You are now reading:

UOB Business Outlook Study 2024 (Regional): Positivity and resilience take centre stage

What does the ASEAN consumer think and feel about the economy? How has spending and financial behaviour changed? Get the latest highlights from the region’s barometer of consumer sentiments.

What does the ASEAN consumer think and feel about the economy? How has spending and financial behaviour changed? Get the latest highlights from the region’s barometer of consumer sentiments.

Explore key business trends and sentiments today.

View reportyou are in UOB ASEAN Insights

You are now reading:

UOB Business Outlook Study 2024 (Regional): Positivity and resilience take centre stage

In 2023, businesses had to take on and navigate various tests, amidst a backdrop of macroeconomic and sociopolitical uncertainty. These included high levels of inflation, high interest rates, rising operational and labour costs, as well as a stuttering economy.

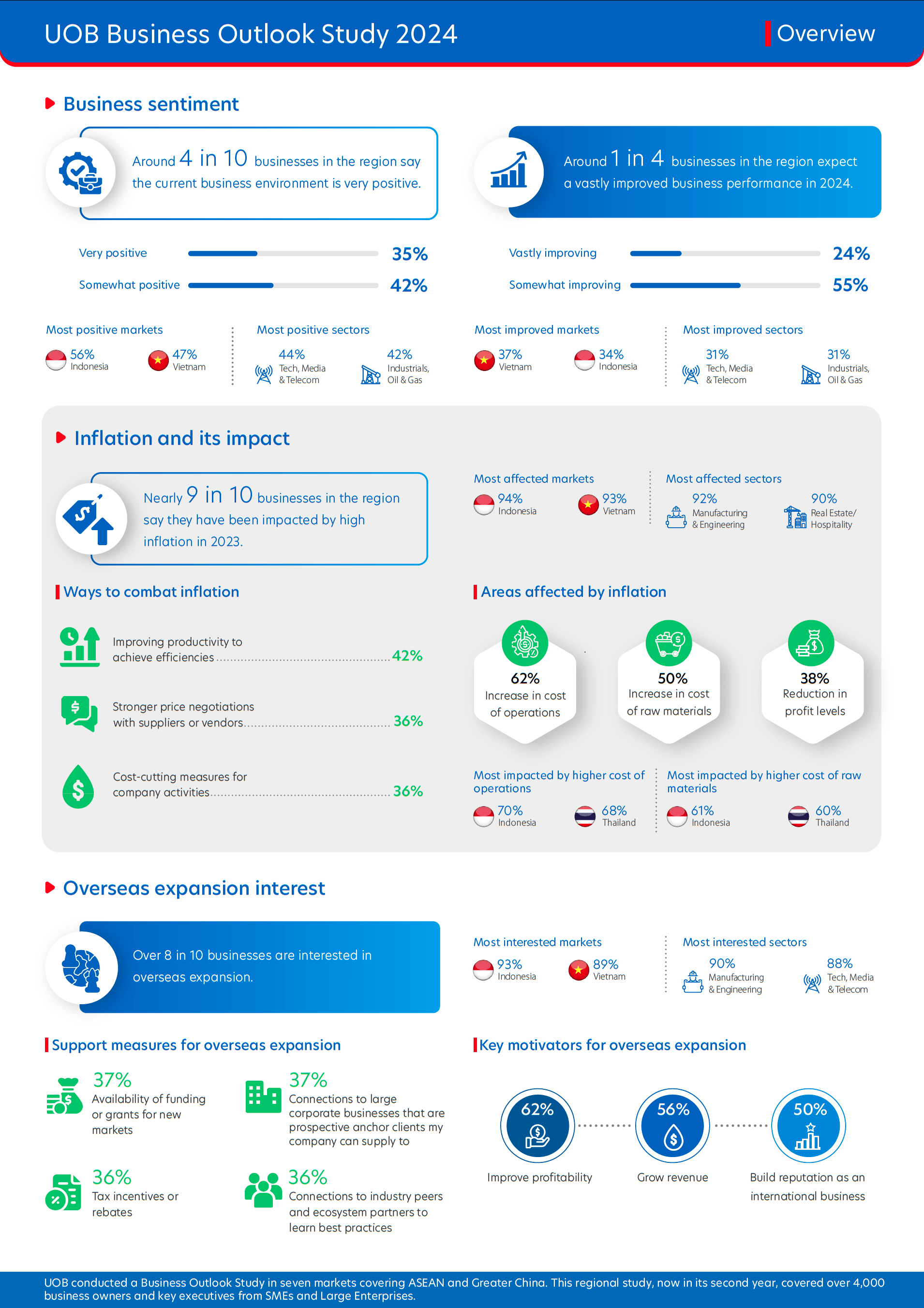

Despite the hurdles, businesses are displaying resilience. According to the latest UOB Business Outlook Study 2024 (SMEs & Large Enterprises), 35 per cent of businesses across ASEAN and Greater China say that the current business environment is very positive.

Figure 1: Snapshot of the key findings from businesses in ASEAN and Greater China.

The number of very positive business sentiments saw a slight dip of two percentage points compared with the previous year (37 per cent). Meanwhile, one in four businesses are expecting a vastly improved performance in 2024, with the most positive markets being Indonesia (56 per cent) and Vietnam (47 per cent).

Figure 2: Businesses were most impacted by high inflation and rising labour costs last year.

Notably, the most positive sectors are tech, media and telecom (44 per cent), followed by industrials, oil and gas (42 per cent).

Although inflation continues to impact the bottom line of nine in 10 businesses, companies are finding ways to mitigate its impact. These include short-term goals such as reducing costs (30 per cent), as well as long-term plans that include sourcing for new customer bases (26 per cent) and digitalising businesses (26 per cent).

When it comes to overseas expansion, 83 per cent of businesses are eyeing growth beyond their local markets. In fact, businesses in Indonesia (93 per cent) and Vietnam (89 per cent) are leading the charge with an interest to venture abroad.

