An interest earning savings account for corporate clients. Provides account statements every month.

Requirement:

- Minimum maintaining balance of P1M

- Required Documents Checklist

UOB Group first operated in the Philippines in November 1999 when UOB Limited acquired a 60% stake in a domestic bank, Westmont Bank, which was subsequently renamed United Overseas Bank Philippines ("UOBP"). In July 2002, the stake was increased to 100%, and in 2006, UOBP was converted from a commercial bank into a thrift bank subsidiary with the sale of 66 branches to BDO Unibank. UOBP continued its operations in a single location providing wholesale banking products and services.

UOB Limited ("UOBL") applied for a branch license following a new banking law enacted in July 2014 which allows the conversion of UOBP from a wholly-owned subsidiary to a commercial bank branch. On 26 August 2015, Bangko Sentral ng Pilipinas approved UOBL to register a branch in the Philippines to be called United Overseas Bank Limited, Manila Branch and received its license to transact business from the Securities & Exchange Commission on 12 November 2015.

UOBL Manila Branch commenced operations on 4 Jan 2016 and offers a range of commercial banking products and services.

Quick Links:

UOB Manila Privacy Notice (Individual)

UOB Manila Privacy Notice (Corporate)

UOB is committed to building lasting relationships with our customers, through product and market expertise, and our promise to always do what is right.

With a well-established global presence today and particularly in Asia, UOB has understanding of Asian markets, corporate culture and business mindsets, which is matched by few. Our strong foothold in Singapore, Malaysia, Indonesia, Thailand and China is well-placed to create greater access and growth in this region, for our customers.

Find out more

An interest earning savings account for corporate clients. Provides account statements every month.

Requirement:

A current account for corporate clients. Provides account statements every month.

Requirement:

An interest earning current account for corporate clients. Provides account statements every month.

Requirement:

A Peso or USD time deposit account for corporate clients. Pays interest on the maturity date.

Requirement:

An interest earning USD savings account for corporate clients. Provides account statements every month.

Requirement:

Offered to companies for business expansion or modernization of facilities and acquisition of fixed assets such as plant, machineries, land and building.

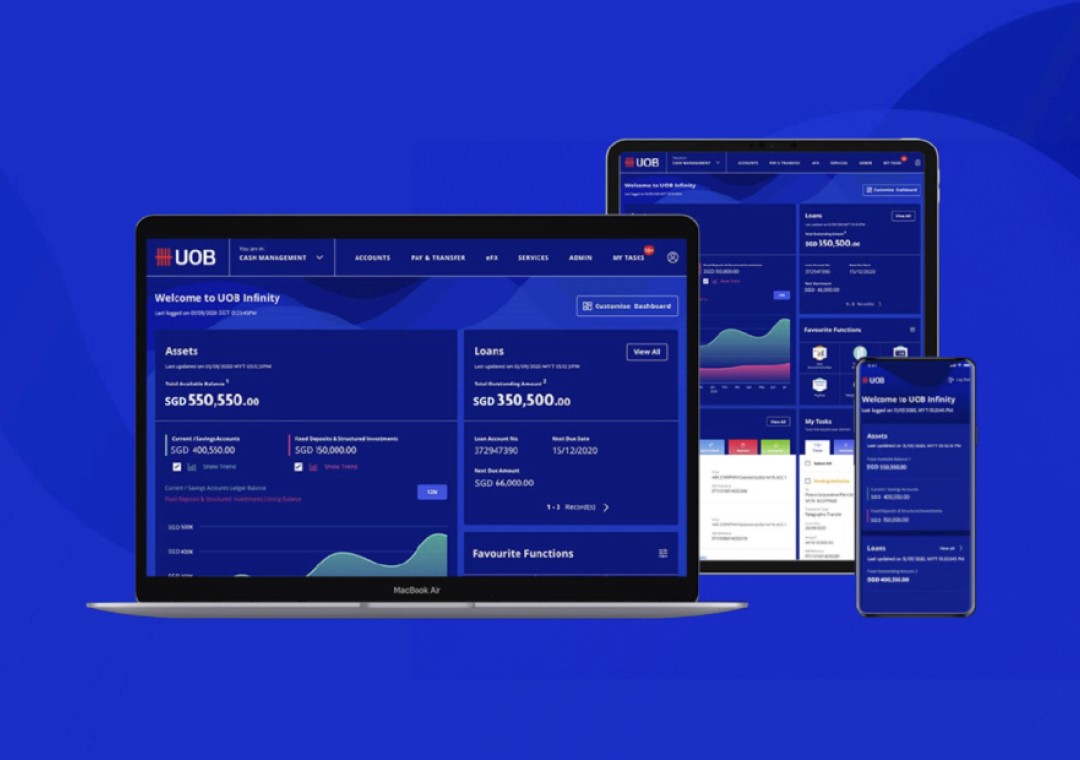

One-stop e-banking platform for your cash transactions

17th Floor, Pacific Star Bldg.,

Sen. Gil Puyat Ave., Cor. Makati Ave.,

Makati City, Philippines

Telephone

(632) 8548-6400

Fax

(632) 8811-5603

Cash Department:

(632) 8548-6416

Marketing:

(632) 8548-6408

Email:

UOB.Manila@UOBgroup.com

At UOB, we strive to address your concern immediately. Upon receipt of your feedback/concern, we will acknowledge receipt and conduct a thorough review to resolve your concerns. In cases whereby further investigations are required due to complexity of the issue, we will keep you updated on the progress and strive to resolve your concern within a reasonable period of time.

Our bank is regulated by the Bangko Sentral ng Pilipinas, whose Financial Consumer Department can be contacted through its telephone number (632) 8708-7087 or its e-mail address: consumeraffairs@bsp.gov.ph. Alternative access modes are as follows: via BSP Online Buddy (BOB) through BSP Webchat – http://www.bsp.gov.ph or BSP Facebook page https://www.facebook.com/BangkoSentralngPilipinas.

We use cookies to improve and customise your browsing experience. You are deemed to have consented to our cookies policy if you continue browsing our site.