Sustainability

In creating sustainable value for our stakeholders, we are committed to aligning our long-term business strategies with their interests. We take into consideration their expectations and concerns as we identify and assess the environmental, social and governance risks, as well as opportunities across our business. Our commitment is a natural extension of our values of honour, enterprise, unity and commitment.

Sustainability Governance Structure

Good governance is at the core of running our business responsibly.

The Strategy Committee (SC) assists the Board in providing advice to the Bank as it considers sustainability issues in formulating the strategic plan for the Group. Chaired by an independent director, the SC considers material environmental, social and governance (ESG) issues, reviews ESG goals and targets, and oversees the management and monitoring of material ESG factors. The SC makes its recommendations on our sustainability strategy and reporting for the Board’s review and approval.

The SC is supported by the Management Executive Committee (MEC), which consists of the Group Chief Executive Officer, Group Chief Financial Officer, Group Chief Risk Officer, Head of Group Technology and Operations, Head of Group Retail, Head of Group Wholesale Banking and Head of Global Markets. The MEC reviews and determines the material ESG issues and their scope, evaluates key performance indicators, reviews long-term goals and provides strategic direction for sustainability reporting.

The MEC is in turn assisted by a sustainability reporting project team, comprising senior managers from key functions within the organisation. With guidance from an external consultant, the project team collates and reviews ESG data in collaboration with internal stakeholders for sustainability reporting.

