You are now reading:

UOB Business Outlook Study 2024 (Vietnam): Companies undeterred by economic headwinds

What does the ASEAN consumer think and feel about the economy? How has spending and financial behaviour changed? Get the latest highlights from the region’s barometer of consumer sentiments.

What does the ASEAN consumer think and feel about the economy? How has spending and financial behaviour changed? Get the latest highlights from the region’s barometer of consumer sentiments.

Explore key business trends and sentiments today.

View reportyou are in UOB ASEAN Insights

You are now reading:

UOB Business Outlook Study 2024 (Vietnam): Companies undeterred by economic headwinds

In 2023, Vietnamese firms faced high inflation levels and a slowing economy, in part due to macroeconomic uncertainty and a falling global demand for the country’s exports.

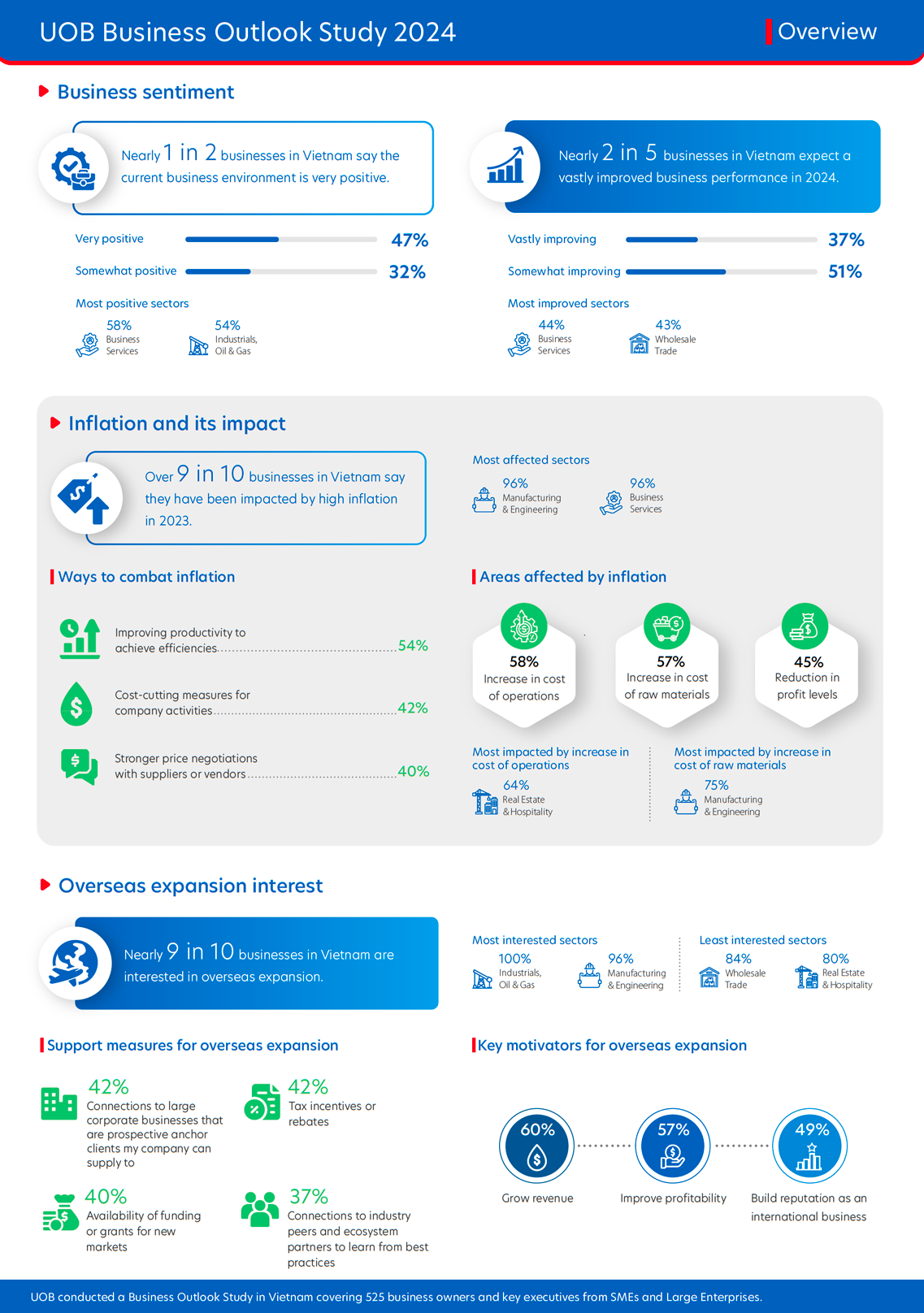

Most Vietnamese companies, however, remain optimistic. According to the UOB Business Outlook Study 2024 (SMEs & Large Enterprises), nearly one in two businesses believe the current environment is very positive, with the most positive sectors being business services (58 per cent) and industrials, oil and gas (54 per cent).

