Scaling and growing in ASEAN? Find out how you can better navigate the challenges of doing so with this report.

ASEAN’s growing FinTech scene has seen great change in 2020. Global economic headwinds and recovery uncertainties have weighed on investments in ASEAN’s FinTech firms, while COVID-19’s border closures have resulted in start-ups making and closing deals virtually.

We ran a survey with over 100 FinTech firms, followed by interviews with Venture Capitalist (VC) firms and FinTech founders, to get a first-hand account of how the region’s FinTech industry has been impacted by the pandemic.

Get up: Year in review

While this year’s headlines have been largely shaped by the pandemic, it is worth noting that 2020 marks five years since the inaugural Singapore FinTech Festival. In 2016, there were 1,383 FinTech firms operating in ASEAN-6 (Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam), and this number has almost doubled to 2,744 firms this year.

Despite the macro challenges, FinTech firms in ASEAN have largely stayed focused and resilient, taking advantage of new opportunities resulting from the acceleration towards a digital economy.

Browse through the milestones below for a summary of the highlights this year, as well as over the past five years.

Singapore takes the lion’s share of funding

The global pandemic in 2020 has cooled the steady growth of FinTech in ASEAN. Funding amounts up to Q3 fell 20 per cent from last year’s record US$1.12 billion year-on-year, but still exceeded 2018’s figures.

Singapore continues to attract the most FinTech funding in ASEAN-6 (42 per cent of disclosed deals), followed by Indonesia (20 per cent), Thailand and the Philippines (15 per cent each). Every two out of three deals went to Singapore-headquartered firms. Singapore’s ability to stabilise and to manage the spread of COVID-19 within its borders, along with its established leadership position in ASEAN’s FinTech landscape, may have contributed to its continued strong performance in attracting funding.