According to the report, ASEAN and Mainland China are key markets for future expansion. Within ASEAN, Malaysia, Singapore and Thailand are the top destinations for businesses.

For companies that are keen to leverage both ASEAN and Mainland China markets, such a direction aligns with the ‘China Plus One’ approach, as businesses reduce dependency on Mainland China by diversifying their supply chains.

The ASEAN-China Free Trade Area (ACFTA) further enhances the strategy by streamlining trade and investment between the two regions, offering a solid framework for growth.

In addition to improving profitability (62 per cent), companies are motivated by the opportunity to grow revenue (56 per cent) and build their reputation as an international business (50 per cent).

Figure 3: Top factors motivating businesses to expand overseas.

However, expanding overseas can be a challenging endeavour. The need to find suitable local partners (39 per cent), a lack of in-house talent to drive overseas expansion (36 per cent), plus a lack of customers in new markets (35 per cent), remain some of the top barriers.

Despite the hurdles, businesses recognise the support measures that they need, with financial support (37 per cent) and connections to large corporate companies (37 per cent) key to their business strategy.

There are also avenues that these companies can tap to kick-start their ambitions. For example, companies can connect with UOB’s Foreign Direct Investment (FDI) Centres that are set up across the region, leveraging the Bank’s regional footprint and local expertise to power their cross-border goals.

Companies are re-evaluating their supply chain strategies in today’s fast-evolving market dynamics – fuelled by geopolitical uncertainty in the shape of US-China trade tensions, the Russia-Ukraine war and brewing conflict in the Middle East, among others.

More than 90 per cent of businesses consider supply chain management (SCM) important, particularly in Indonesia (98 per cent), Mainland China (97 per cent), Thailand and Vietnam (both 94 per cent).

However, fewer ASEAN businesses (55 per cent) are feeling the impact of geopolitical tensions on supply chains, down from 62 per cent in the previous year.

