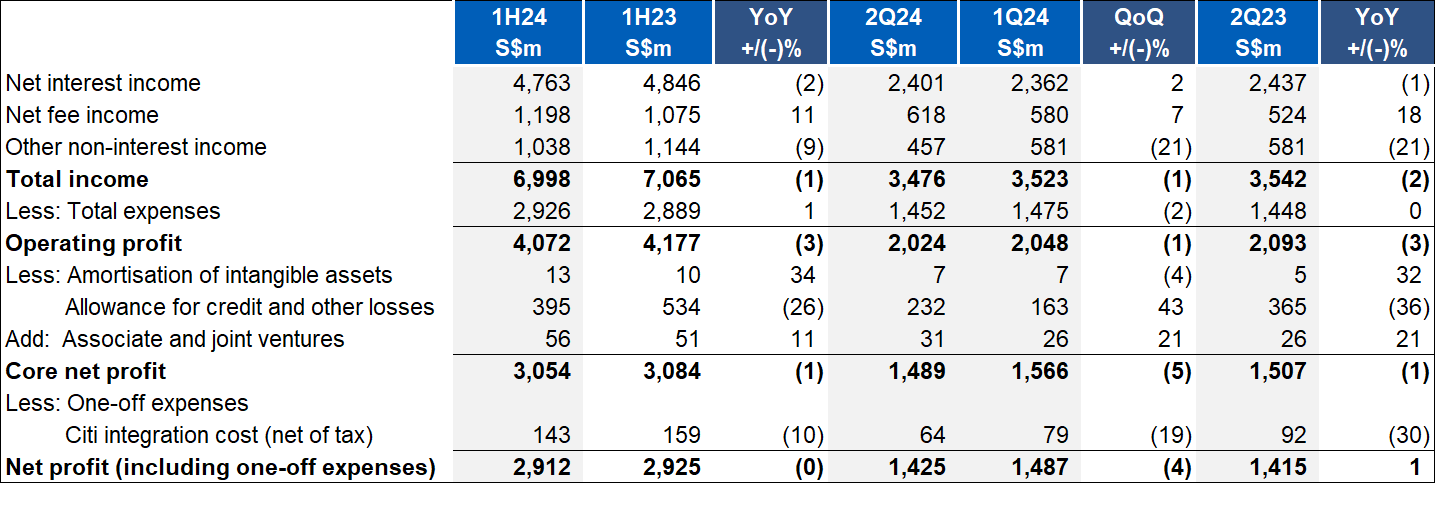

Singapore, 1 August 2024 – UOB Group reported core net profit1 of S$3.1 billion for the first half of 2024 (1H24), stable year on year, supported by double-digit fee income growth and lower credit allowances. Including the one-off Citigroup integration expenses, net profit was at S$2.9 billion.

The Board declared an interim dividend of 88 cents per ordinary share, representing a payout ratio of approximately 51%.

Core net profit for the second quarter of 2024 (2Q24) remained steady at around S$1.5 billion compared with a year ago. Net interest income for 2Q24 eased 1% year on year from lower net interest margin but grew 2% from the previous quarter due to broad-based loan growth and improved margins. Net fee income for 2Q24 grew 18% year on year to a near historical high of $618 million, driven by a rebound in loan-related and wealth management fees and double-digit growth in credit card fees. Other non-interest income declined 21% compared with last year as stronger customer-related treasury income was moderated by lower swap gains and valuation on investments.

Asset quality remained resilient with non-performing loan (NPL) ratio stable at 1.5% and total credit costs at 24 basis points.

Group Wholesale Banking’s trade and loan-related fees for 2Q24 grew 19% year on year in tandem with the pickup in demand for loans and deals booked in the quarter. Cross-border income now makes up around 25% of total Wholesale Banking income, while Transaction banking revenue accounts for around 53% of total Wholesale Banking income.

Group Retail’s wealth management income for 2Q24 grew 40% year on year led by improved sales in structured notes, bonds and unit trusts, as well as steady growth in bancassurance. Card fee income sustained growth this quarter, boosted by continued consumer confidence and spending. The Group continued to see positive net new money inflows, bringing total assets under management from affluent customers to S$182 billion, 10% higher than a year ago.

The Group remains committed to supporting its customers on their green journeys. In June, UOB partnered Enterprise Singapore to launch the Sustainability-Linked Advisory, Grants and Enablers, or SAGE Programme, to help small and medium-sized businesses set sustainability performance targets and simplify financing solutions for them. As at end of June 2024, the Group’s sustainable trade financing portfolio more than doubled year on year.