Figure 1: Snapshot of the key insights from Vietnamese businesses

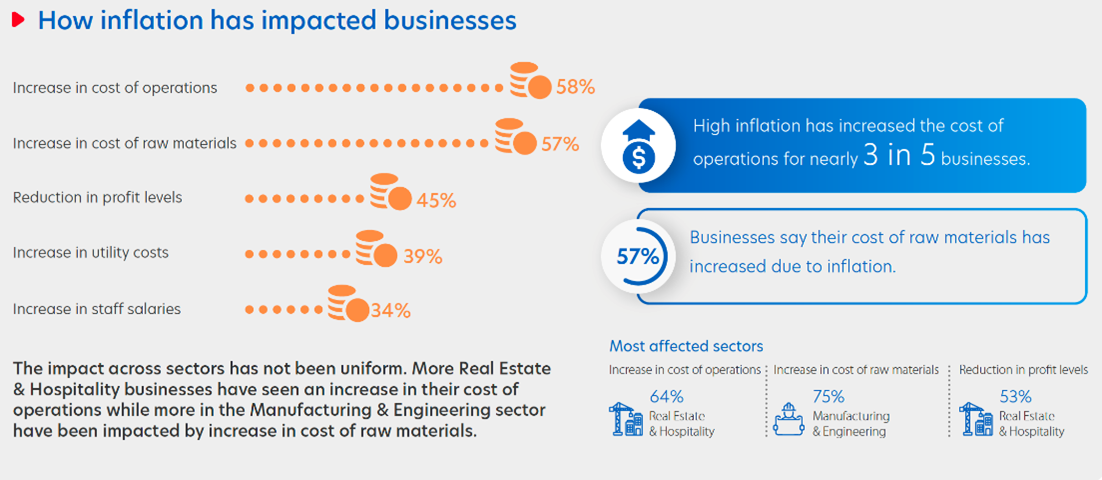

Much like those across the region, Vietnamese businesses were impacted by various factors in 2023, with nearly four in 10 affected by high inflation levels and more than three in 10 challenged by fluctuating commodity prices and the overall economic slowdown.

Figure 2: Businesses were most impacted by high inflation and uncertainty over commodity prices last year

Despite such pressures, local firms are still expecting a vastly improved performance in 2024 (nearly four in 10). The most positive sectors are business services (44 per cent) and wholesale trade (43 per cent).

To enable growth, Vietnamese companies have identified key business priorities for the next one to three years. This includes diversifying supply chains (31 per cent), sourcing for new partnerships (30 per cent) and reducing costs (30 per cent).

With a keen eye on sustaining the post-pandemic revenue growth momentum, about four in five businesses are committed to broadening their reach.

