- UOB is first local Bank to adopt first-of-its-kind service inclusiveness training programme to cater to caregivers and customers living with dementia, with all branch staff to be trained by November 2023.

- Programme was conceptualised through a collaboration between UOB and NTUC LearningHub, with support from the Agency for Integrated Care (AIC), NTUC’s e2i (Employment and Employability Institute), and unions.

- Training will complement technical knowledge branch staff already possess, such as Lasting Powers of Attorney and estate accounts, ensuring a more seamless and comfortable experience for caregivers seeking assistance at our branches

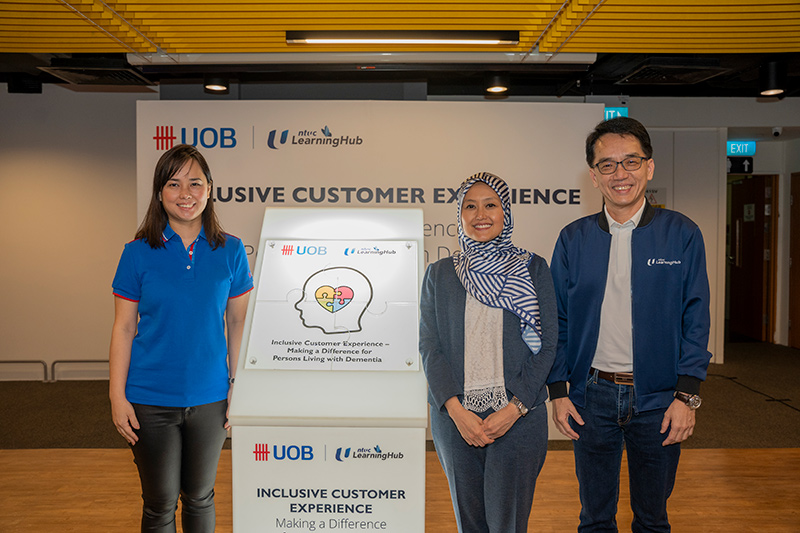

UOB Executive Director of Group Channels and Digitalisation Ms Chew Li Lian (left) with Senior Parliamentary Secretary for the Ministry of Health and Ministry of Law Ms Rahayu Mahzam (middle) and NTUC LearningHub CEO Mr Jeremy Ong (right).

Singapore, 9 June 2023 – UOB and NTUC LearningHub (NTUC LHUB) jointly announced today the launch of a training programme for frontline staff named the “Inclusive Customer Experience – Making a Difference for Persons Living with Dementia”. Officially launched by Senior Parliamentary Secretary, Ministry of Health and Ministry of Law, Ms Rahayu Mahzam, it is the first service inclusiveness training programme in Singapore to equip frontline banking employees with the skills on how to interact with persons living with dementia, identify the needs of caregivers, as well as use their knowledge of available resources to support caregivers looking after their loved ones.

By November 2023, all 1,000 UOB branch staff will be trained on the practical steps that can be taken to provide support and resources for caregivers who are caring for their loved ones living with dementia, as well as create an accessible and safe banking environment for them. The one-day programme, which entails immersive hands-on training and role-playing, will also be mandatory for all new branch staff as well.

Conceptualised through a collaboration between UOB and NTUC LHUB, with support from AIC, e2i, and unions, the training programme complements both the Dementia-Friendly Singapore (DFSG) movement driven by the AIC and Ministry of Health (MOH), as well as the 2023 Action Plan for Successful Ageing launched earlier this year by the Ministerial Committee on Ageing.

Designed and conducted by trainers who are experienced healthcare practitioners, the curriculum is structured to help UOB employees acquire a comprehensive understanding of the needs of caregivers and persons living with dementia. UOB employees will be equipped with skillsets useful in assisting customers with dementia, such as effectively identifying the signs and symptoms of dementia, as well as good practices of interacting with customers living with dementia. This will complement relevant knowledge branch staff already possess, such as the application process for Lasting Powers of Attorney (LPA) and estate accounts, enabling them to better approach, explain and assist caregivers with topics that may be sensitive. By personalising branch staffs’ service to caregivers as well as customers living with dementia, the Bank hopes to reduce the stress placed on both, and make their branch experience a more seamless and pleasant one.

UOB branch staff who had undergone pilot sessions of the training earlier this year have already had occasion to apply the concepts learnt. Denethor Wong, Deputy Branch Manager from UOB Tampines branch had to reassure a customer with dementia when she panicked after not remembering where her home was and not having any identification documents with her.

“Her caregiver had to step outside for a while to run an errand. She was very scared and emotional. Applying what I learnt during the training, I brought her aside to calm her down and repeatedly assured her that I was there to help. She was finally able to give me a number to contact her caregiver when she was more comfortable with me. We stayed with her until her caregiver came back. The training was useful in equipping us with tips and methods to calm the customer down and render the appropriate assistance. We also learnt to empathise with the caregiver, an important component in keeping us patient and poised in such situations,” Wong said.

“UOB recognises the tremendous mental stress and workload caregivers of persons living with dementia shoulder. We admire their selfless sacrifices, and would like to do our part to support them. With this training, our branch staff will be able to better connect and assist customers living with dementia as well as their caregivers. From serving their banking needs, to providing advice on relevant legal and financial documentation, and rendering appropriate assistance and emotional comfort when persons living with dementia seek help at our branches, we are committed to doing right by them,” said Ms Chew Li Lian, Executive Director of Group Channels and Digitalisation, UOB.

Mr Jeremy Ong, Chief Executive Officer of NTUC LearningHub, said, “NTUC LearningHub is proud to co-develop this service inclusiveness training programme with UOB, with the support of AIC and e2i. The uniqueness of this course lies in the curriculum - while UOB is piloting the Inclusive Customer Experience programme for the banking sector, the curriculum and training is highly customisable and applicable for many customer-fronting roles and industries. This programme is well-aligned with our desire to promote social inclusiveness, especially so with the government placing more emphasis on providing stronger support and resources for caregivers. I applaud UOB for being a customer-centric organisation that prioritises excellent customer service and is exemplary in upskilling their employees with relevant skills. Riding on this successful pilot, we intend to reach out to other organisations to enhance service inclusiveness in Singapore.”