CEO Statement

Mr Wee Ee Cheong, UOB’s Deputy Chairman and Chief Executive Officer, said, “The Group delivered a good set of results for the quarter, and we see positive trends across our diversified businesses. Our asset quality remained resilient, while our balance sheet continued to be strong with healthy levels of capital and funding.

“Global growth continues to be weighed down by geopolitical tensions and higher interest rates. However, we expect ASEAN to stay relatively resilient. We are optimistic about the region’s long-term potential, backed by robust fundamentals and foreign direct investments inflows as companies diversify their supply chains. With our enlarged customer franchise and strengthened market position, we are well-placed to seize opportunities in the region.

“We have successfully integrated operations in Malaysia, Indonesia and Thailand, and the one-time costs will be reduced substantially as we move towards integration in Vietnam next year. We will focus on extracting both revenue and cost synergies from this portfolio as we deepen our customer relationship and provide our customers with a more comprehensive suite of solutions, including wealth management. Despite uncertainties in the horizon, we are confident in our ability to navigate the environment with our disciplined approach.”

Financial Performance

1H24 versus 1H23

Core net profit was stable at S$3.1 billion in 1H24, driven by double-digit fees growth and lower credit allowances. After accounting for one-off expenses, net profit was at S$2.9 billion.

Net interest income eased 2% to S$4.8 billion. Net interest margin moderated to 2.04% as deposit repricing outpaced asset yield repricing, cushioned by loan growth of 3%. Net fee income grew double-digit by 11%, spurred by increased lending and capital market activities alongside higher wealth fees as well as stronger card fees on an enlarged regional franchise.

Other non-interest income declined 9% to S$1.0 billion from lower swap gains and valuation on investments. Nonetheless customer-related treasury income delivered healthy growth of 13%, supported by client demand for bonds, structured products and hedging activities.

Core operating expenses increased marginally by 1% to S$2.9 billion as the Group maintained tight cost discipline while investing for franchise growth and digital capabilities. Core cost-to-income ratio was at 41.8%. Total allowance declined 26% on lower specific and general allowance as asset quality stabilised.

2Q24 versus 1Q24

Core net profit for the second quarter was 5% lower at S$1.5 billion. Including the one-off expenses, net profit stood at S$1.4 billion.

Net interest income rose 2% to S$2.4 billion, led by three basis points increase in net interest margin to 2.05% on improved funding costs, coupled with loan growth of 2%. Net fee income of S$618 million for the quarter was near all-time high, boosted by strong loan-related fees and improved performance in wealth and card activities. Customer-related treasury income sustained momentum from retail demand for bonds and structured products, while other trading and investment income eased from last quarter’s exceptional high.

The core cost-to-income ratio was stable at 41.8% as expenses kept pace with income. Total allowance increased to S$232 million, with total credit costs on loans relatively flat at 24 basis points.

2Q24 versus 2Q23

Net interest income declined by 1%, following seven basis points moderation in net interest margin. Net fee income grew by 18% to near record level. Loan-related fees and wealth management fees rebounded from a year ago, driven by a pickup in lending activities and improved market sentiments. Credit card fees similarly registered strong double-digit growth momentum.

Customer-related treasury income grew 19% to S$216 million from retail bond sales and strong hedging demands. Other trading and investment income declined on lower swap gains and valuation on investments. Total credit costs on loans improved from 30 to 24 basis points, due to specific allowance on a major Thailand corporate account last year.

Asset Quality

Asset quality remained stable with NPL ratio at 1.5% as of 30 June 2024. New non-performing assets (NPA) formation was more than offset by recoveries and write-offs. The NPA coverage stood at 98% or 214% after taking collateral into account. Performing loans coverage was maintained at a prudent level of 0.9%.

Capital, Funding and Liquidity Positions

The Group’s capital position remained healthy with Common Equity Tier 1 Capital Adequacy Ratio eased to 13.4% for the quarter due to 2023 final dividend payout. Liquidity remained ample with the average all-currency liquidity coverage ratio at 149% and net stable funding ratio at 118%, both well above regulatory requirements.

1Excluded one-off expenses related to acquisition of Citigroup’s Malaysia, Thailand, Vietnam and Indonesia consumer banking business.