Payments, alternative lending and well-run firms stay strong

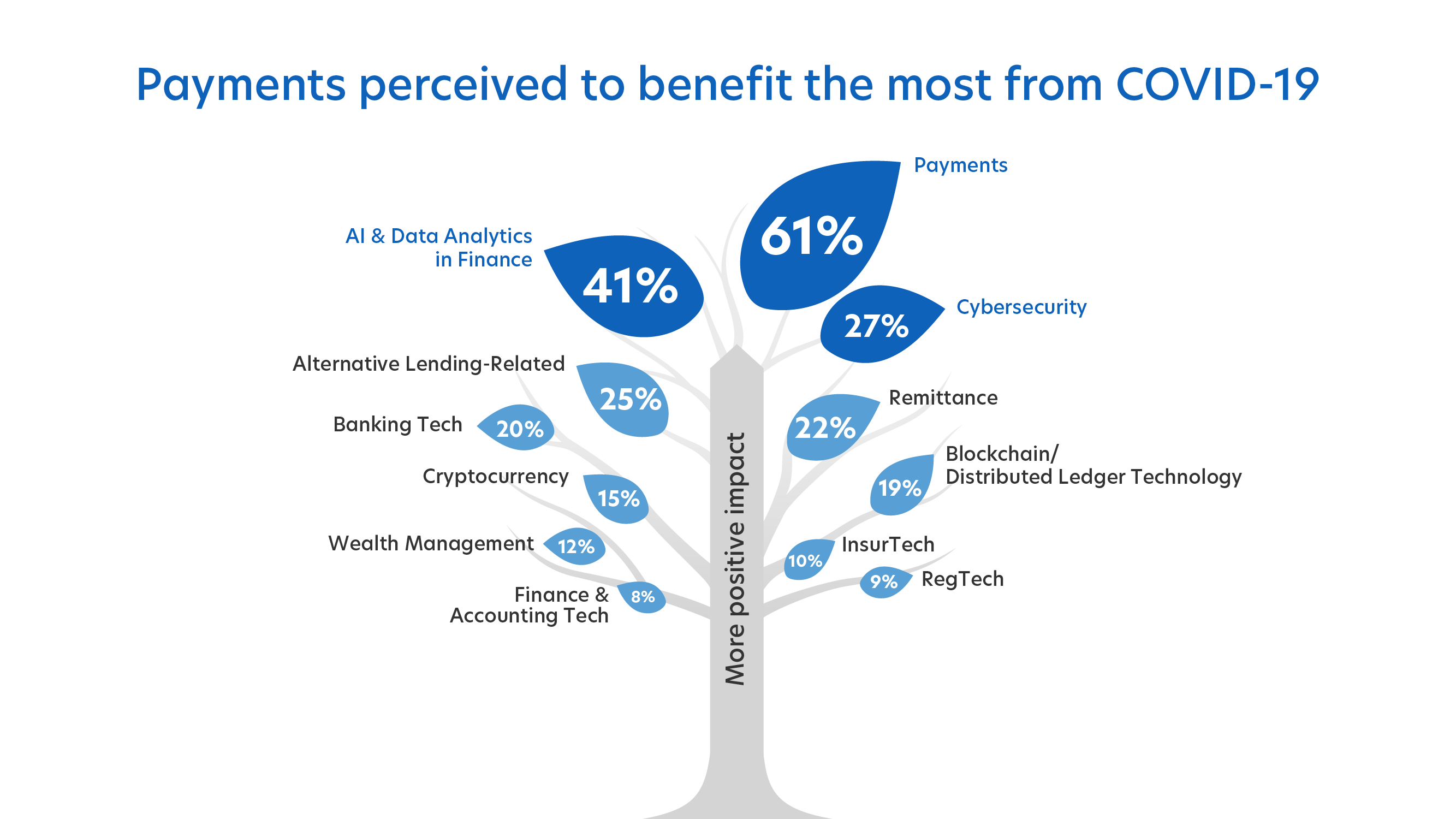

Payments is by far the most funded FinTech category across ASEAN (US$470 million), followed by alternative lending (US$162 million). Both categories help ASEAN’s mobile-ready and underbanked population—especially in Indonesia, Vietnam and the Philippines—reach basic digital financial services. Given the growth in e-commerce and changing consumer behaviours post-COVID-19, digital payments will continue to remain strong.

Total investments into FinTech firms saw a decline due to COVID-19’s impact on the region. Well-run, “sound” firms may see better valuation, even as newer, seed-stage companies face uphill battles for funding.

Fewer new firms emerge during the pandemic

Up until September 2020, 54 new FinTech firms were established in ASEAN-6, compared to 338 firms in 2019. In terms of the total number of FinTech firms in operation, the year-on-year growth rate tapered from 31 per cent at its peak in 2018 to two per cent this year. COVID-19’s impact on funding and the economy has likely contributed to this.

Singapore, Indonesia, and Malaysia remain ASEAN’s hubs for FinTech headquarters.

Reset: Survival of the fittest

When the pandemic first hit, many FinTech firms took the opportunity to reflect on their business efficiencies. For firms that had been experiencing accelerated growth, it was time to pause and question the status quo – could activities be automated, processes optimised and output better measured?

Our survey of 109 FinTech firms in September 2020 found that despite negative short-term effects, FinTech firms have worked to rebuild better, and they remain optimistic about the industry’s future.

