Net Zero Commitment

UOB's net zero commitment by 2050 is grounded in the need for a just transition that continues to support socioeconomic growth and improve energy access across ASEAN.

UOB’s commitment to building a sustainable ASEAN

Southeast Asia, a region with almost 700 million in population, is UOB’s home ground and where our strategic focus is. Also one of the most vulnerable regions to climate change, the region is facing stark consequences – rising sea levels, heat waves, droughts and increasingly severe rainstorms and floods. Southeast Asia risks losing more than 35% of its gross domestic product (GDP) by 2050 due to climate change.

At UOB, we believe that we must deliver environmental commitments that incorporate energy security, as well as economic and social equity and equality, considering the just transition of the region. Southeast Asia has been reliant on fossil fuels such as thermal coal to drive massive economic expansion, urbanisation and industrialisation in the past two decades, and the shift towards decarbonisation can result in trade-offs with real-life consequences.

As a leading financial institution operating in this region, UOB is steadfast in being a positive force in the fight against climate change.

Our progress for 2023

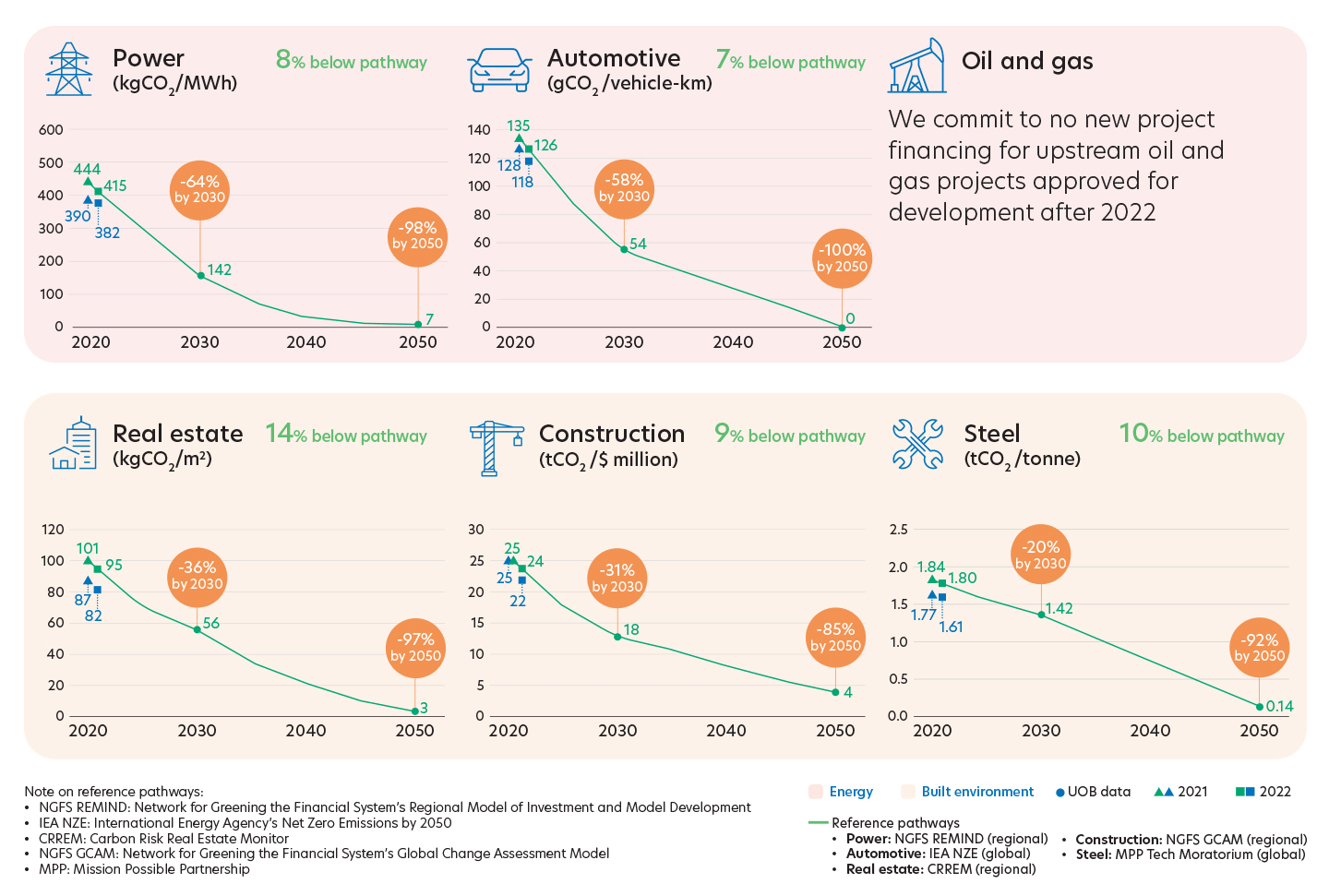

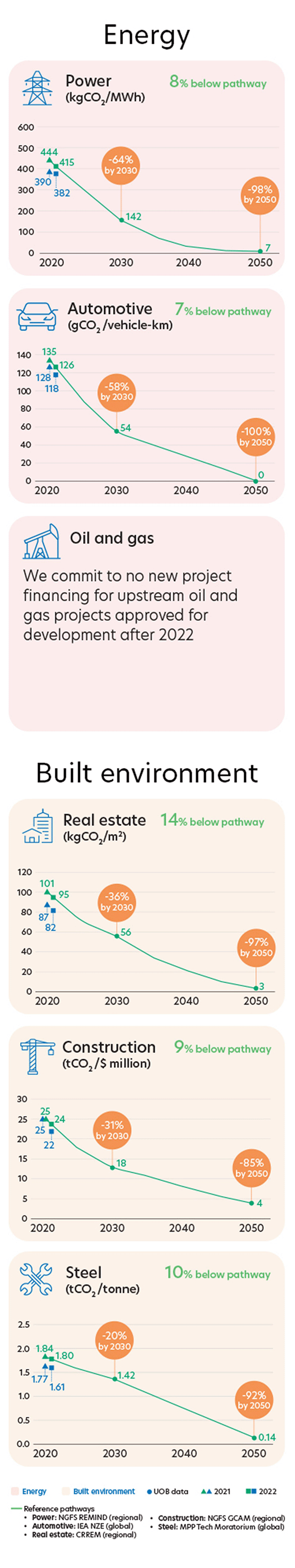

We are guided by the science in setting our net zero targets and have based our targets on internationally-recognised climate models. In consideration of structural differences across the region, we have extracted regional pathways for some targets that represent fair contributions of our key markets.

Our approach is in line with the guidance from the Glasgow Financial Alliance for Net Zero (GFANZ) on how financial institutions should set targets and use sectoral pathways in alignment with the Paris Agreement and the 1.5°C global warming trajectory outlined by the Intergovernmental Panel on Climate Change. We have applied standards by the Partnership for Carbon Accounting Financials (PCAF) to account for the GHG emissions associated with our financed portfolio. Our data selection priority is also in line with PCAF’s guidance, with limited deviations where necessary to reflect the reality of emissions data availability.

Related

Responsible financing

We play a vital role through our financing practices in shaping responsible actions from our customers as we collectively build a sustainable future.

Financing for businesses

We support businesses in the transition to a low carbon economy, helping them stay relevant and competitive for the long term.

Direct environmental impact

We are committed to maintaining carbon neutrality for our operations and conserving resources for the well-being of future generations.