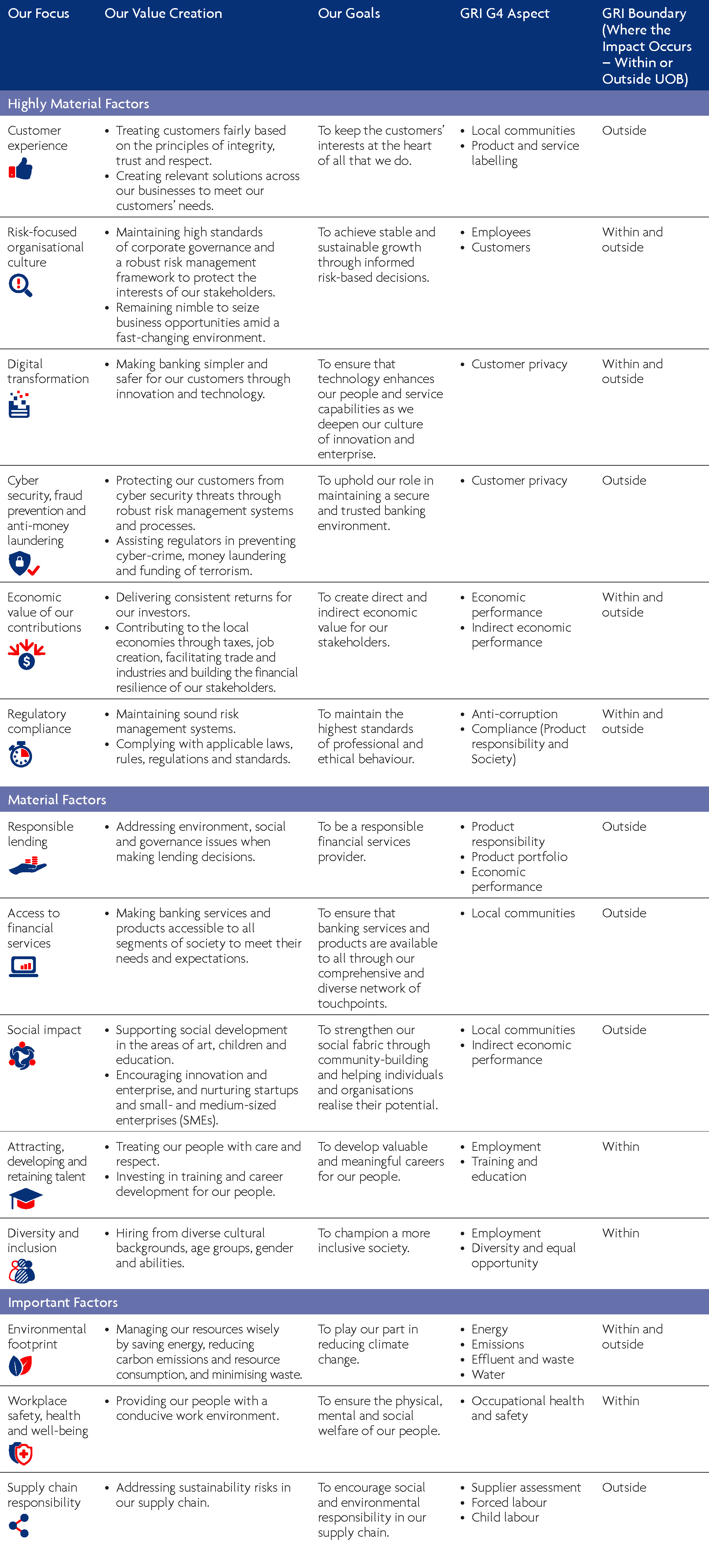

Our Material ESG Factors

Materiality Analysis

In 2016, senior and middle management executives from 13 functions and departments, including the sustainability reporting project team, attended a workshop facilitated by an external sustainability consultant.

The participants identified the ESG factors material to the Group based on their knowledge of their respective business areas, the challenges faced by the banking industry and the corresponding implications for UOB’s businesses and operations. They also considered the insights they gained from their day-to-day engagement with their stakeholders.

The workshop outcomes were followed by extensive consultation with internal stakeholders, including members of the senior management team, to establish the direction for sustainability reporting.

The sustainability reporting project team also examined the evaluation criteria applied by the relevant sustainability indices and rankings to understand the ESG matters of interest to our stakeholders.

In addition, the consultant conducted a global sustainability reporting benchmarking study, which included sustainability reporting practices of leading financial institutions.

Finally, we considered the guiding principles from the Singapore Exchange’s Sustainability Reporting Guidelines, The Association of Banks in Singapore’s Responsible Lending Guidelines, UN Principles for Responsible Investment and the Equator Principles.

Based on the above process, we categorised the identified ESG factors into three groups: Highly Material, Material and Important. A summary of these factors, how we create value, our goals and how they relate to the Global Reporting Initiative’s (GRI) aspects and boundaries is presented in the following table.

Principles of Reporting

In line with regulatory developments towards broader corporate disclosure, we aim to meet GRI’s ‘in-accordance-core’ criteria by providing information on the material ESG factors relevant to our business.

In defining our reporting content, we have observed the GRI’s principles of stakeholder inclusiveness, sustainability context, materiality and completeness. For reporting quality, we have observed the principles of accuracy, balance, clarity, comparability, reliability and timeliness.

The ESG data and information provided have not been verified by an independent third party. We have relied on internal data monitoring and verification to ensure accuracy, while our external sustainability consultant reviewed the data and information, verified samples of data and conducted interviews to ascertain accuracy.

Stakeholder Engagement

At UOB, we believe that constructive stakeholder engagement enables us to serve the needs of our customers more effectively, to build meaningful careers for our people and to make a difference in the communities in which we operate.

By gathering stakeholder feedback through dialogue, collaboration and cooperation, we secure insights into the ESG factors that matter most to them and that are relevant to our business.

A summary of our stakeholder engagement efforts is presented in the following table.