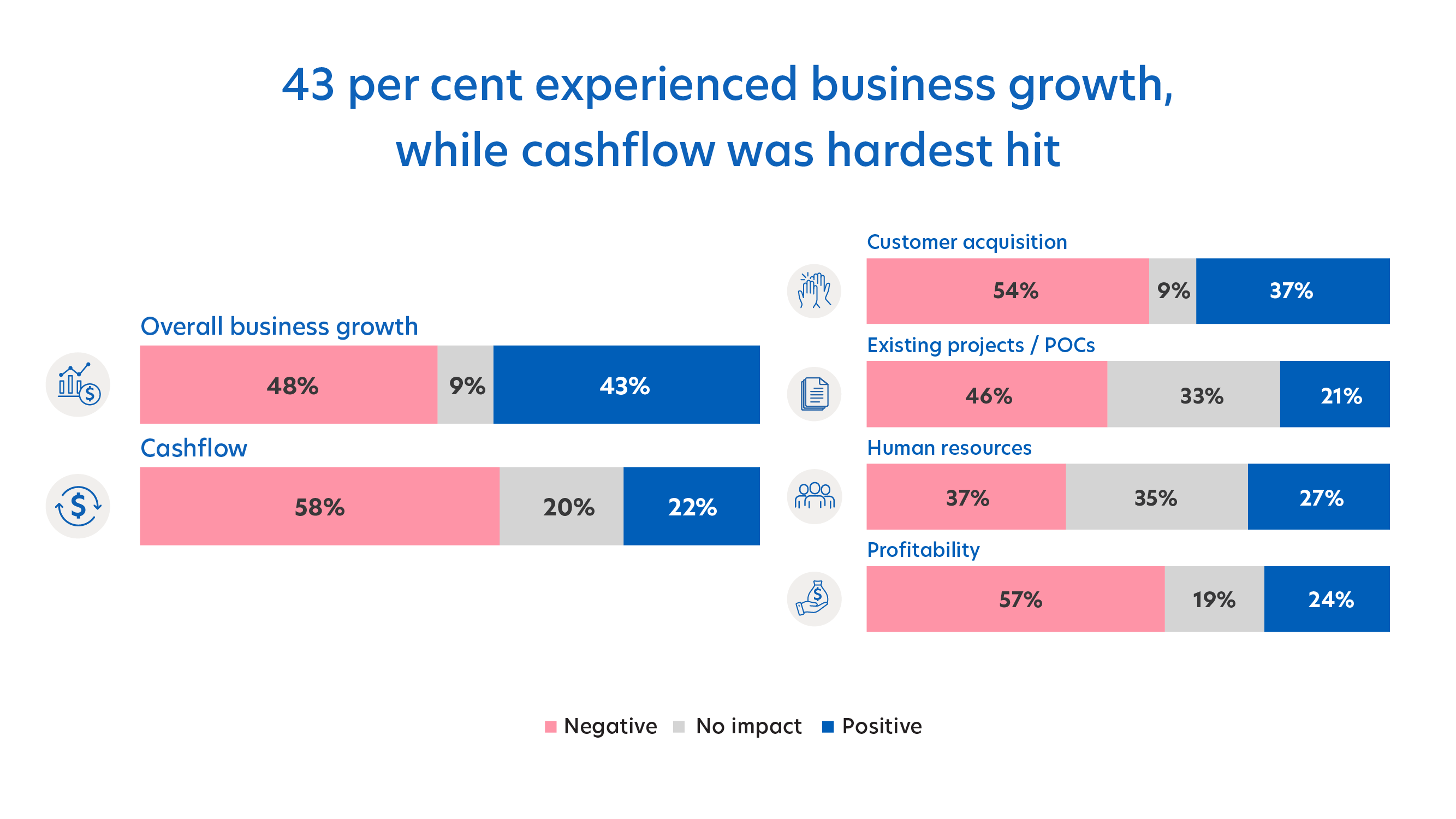

COVID-19 has been a catalyst for digital transformation, which includes digitising financial services – the expert domain of FinTech firms. FinTech firms that saw their cashflow and profitability erode looked for ways to manage their business costs and processes more effectively. Some firms reviewed their headcount to ensure that only the most motivated and competent team members stayed to ride out the COVID-19 storm.