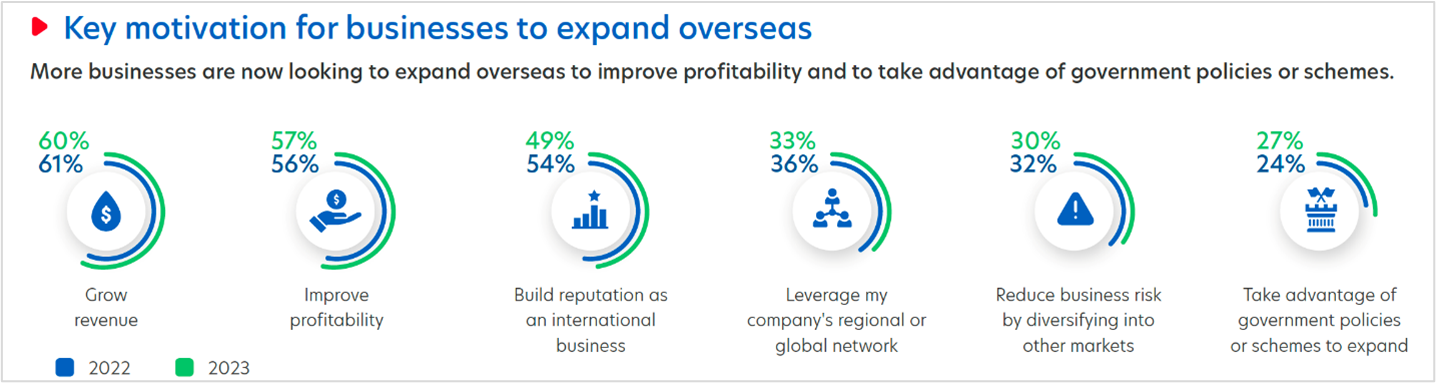

Figure 3: Top factors motivating Vietnamese businesses to expand overseas

To achieve this goal and tap into new customer bases, nine in 10 enterprises are increasingly exploring opportunities beyond domestic borders. Companies in industrials, oil and gas, as well as manufacturing and engineering are particularly interested in venturing abroad.

ASEAN and Mainland China are the primary destinations for expansion – Thailand, Singapore, and Cambodia top the list of preferred markets. However, venturing into international markets comes with its own set of challenges, including difficulties in customer acquisition, navigating legal and regulatory frameworks, and establishing strategic partnerships.

To meet these challenges, businesses are seeking connections with large corporations, enhanced tax incentives and access to funding for new market entry.

In the aftermath of Covid-19 disruptions, the awareness of effective supply chain management has surged among businesses in Vietnam. Ongoing geopolitical tensions, rising supply costs, procurement complexities, and supply chain risks have underlined the importance of building supply chain resilience.

Over 90 per cent of respondents recognise the role of strategic supply chain management in ensuring operational stability and resilience, a level that has surpassed their counterparts in the region.

Figure 4: Top practices to manage supply chain volatility

Vietnamese companies are seeking to diversify, with many aiming to explore alternative raw material sources (35 per cent) to mitigate disruption risks. Additionally, a number of firms intend to nurture more robust supplier networks (33 per cent) and technological partnerships in addition to leveraging tax incentives.

Vietnam has emerged as the fastest growing digital economy in ASEAN, a trend projected to continue into 2025 and beyond.

The rapid increase in internet penetration, with more than 80 per cent of the population now online, is fuelling the expansion of e-commerce and digital payments.

Our report found that 90 per cent of businesses, particularly those in technology, media, and telecommunications sectors, have embraced digital technologies.