With high interest rates and procurement challenges, there is a real risk to the steady flow of goods. To weather the storm, businesses are diversifying their supplier base (30 per cent) and enhancing inventory management practices (28 per cent). There is also a growing reliance on data analytics to improve decision-making processes (28 per cent).

Figure 4: Top practices to manage supply chain volatility.

The digital landscape is reshaping the region’s economy, from transformative e-commerce platforms in Vietnam to smart manufacturing in Malaysia.

With over 70 per cent internet penetration among its 670 million population, ASEAN is at the forefront of global digital connectivity. In 2023, revenues from online commerce in the ASEAN region and Mainland China experienced growth rates of 22 per cent and 12 per cent respectively.

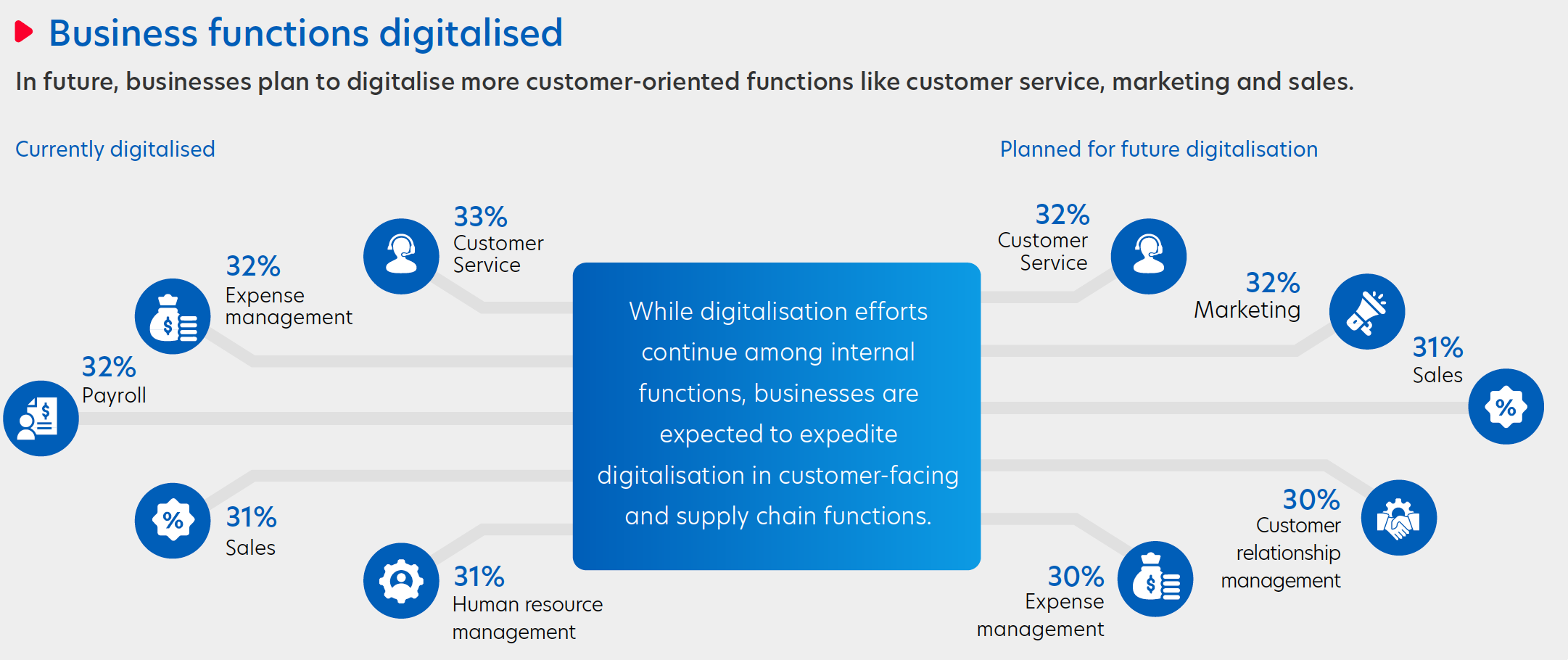

According to the study, 80 per cent of businesses have adopted digitalisation in at least one department, with the most digitalised markets being Thailand (92 per cent) and Mainland China (90 per cent).