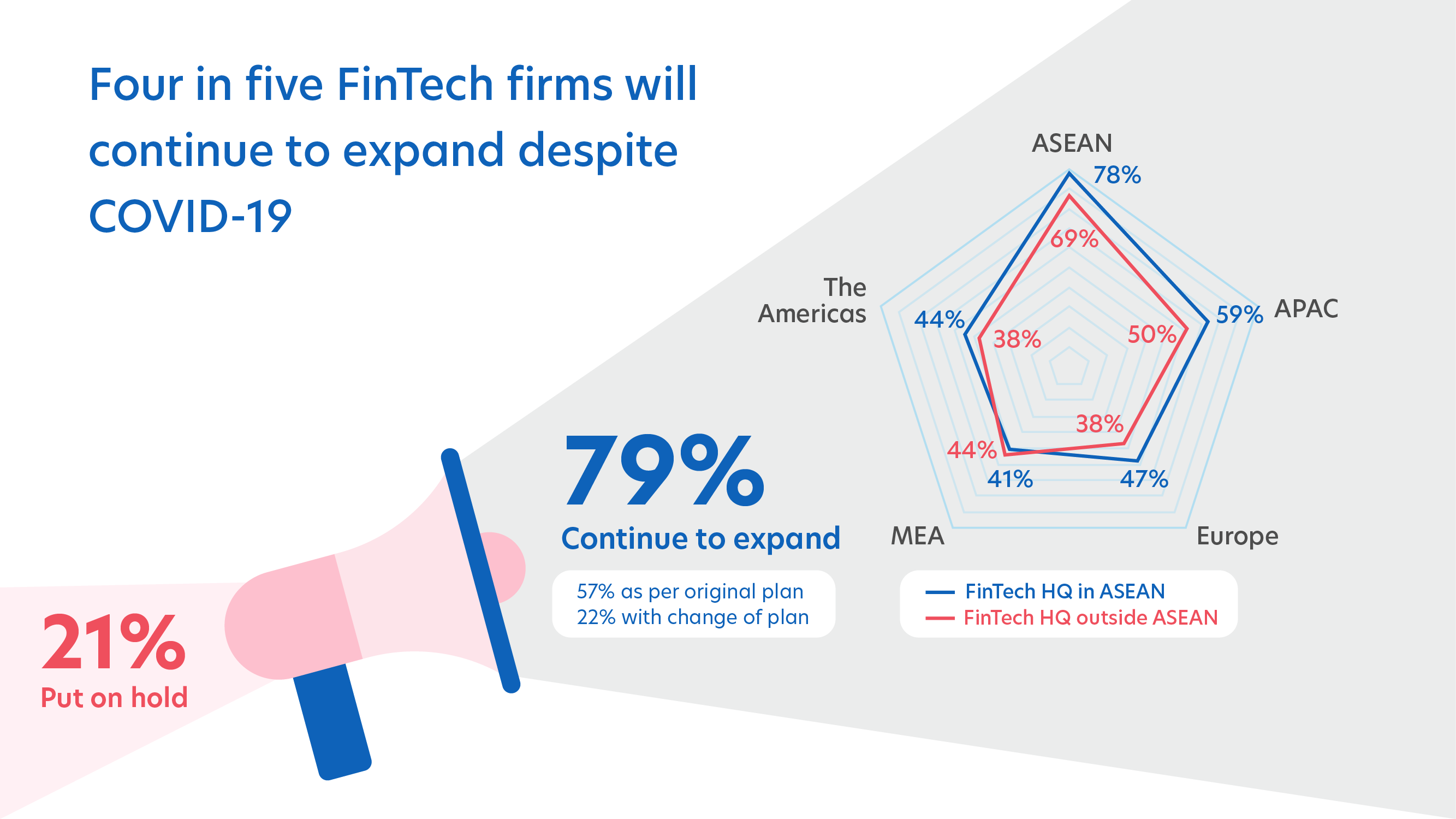

Nonetheless, COVID-19 has not seriously dampened the expansion plans of FinTech firms. Four in five will continue to expand despite COVID-19, with ASEAN remaining the top choice for firms based within and outside the region. Most FinTech firms (87 per cent) believe they are on track to future-proofing their business.

In the next 12 months, FinTech firms will focus on product innovation, zooming in on high-revenue products/segments, entering new markets or pivoting to a new line of business. Getting external support will be the next priority, via additional funding from investors, salary support/relief measures from the government or through mergers and acquisitions (M&A).