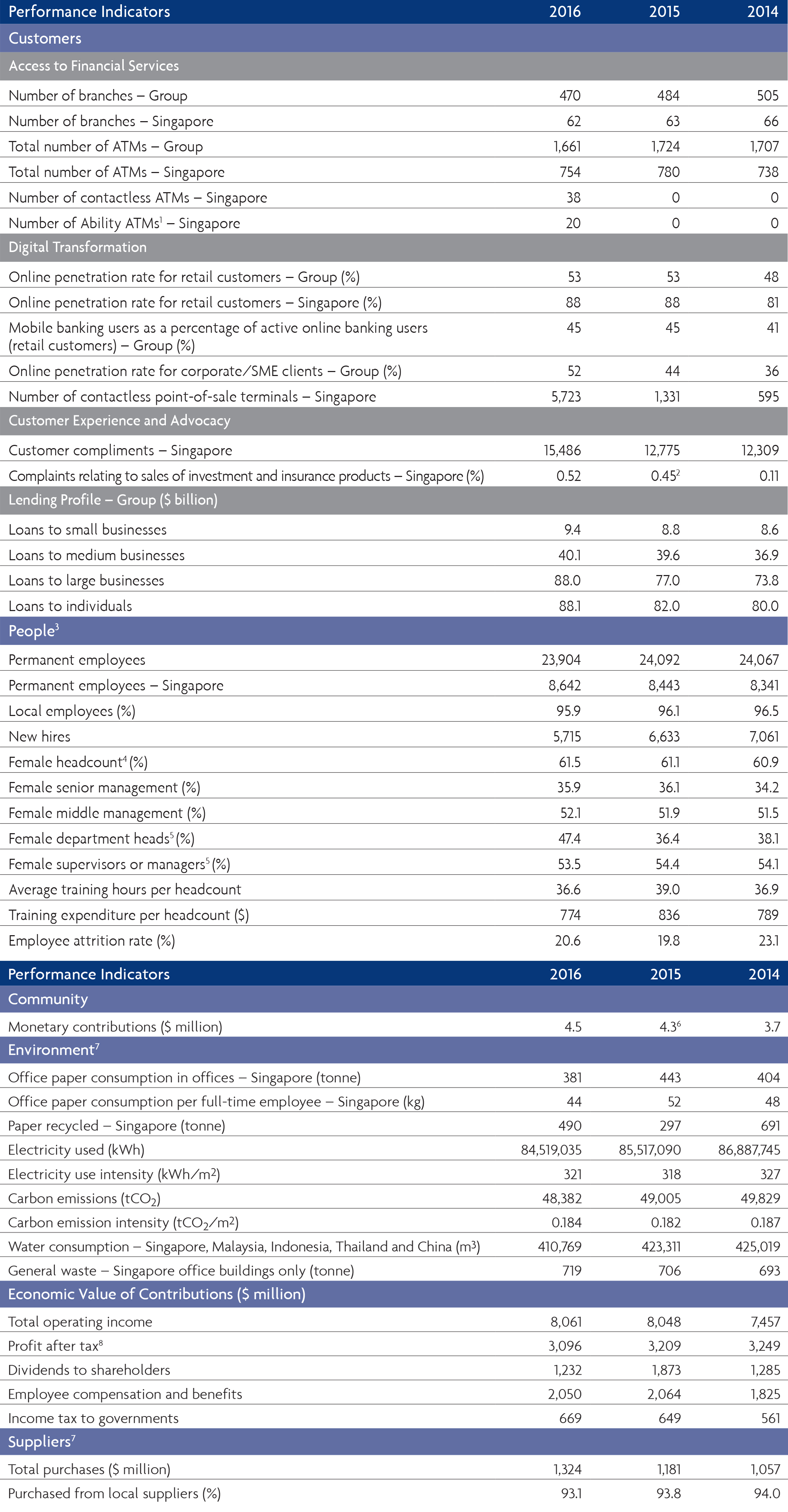

Our Sustainability Scorecard

- Ability ATMs are designed to provide visually-impaired customers with audio assistance.

- We introduced in 2015 a more stringent process for the recording of complaint cases.

- All People data applies to UOB Group unless stated otherwise.

- Headcount includes permanent and contract employees.

- Data applies to Singapore, Thailand and Greater China.

- Excludes UOB80 - related community contributions of $38.6 million.

- All Environment and Suppliers data applies to UOB’s six key markets of Singapore, Malaysia, Indonesia, Thailand, China and Hong Kong unless indicated otherwise.

- Relates to the amount attributable to equity holders of the Bank.

Notes:

- The above data, extracted from internal systems and records, covers the period from 1 January 2014 to 31 December 2016, and includes UOB’s subsidiaries unless stated otherwise.

- Internationally accepted measurement units have been used in presenting the information. The basis for data calculation is discussed in the relevant sections within this report.

Feedback

Your views are important to us. Please send your comments, questions or suggestions to:

Mr Stephen Lin

Head of Investor Relationssustainability@UOBgroup.com