This third white paper, co-published by Deloitte and UOB, examines the use of innovation and advanced analytics in a world dominated by digital technology and disruption. We will touch on potential risks that stem from business disruptions in unprecedented times, including how the global coronavirus pandemic has resulted in a rise in financial crime. We describe how technology and innovation are necessary in weathering unforeseen circumstances and in achieving better outcomes for Financial Crime Compliance (FCC).

The financial services sector is now facing greater challenges from sophisticated criminals who have found ways to profit from an increasingly digitalised economy, accelerated partly due to the COVID-19 pandemic. Efforts to enhance detection by augmenting investments made in artificial intelligence (AI) and machine learning (ML), analytics and robotic process automation (RPA) have paid off. However, more work still needs to be done to ensure that the sector is able to adequately respond and curb various risks including financial crime, and maintain the trust it has established with its relevant stakeholders.

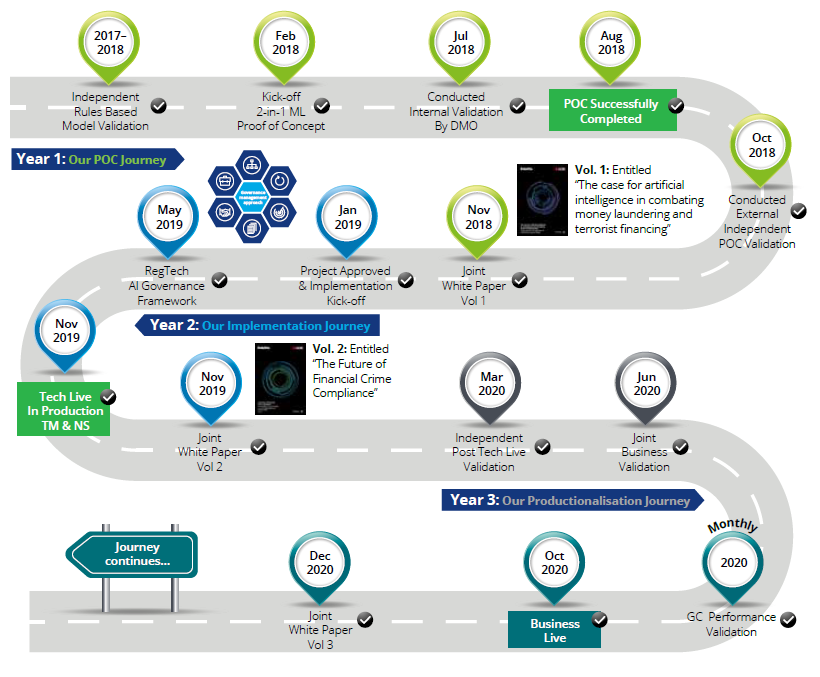

Our white paper examines the ongoing journey of UOB’s AI anti-money laundering solution, from proof of concept (POC) to production stage, explaining how it gradually calibrated models for integration into current banking operations. It outlines the justification for the Bank’s investment in advanced analytics, AI/ML and robotics – noting how these have been instrumental in mitigating major disruptions.

Deloitte and UOB previously published two white papers in 2018 and 2019. The first white paper titled, “The case for artificial intelligence in combating money laundering and terrorist financing” explains how financial institutions (FI) can leverage innovation to manage FCC effectively. It shared UOB’s case study in successfully piloting machine learning to identify suspicious accounts and transactions with greater accuracy. The second white paper titled, “The future of financial crime compliance”, depicted the future-state of FCC that incorporates AI and Machine Learning, Advance Analytics and RPA to manage evolving financial crime risks. It details what is involved to operationalise ML for FCC, taking reference from UOB’s successfully implemented ML model.