You are now reading:

Are You Unbanked or Underbanked?

you are in Better TMRW

You are now reading:

Are You Unbanked or Underbanked?

Get the most out of your banking services. To reach your financial goals, read on to find out more.

Did you know? About 4 in 10 adults in Singapore do not sufficiently utilise the financial services and products offered by banks – a surprisingly high number for a developed country like Singapore.

One main reason for this is the lack of financial literacy, which is the ability to understand and effectively use various financial skills like budgeting and investing. If this term sounds uncomfortably foreign to you, don’t fret and have a quick crash course with us.

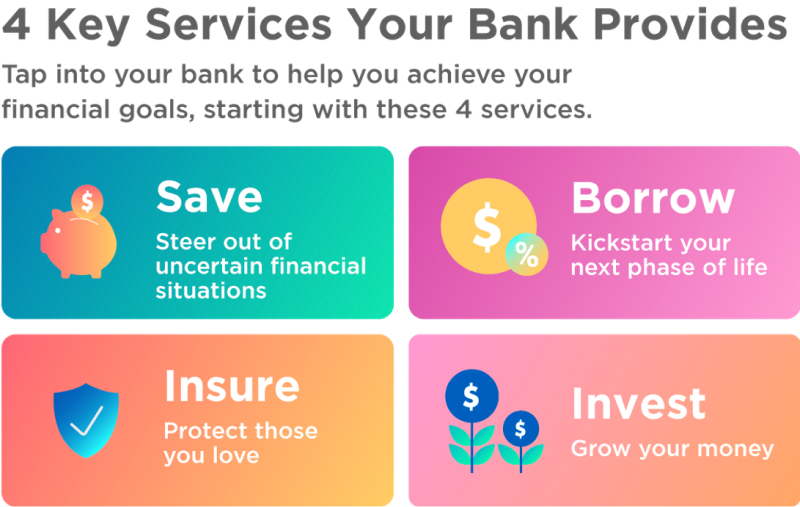

So, do you think you’ve made the most of your bank services? Here’s a glance of what you can expect!

Now, let’s dive right in.

Everyone knows that saving is important, especially to weather out potential rainy days. That said, knowing how best to save is the key.

When you open a savings account with a bank, you get to enjoy various benefits that you may otherwise have harder access to:

With UOB, you can find a suitable account that meets your banking and saving goals. Psst, there’s quite a range.

Borrowing money isn’t necessarily a bad thing. In fact, loans have many uses. They can help you fund a new home, pay for school fees or even kickstart a new business venture.

Many tend to borrow from these 3 main sources:

However, not all loans work the same. Secured loans require borrowers to offer a collateral, while unsecured ones don’t. This difference can affect your interest rate, borrowing limit and repayment terms.

Thinking of taking out a loan? UOB offers an extensive list of loans to cater to your different needs, from personal financing to property loans.

Most of us have some sort of insurance coverage. But are you insured well or sufficiently? If not, it may be time to review what policies you have and whether they are essential – you may not even have the necessary ones to begin with!

As a start, you could consider refreshing what you know about insurance basics or check out this list of insurance must-haves:

No matter the protection you require, UOB provides you with a wide variety of coverage, including maid, travel and car insurance plans.

Have you thought of “growing” your funds?

Unlike saving, investing allows you to get potentially higher returns! Read more about their differences for a better picture of what to expect when you do either and/or both.

Of course, investing may seem pretty intimidating for those new to it – who may have worries about making big losses. That’s why it’s important to invest according to your risk tolerance, which is the amount of risk you’re willing to endure in relation to the value of your investment.

Good financial planning can be a tough skill to master. Moreover, as the world advances and grows increasingly fast-paced, sticking to the old style of money management may prove to be difficult.

That’s why learning to take advantage of bank services can help you bridge that gap and reach your financial goals in a strategic and systematic manner. With your bank’s account personalisation and automation, as well as online and mobile tools, you can gain a holistic view of your wealth with ease.

The Benefits of Using a Bank, https://www.intrustbank.com/article/the-benefits-of-using-a-bank

Low Youjin, 4 in 10 Singaporean adults ‘underbanked’; SE Asia ripe for picking by digital financial firms: Report; https://www.todayonline.com/singapore/4-10-singaporean-adults-underbanked-south-east-asia-ripe-picking-digital-financial-firms

Julia Kagan; Savings; https://www.investopedia.com/terms/s/savings.asp

Elvis Picardo; Investing; https://www.investopedia.com/terms/i/investing.asp

Glenn Curtis; The Best Ways to Borrow Money; https://www.investopedia.com/articles/basics/07/financing-options.asp

We are providing you this financial literacy information (including any videos) (“Information) for your general information only. We do not intend for you to use the Information as accounting, legal, regulatory, tax, financial or any other type of advice. Before making any financial decisions, please speak with your own professional advisors on suitability. We make no representation or warranty as to the accuracy and completeness of the Information. We are not liable should you suffer any losses arising from your reliance on the Information.

10 Apr 2023 • 5 mins read

03 Feb 2023 • 5 mins read

03 Feb 2023 • 5 mins read