We provide deposit account services to help clients manage their day-to-day finances as well as benefit from excess liquidity by providing attractive returns for fixed deposits.

About UOB Brunei

- The Bank first began operations in Bandar Seri Begawan under the name of Overseas Union Bank Limited (OUB) in 1974.

- The branches took on UOB's name when OUB merged with UOB in January 2002.

- UOB Brunei has won the award at the Asia Banking & Finance Wholesale Banking Awards consecutively from 2019 to 2021. The branch focuses on supporting SMEs and large corporates operating in Brunei, as well as facilitates companies outside the country in their expansion into Brunei and encourage local companies to expand their business horizon in other part of the world.

- UOB Brunei business focuses on commercial banking.

- Further details of products offered can be found under "Products & Services".

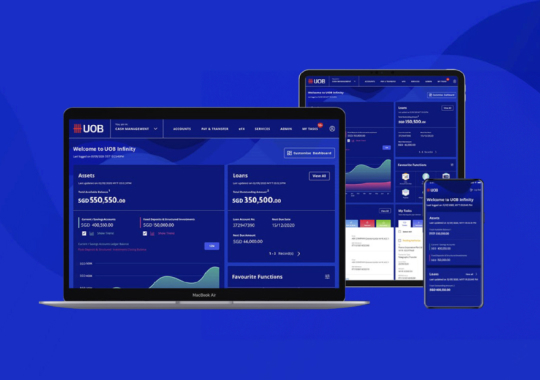

Product & Services

Deposit (Fixed / Current) Accounts

Loans

To help your business meet the dynamic challenges in the marketplace, UOB offers you working capital solutions. Please get in touch with our dedicated Relationship Managers to customize your working capital needs.

As a leading player in the Small and Medium Enterprises (SMEs) market, our core strength lies in our ability to combine our knowledge and experience in the SME market with innovative financial solutions to meet your changing needs. As you strive to accelerate your business growth, we can provide the working capital support you need to complement your business cash flow.

Working Capital Solutions – Term Loan

- Enhance your cash flow and improve your day-to-day business operations including financing purchase of assets like factories, commercial lots etc.

- Plan your finances effectively with fixed and regular repayment schedule

Trade Services

Our comprehensive suite of import solutions support your procurement of goods and services from around the world by providing liquidity, risk mitigation and working capital assistance. This way, you can expand to new markets and grow your business confidently.

Import

- Bridge cash flow gap between settlement with suppliers, counter parties and payment from buyers

- Customized solution to suit your specific trading cycle

- Enjoy direct links with worldwide trading parties through the UOB’s excessive network of offices and worldwide correspondent relationships

Standby Letter of Credit (SBLC) / Guarantees / Bonds

We offer a wide range of Banker’s Guarantees and Standby Letter of Credit (SBLC) as guarantees to your beneficiaries, counter-parties and suppliers.

Type of Guarantees

- Bid Bond

- Performance Bond

- Warranty Bond

- Advance Payment Guarantee

- Financial Guarantee

Remittances

Telegraphic Transfer (TT) is an efficient and secure way of sending electronic payments in a wide range of remittance currencies to your beneficiaries overseas.

Overdraft

Provide our clients with greater liquidity and financial flexibility for their working capital needs

- Flexible repayment options