Companies are keen to digitalise more customer-oriented functions such as customer service (32 per cent), marketing (32 per cent) and sales (31 per cent). This can be seen in the projected digitalisation spending in 2024, where three in four businesses intend to spend more on digitalisation efforts – budgeting an increase of 10 to 25 per cent.

Figure 5: Functions being digitalised by businesses in ASEAN and Mainland China.

The digitalisation drive, however, comes with challenges that range from cybersecurity concerns (36 per cent) to high implementation costs (33 per cent) and a lack of digital skillsets among employees (32 per cent).

One in two businesses recognise the value of support from banks and financial institutions in their digital transformation efforts, noting considerable savings in time and effort during implementation. This collaborative approach highlights the collective effort towards a digitally empowered future.

When it comes to adopting sustainable practices, the report reveals a disconnect among businesses on the importance of going green and actual adoption. For example, 87 per cent of ASEAN companies view sustainability as important to their business, but only 44 per cent have adopted green practices.

Despite the contrast, businesses understand the benefits that sustainable practices can bring, such as improved branding, potential cost savings and becoming more attractive to investors.

Figure 6: Regional businesses embrace sustainable practices for direct cost savings.

There remain barriers that are preventing businesses from implementing sustainability practices. Some of the biggest challenges include concerns about negative impact on profits (30 per cent), the impact to revenues in the short term (27 per cent) and the lack of proper infrastructure (29 per cent).

Despite the perceived barriers, companies have identified the type of support needed to help them incorporate sustainable practices into their strategies. Examples range from training programmes to reskill employees to easier access to funding and grants.

Both ASEAN and Mainland China are making concerted efforts to realise the United Nations 2030 Sustainable Development Goals, further driving businesses in the region to adopt sustainable practices aligned with global standards. The UOB Sustainability Compass supports business leaders uncertain about sustainability's impact or are already on the path, ensuring alignment with global standards.

As businesses in ASEAN and Greater China face a challenging landscape, we want to help them seize opportunities, forge new paths, and reimagine a sustainable future together.

With over 80 years of experience, UOB has an extensive regional network with a deep understanding of ASEAN dynamics. At UOB, we are committed to helping businesses navigate the dynamic landscape of the ASEAN region to unlock their full potential. From cross-border trade support to green financing, UOB offers tailored solutions, industry knowledge, and market expertise.

The UOB Business Outlook Study 2024 (SMEs & Large Enterprises) surveyed more than 4,000 business owners and key executives from various sectors across Indonesia, Malaysia, Singapore, Thailand, Vietnam, Mainland China and Hong Kong SAR. The quantitative online study – conducted between December 2023 and January 2024 – captured insights on the following themes:

This article shall not be copied or relied upon by any person for whatever purpose. This article is given on a general basis without obligation and is strictly for information only. The information contained in this article is based on certain assumptions, information and conditions available as at the date of the article and may be subject to change at any time without notice. You should consult your own professional advisers about the issues discussed in this article. Nothing in this article constitutes accounting, legal, regulatory, tax or other advice. This article is not intended as an offer, recommendation, solicitation, or advice to purchase or sell any investment product, securities or instruments. Although reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this article, UOB and its employees make no representation or warranty, whether express or implied, as to its accuracy, completeness and objectivity and accept no responsibility or liability for any error, inaccuracy, omission or any consequence or any loss or damage howsoever suffered by any person arising from any reliance on the views expressed and the information in this article.

Get the full UOB Business Outlook Study 2024 (Regional edition).Download now

07 Nov 2024 • 5 mins read

28 Oct 2024 • 4 mins read

19 Aug 2024 • 5 mins read

19 Aug 2024 • 5 mins read