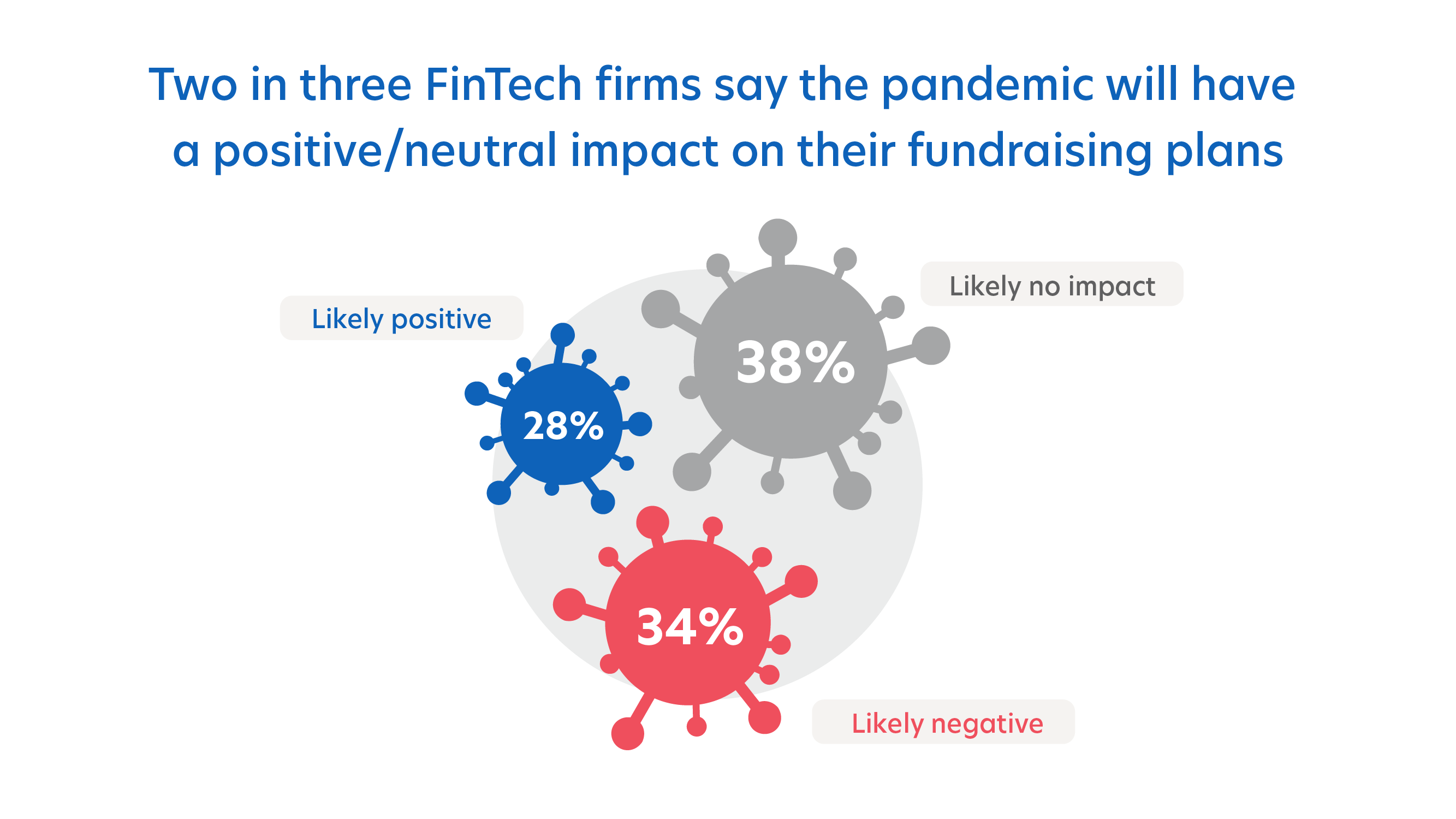

Two of three FinTech firms say that COVID-19 would have a neutral or positive impact on their future fundraising plans.

Across ASEAN, business growth and customer acquisition were more upbeat, as clients and prospects sped up digital transformation initiatives worldwide due to the effects of the pandemic. Payments, AI and Data Analytics in Finance, and Cybersecurity were deemed as the top three FinTech sectors most positively impacted by the pandemic.

Other key findings from the survey

Go! Shape of things to come

While the impacts of COVID-19 on ASEAN’s FinTech industry are still being felt, eventually, the pandemic will fade, borders will reopen, travel will recommence and we will emerge into the new normal.

Looking to a time beyond this recovery, several key indicators emerged in the researching and writing of this report, and the seeds of many have already been planted.

These include:

- China's influence in FinTech, "super apps" and what this means for ASEAN's FinTech industry

- Wider regional integration of standards and protocols (e.g., cross-border payments, smart contracts, crypto-assets and tokens, digital currencies)

- Digital banks and their role in advancing financial inclusion in ASEAN

Explore other reports

FinTech in ASEAN 2019: From Start-up to Scale-up

FinTech in ASEAN 2018: The Next Wave of Growth

Find out how you can ride on the growth opportunities in ASEAN with this report.

State of FinTech in ASEAN (2017)

ASEAN's growing FinTech industry is creating opportunities for the region's unbanked and underserved population.