Bank deepens alliance with Dairy Farm Singapore to bring greater value to customers

As more consumers in Singapore spend more on daily essentials to accommodate the move towards staying at home more for work and play, United Overseas Bank (UOB) has enhanced its UOB One Card rebate programme to bring greater value to consumers.

Through UOB’s collaboration with the Dairy Farm Singapore (DFSG), more than a million UOB One Credit and Debit cardmembers can earn the highest rebates in Singapore when they spend on necessities, such as groceries and other household essential items at any DFSG stores.

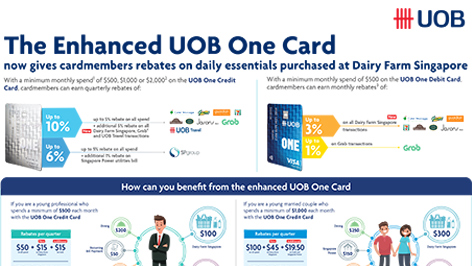

UOB One Credit cardmembers can now earn up to 10 per cent cash rebates for all purchases1 made at any of DFSG’s physical and online stores such as Cold Storage, Giant, Guardian and 7-Eleven2. With more than 600 stores island-wide, DFSG has the widest network of groceries, health and beauty and convenience stores in Singapore.

The enhanced UOB One Card rebate programme will also benefit cardmembers of the UOB One Debit card, who can now earn three per cent rebates on groceries, health and beauty products at DFSG stores. This new benefit can be enjoyed with a minimum spend of $500 per month.

Ms Choo Wan Sim, Head of Payments and Cards Singapore, UOB, said groceries have been one of the fastest-growing spending categories since COVID-19 safe distancing requirements were enforced.

“From January to May of this year, UOB cardmembers spent 55 per cent more on groceries compared with the same period last year. For online groceries, they spent 78 per cent more. While many priorities have changed as a result of COVID-19, providing for our loved ones has not. Among UOB One Cardmembers for example, groceries has been among their top five spending categories since 2017. This year, it moved into the top three3. Through our collaboration with DFSG, we want to help our customers stretch their household budget that bit further,” Ms Choo said.

Ms Gwendolyn Cheong, Head of Corporate and Consumer Affairs, South East Asia, DFSG, said, "Since the beginning of COVID-19, we have seen a significant upward trend of customers buying more and at a higher frequency, at both our in-store and online stores. We are also aware that our customers are increasingly looking to maximise savings given that many are still spending more time at home.

“As such, it is timely and important that we continue our partnership with UOB. Through the UOB One Card, customers can earn rebates across all our brands including Cold Storage, Market Place, Jasons, Jasons Deli, Giant, Guardian and 7-Eleven, giving them greater value across a wide network of stores and product range.”

Providing the most generous rebates for daily essentials and everyday spending

The enhanced rebate rate for purchases made at DFSG stores adds to the UOB One Credit Card’s existing privileges, including rebates for other everyday expenses, such as paying for Grab rides and food delivery and home utility bills.

For example, a cardmember who spends an average of $2,000 each month on their UOB One Credit card will be able to earn five per cent cash rebate on all spend. They will earn an additional five per cent cash rebate on spend made at DFSG stores and for Grab rides and food delivery paid through the One Credit Card. If the cardmember uses the UOB One Credit Card to pay for their Singapore Power (SP) home utility bills, they will also enjoy an additional one per cent cash rebate.

| Estimated UOB One Credit Card cash rebates with an average monthly spend of $2,000 | ||

| Type of expenditure | Amount spent | Cash rebates earned on spend |

| Buying daily essential items at DFSG stores (in-store and online) | $500 | 10 per cent |

| Grab rides and ordering food delivery | $200 | 10 per cent |

| Paying for SP utility bills | $200 | 6 per cent |

| Other spend (such as retail, dining and other bill payments) | $1,100 | 5 per cent |

| Total monthly spend | $2,000 | |

| Total cash rebate amount in a year | $1,644 | |

Customers who prefer to spend on their UOB One Debit card can also earn three per cent cash rebate when they charge their card at any DFSG store, capped at $20 a month. UOB One Debit cardmembers simply need to ensure that they meet the required minimum monthly spend of $500 to enjoy the cash rebate.

For more information on the enhanced UOB One Card rebate programme, please visit www.uob.com.sg/onecards.

1 UOB One Credit cardmembers can earn a base quarterly rebate of 3.33 per cent on all spend with a minimum monthly spend of $500 and a base quarterly rebate of five per cent on all spend with a minimum monthly spend of $2,000. They can earn an additional five per cent rebate on their purchases made at DFSG stores, Grab and UOB Travel upon fulfilling the minimum spend requirement for quarterly rebates.

2 DFSG brands include Cold Storage, Giant, Guardian, Jasons, Jasons Deli, MarketPlace, and 7- Eleven stores.

3 Source: UOB Card data, as at end-April 2020.