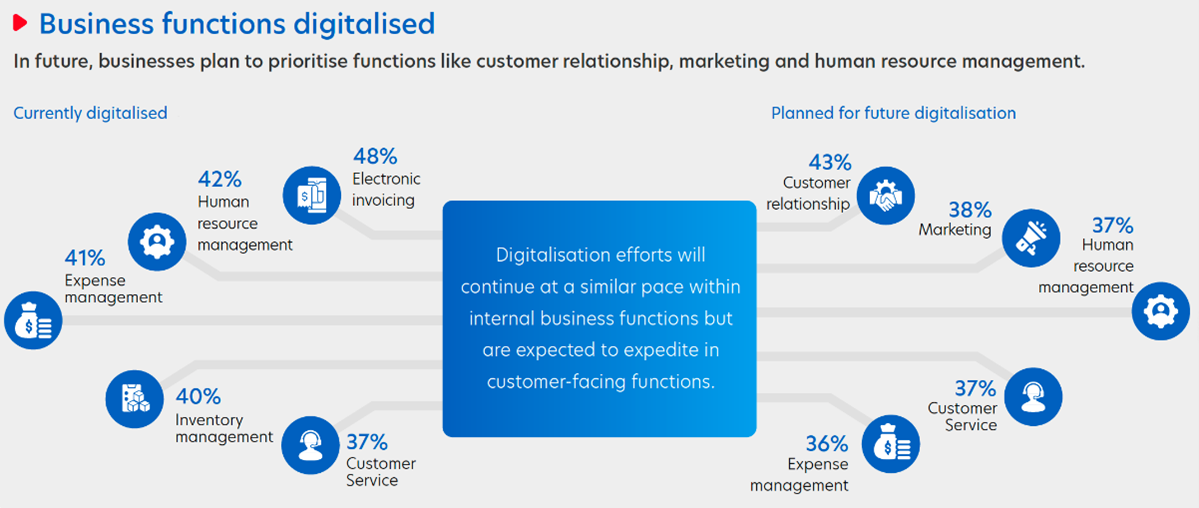

Digitalisation has spread across the organisational layers, with internal functions mostly tech-enabled while customer-facing and supply chain digitalisation are in the works.

Nevertheless, challenges such as cybersecurity risks, digital skill shortages, and data breach concerns underscore the need for collaborative efforts between industry stakeholders and government bodies to facilitate seamless digital adoption, particularly among medium enterprises.

Vietnam’s National Digital Transformation Programme aims to tackle these challenges and accelerate digital transformation by 2030 with the rollout of digital government and improved broadband coverage.

Figure 5: Functions being digitalised by businesses in Vietnam

Sustainability is as a key priority for businesses, with half of Vietnamese business respondents already implementing sustainable practices.

Figure 6: Vietnamese businesses welcome sustainable practices for direct cost savings

Nine in 10 businesses recognise the importance of sustainability, especially those from the wholesale trade as well as the technology, media, and telecommunications sectors. According to the report, improved business reputation, investor attraction, and competitive advantage are factors that incentivise businesses to embrace sustainability practices.

However, inadequate infrastructure (38 per cent), lack of viable financing options (34 per cent), and perceived impacts on profitability (34 per cent) are hindering widespread adoption. Companies in the manufacturing and engineering sector have expressed particular concerns about inadequate infrastructure for renewable energy.

Financial measures such as tax incentives and options for sustainable financing also go a long way in addressing some of these concerns.

UOB is committed to supporting businesses on their sustainability journey, offering a suite of tailored financing solutions to address the diverse needs of businesses at every stage of their sustainability journey.

As businesses in ASEAN and Greater China face a challenging landscape, we want to help them seize opportunities, forge new paths, and reimagine a sustainable future together.

With more than 80 years of experience, UOB has an extensive regional network with a deep understanding of ASEAN dynamics. At UOB, we are committed to helping businesses navigate the dynamic landscape of the ASEAN region to unlock their full potential. From cross-border trade support to green financing, UOB offers tailored solutions, industry knowledge, and market expertise.

Download the full report and infographics. Available in both English and Vietnamese.

The UOB Business Outlook Study 2024 (Vietnam) surveyed 525 business owners and key executives from SMEs and Large Enterprises to understand their views on key topics, including:

This article shall not be copied or relied upon by any person for whatever purpose. This article is given on a general basis without obligation and is strictly for information only. The information contained in this article is based on certain assumptions, information and conditions available as at the date of the article and may be subject to change at any time without notice. You should consult your own professional advisers about the issues discussed in this article. Nothing in this article constitutes accounting, legal, regulatory, tax or other advice. This article is not intended as an offer, recommendation, solicitation, or advice to purchase or sell any investment product, securities or instruments. Although reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this article, UOB and its employees make no representation or warranty, whether express or implied, as to its accuracy, completeness and objectivity and accept no responsibility or liability for any error, inaccuracy, omission or any consequence or any loss or damage howsoever suffered by any person arising from any reliance on the views expressed and the information in this article.

Get the full UOB Business Outlook Study 2024 (Vietnam). Download now

28 Oct 2024 • 4 mins read

19 Aug 2024 • 5 mins read

19 Aug 2024 • 5 mins read

14 Aug 2024 • 6 mins read