Almost nine in 10 employees believe having new or broadened skillsets are necessary to compete in an increasingly tight job market

In an increasingly uncertain job market, nine in 10 Singapore employees (90 per cent) see the need to reskill or to upskill to stay relevant in the post-pandemic world, according to the results of the UOB ASEAN Consumer Sentiment Study1.

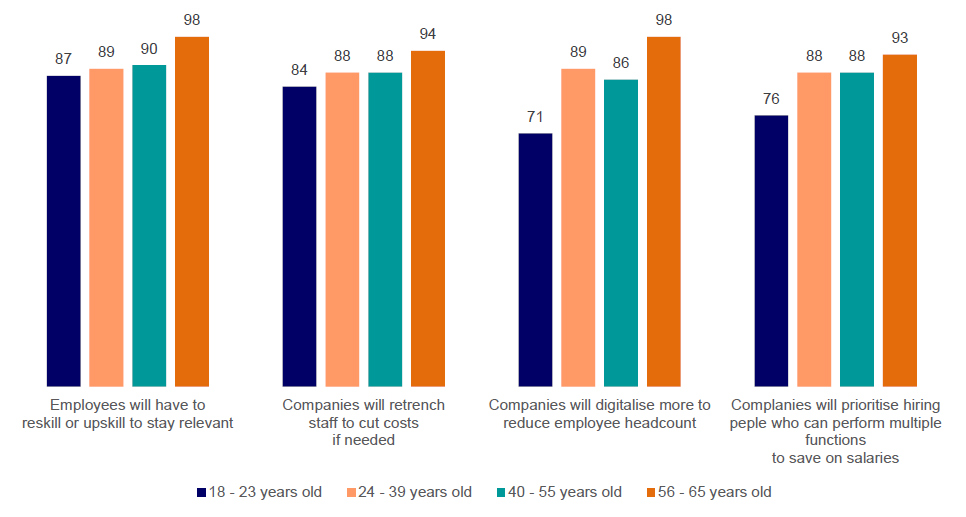

The findings come as Singaporeans expect that securing a new role in the current job market will be tough due to the economic recession. Close to nine in 10 of Singapore respondents believe that companies will prefer candidates who can perform multiple roles (88 per cent) or choose not to hire and instead digitalise as means to reduce costs (87 per cent). The majority of Singapore respondents also expect that companies will use retrenchment as a tool to cut costs (88 per cent).

Among the different age groups, the concerns around job security are felt most strongly by Singaporeans between the age of 56 to 65 years old. Ninety-eight per cent of respondents within this age range are focused on reskilling or upskilling to stay competitive.

UOB ASEAN Consumer Sentiment Survey 2020

Singapore employees' sentiment towards employment

Mr Dean Tong, Head of Group Human Resources, UOB, said that the COVID-19 pandemic has reaffirmed the importance of adaptability and continual learning to ensure that people are ready to take on changing job demands and to seize future opportunities.

“COVID-19 has shown that a key driver for companies to grow sustainably in a post-pandemic world is having people within the organisation that are adaptable and open to new challenges. As the trend of digitalisation accelerates in response to the pandemic, it is imperative that employees are developing the skills needed for a future of work dominated by digital technology and data.

“At UOB, we continue to support our more than 26,000 people across our global network to build a growth mindset and to deepen their digital and data skills. We are deeply committed to nurturing a pipeline of talent with an emphasis on future-focused skills.”

Developing a future-focused workforce through traineeship programmes

As UOB continues to develop a workforce that is future-focused and relevant in the digital future, it also champions several traineeship programmes that provide on-the-job experiences for new graduates and mid-career professionals to develop the necessary skillsets that will help them to succeed in the banking and finance industry.

UOB recently welcomed its second cohort of 18 trainees under the Technology in Finance Immersion Programme (TFIP) which supports recent graduates and mid-career individuals who are looking to pursue a career in technology but may not have the necessary banking or technical experience. As part of the programme, the Bank has specially designed a structured and hands-on training curriculum to enable its trainees to build up knowledge and gain practical experience in areas such as cybersecurity, cloud computing and data analytics.

UOB is also creating opportunities for new graduates and mid-career professionals to develop and to deepen new skills or knowledge through the SGUnited Traineeships Programme (SGUT) and SGUnited Mid-Career Pathway Programme (SGUP) as they embark on a new career or pathway in the banking and finance industry. The Bank has taken in more than 100 trainees under the SGUnited programmes in roles such as data analysts, user interface design analysts, business analysts, and risk and compliance analysts and plans to hire about 200 more by the end of 2020.

“Over the past five months, we have grown our pool of trainees at UOB who join us through initiatives such as the SGUnited Traineeship Programme, SGUnited Mid-Career Pathway Programme and Technology in Finance Immersion Programme. Many of our trainees have told us that UOB’s culture of continual learning and access to the Bank’s extensive learning and development resources are integral to giving them a leg-up in building up their knowledge and skills quickly. This enables them to be more ready to capture future opportunities as they pursue a career in the financial services industry,” Mr Tong said.

Mr Marcus Yeo, Business Insights Analyst, Group Wholesale Banking, UOB, said, “Having joined UOB for two months via the SGUnited Traineeships Programme, I have gained valuable insight into developing research and analysis to support the Bank’s sector-specific solutions for businesses across the region. The Bank’s structured training curriculum, e-learning resources and emphasis on digital and data skills give me the confidence to develop the relevant knowledge and skillsets for pursuing a future career in this industry. I feel motivated to learn and to grow with the guidance from my supervisors and team members, as well as the welcome through the warm culture at UOB which makes me feel part of a big family.”

Jobseekers who are interested to know more about the traineeship and career growth opportunities at UOB should visit MyCareersFuture’s website and UOB’s LinkedIn page.

1 Please refer to the Google-UOB joint news release on the launch of the SME Leadership Academy.

2 STB Marketing College is a learning and development programme tailored for marketing professionals in the travel and tourism industry. The STB Marketing College team is working with key digital partners to roll out online training resources to help the tourism industry upskill during the COVID-19 period.